Intel (INTC Stock) and AT&T (T Stock) quarterly report: Will they keep growing?

Companies worth more than $200 billion are in queue to report earnings on Thursday, April 22, including Intel Corporation (INTC) and AT&T Inc. (T), with Intel reporting after the market closes, while AT&T is expected before the US market opens.

Intel Corporation (#Intel or INTEL), the world’s largest semiconductor manufacturer with a market capitalization of over $26 billion, reported in the last quarter with earnings per share of $1.52 and sales of $20 billion. Both numbers were higher than forecasts. Now, in the first quarter of 2021, Zacks has forecasted lower at $1.15 per share and sales of $18 billion.

The company’s products that are expected to perform better in the first quarter are personal computers (laptops) that continue to benefit from the workflow and home schooling. The lockdown, vaccination and relaxation programs might be proven a major boost for distribution. According to IDC data, in the first quarter of this year, it saw a 55.2% increase in personal computer shipments, which is 84 million year-over-year.

In addition, the efficient adoption of Xeon processors in conjunction with Optane DC Persistent Memory, which is DRAM-like, but has different behaviour, may be mentioned in the upcoming report as a top product line.

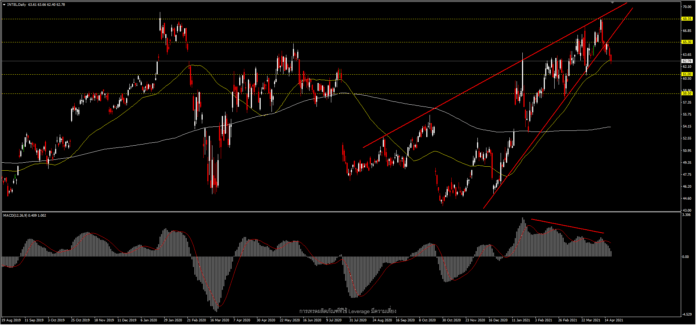

Intel’s share price earlier this year had been steadily rising. Since the beginning of this year, the company’s share price has been positive 25.85%. However, from a technical point of view, we now see a reversal pattern of the rising wedge, where the price has broken down and stuck close to the 50-DMA. If the company misses expectations, it is possible that the price may fall heavily. The first Support is at 61.00 and the next is at 58.50, while if the numbers come out positive, the price may rise above the 50-DMA again with Resistance at 65.30 and the original high at 68.35 will be the next target.

As for AT&T Inc. (#AT&T), the $2.1 billion telecom, media and technology provider reported sales of $45.6 billion last quarter. The Earnings per share was $0.75, while Zacks forecast sales of the first quarter of this year down to $4.22 billion, with the earnings per share forecast at $ 0.77, lower than the same quarter last year.

The driving force for the first quarter was that AT&T continued to focus on expanding the infrastructure for its 5G network, which is currently capable of covering 230 million users in 14,000 cities, including 5G+ network service in 38 cities. Before reporting results for this quarter, the company has partnered with Fortinet to expand its Managed Security Services segment to provide corporate customers with access to Secure Access Service Edge (SASE), which will enhance the security of their organization, in a period of high remote working demand.

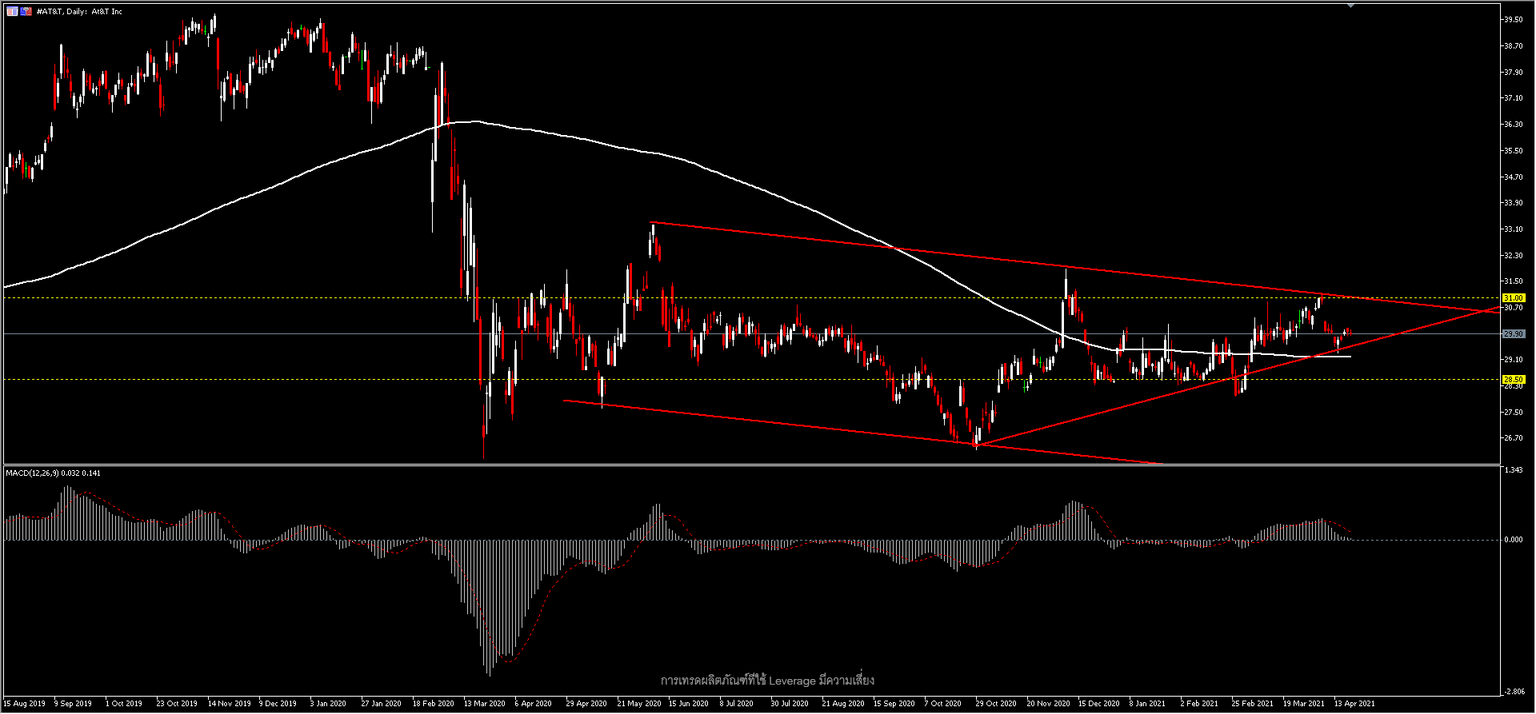

AT&T is one of the giants whose share price has not yet been able to recover to levels before the coronavirus outbreak despite the US stock markets continuing to move to all-time highs. As for the share price trend, the company can now hold above the key support 200-DMA, currently at $29.90, overlooking a triangle pattern. If the numbers are reported above forecasts, the price might appreciate with Resistance at year’s high at the $31.00 zone again, but if the report is lower than expected, the price may come down to the 200-DMA line at $29.20, where the next support is at $28.50.