Intraday market analysis: USD lacks rebound strength

EUR/USD seeks support

The US dollar advanced after the Philadelphia Fed President commented in favor of tapering this year.

The single currency has not looked back after it turned away from the daily resistance at 1.1920. The bulls’ effort to bid at 1.1800 has been futile.

An oversold RSI has attracted some buying interest, but they will need to clear the fresh hurdle at 1.1840. Then 1.1900 would be the next stop.

Failing that, the rebound could be an opportunity to sell into strength. 1.1740 is a key support in case of an extended pullback.

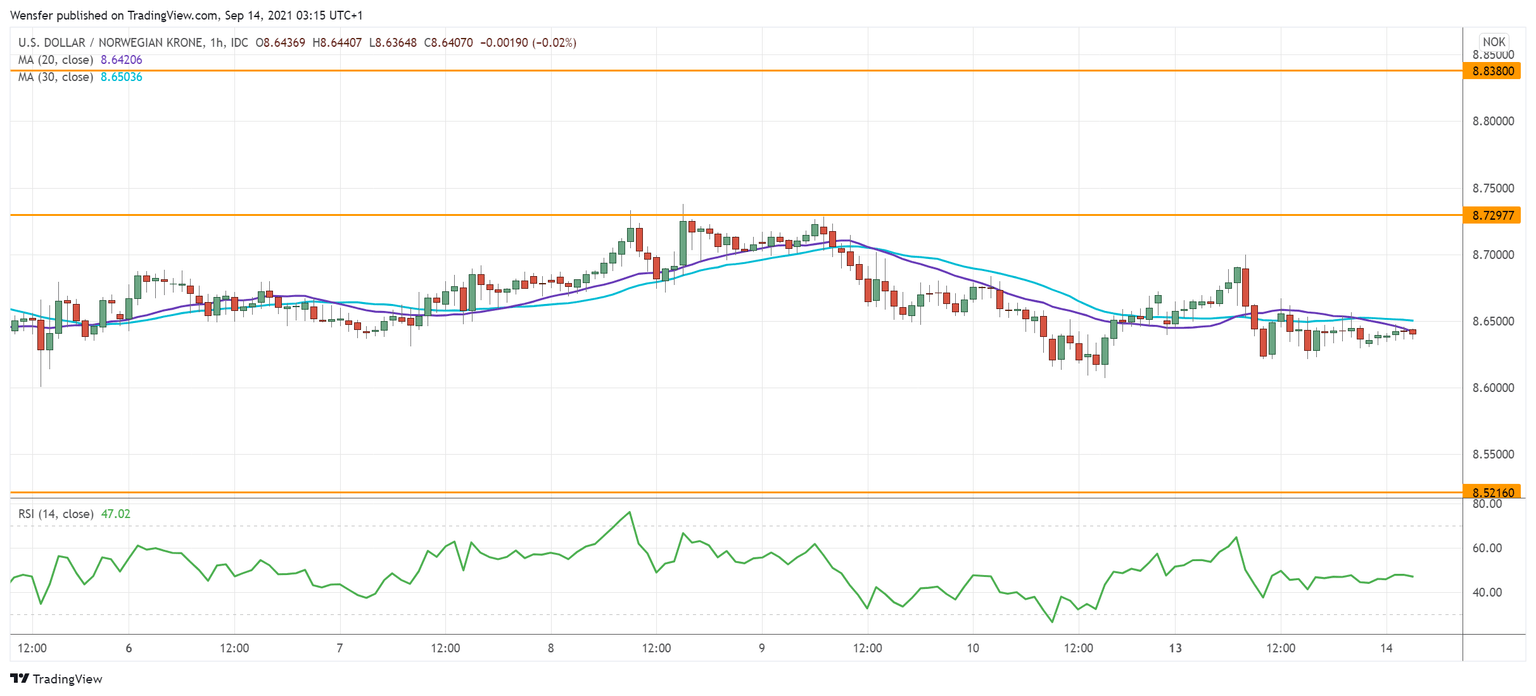

USD/NOK tests supply area

The Norwegian krone held onto its gains thanks to a recovery in oil prices.

The drop below the daily support at 8.7200 suggests that sentiment has turned sour in the short term. The US dollar’s failure to rally back above the supply zone at 8.7300 adds more pressure to the long side.

An oversold RSI has led to a limited rebound. If buyers can clear said resistance, they may gain confidence to claim back 8.8400.

Otherwise, a new round of sell-off would push the price to another support (8.5200) on the daily chart.

UK 100 bounces off daily support

The FTSE 100 recoups losses supported by strong performance in cyclical stocks. The index has bounced off the critical support (6970) from the daily chart.

An oversold RSI near the psychological level of 7000 has attracted bargain hunters. A bullish MA cross confirms the upward bias. 7100 from the latest sell-off is key resistance and its breach could raise bids to the triple top at 7210.

In the meantime, the RSI’s overbought situation may temporarily limit the buying power and the bulls would have to wait to buy the dip.

Author

Jing Ren

Orbex

Jing-Ren has extensive experience in currency and commodities trading. He began his career in metal sales and trading at Societe Generale in London.