Ichimoku cloud analysis: Gold, ETH/USD, USD/CHF

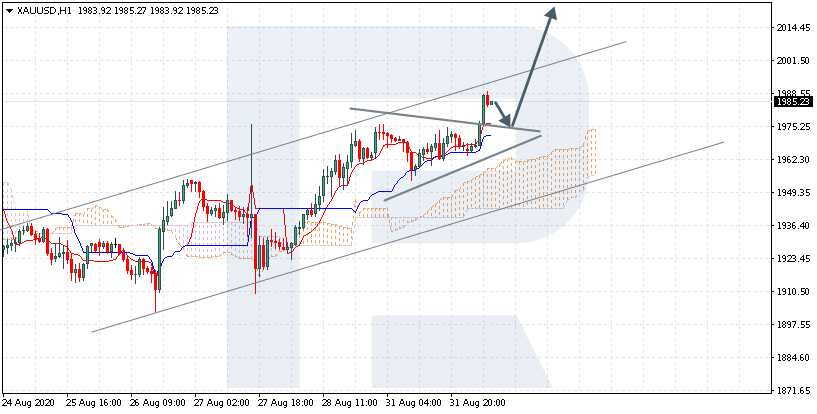

XAU/USD, “Gold vs US Dollar”

GOLD is trading at 1985 above the Ichimoku Cloud, suggesting an uptrend. A test of the signal lines of the indicator near 1975 is expected, followed by growth to 2015. An additional signal confirming the growth will be a bounce off the upper border of the Triangle pattern. The growth will be canceled in the case of a breakaway of the lower border of the Cloud and closing above 1935, which will mean further declining to 1905.

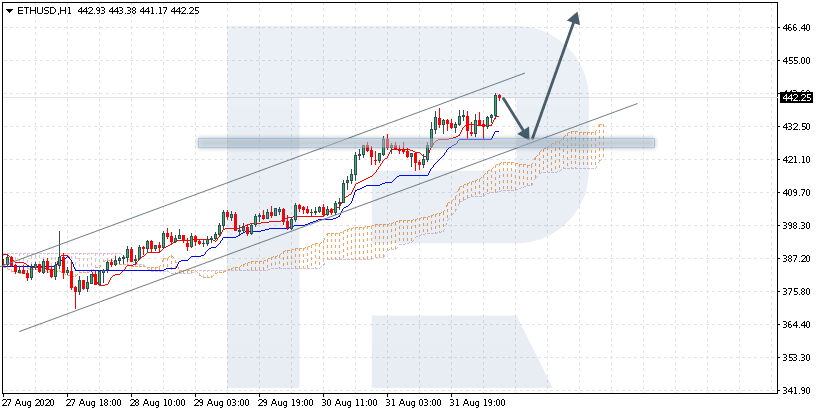

ETH/USD, “Ethereum vs US Dollar”

The Ethereum is trading at 442.25 above the Ichimoku Cloud, suggesting an uptrend. A test of the signal lines of the indicator at 425.05 is expected, followed by growth to 465.05. An additional signal confirming the growth will be a bounce off the lower border of the ascending channel. The growth will be canceled in the case of a breakaway of the lower border of the Cloud and closing under 405.05, which will mean further declining to 375.05.

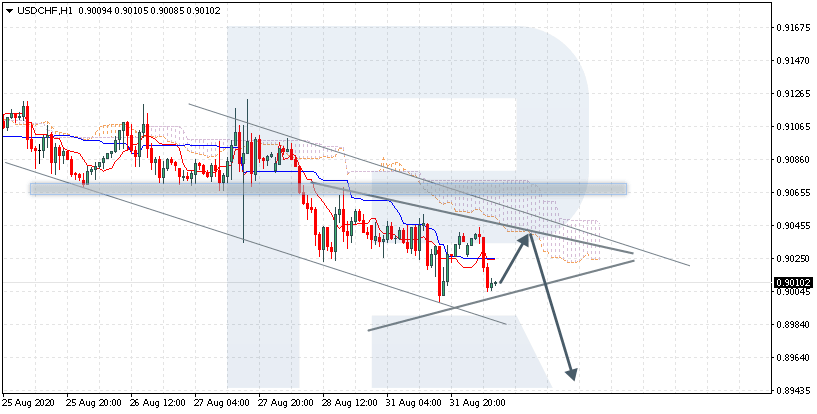

USD/CHF, “US Dollar vs Swiss Franc”

USDCHF is trading at 0.9010 under the Ichimoku Cloud, suggesting a downtrend. A test of the lower border of the Cloud at 0.9035 is expected, followed by falling to 0.8950. An additional signal confirming the decline will be a bounce off the upper border of the descending channel. The falling will be canceled in the case of a breakaway of the upper border of the Cloud and closing above 0.9080, which will mean further growth to 0.9175. The decline will be confirmed by a breakaway of the lower border of the Triangle and securing under 0.8990.

Author

RoboForex Team

RoboForex

RoboForex Team is a group of professional financial experts with high experience on financial market, whose main purpose is to provide traders with quality and up-to-date market information.