Ichimoku cloud analysis: GBP/USD, XAU/USD, USD/CHF

GBP/USD, “Great Britain Pound vs US Dollar”

GBP/USD is correcting after rebounding from the upper boundary of the bullish channel. The pair is moving above the Ichimoku Cloud, suggesting an uptrend. A test of the Cloud’s lower boundary at 1.2745 is expected, followed by a rise to 1.2925. A rebound from the upper boundary of the bearish channel would be an additional signal confirming the increase. The scenario could be cancelled by a breakout of the Cloud’s lower boundary, with the price securing below 1.2715, indicating a further decline to 1.2625.

XAU/USD, “Gold vs US Dollar”

Gold is bouncing off the resistance level. The instrument is moving below the Ichimoku Cloud, suggesting a downtrend. A test of the Cloud’s lower boundary at 2340 is expected, followed by a decline to 2230. A rebound from the upper boundary of the bearish channel would be an additional signal confirming the fall. This scenario could be cancelled by a breakout above the upper boundary of the Cloud, with the price securing above 2355, indicating a further rise to 2395. Conversely, a decline could be confirmed by a breakout below the lower boundary of the ascending channel, with the price gaining a foothold below 2300.

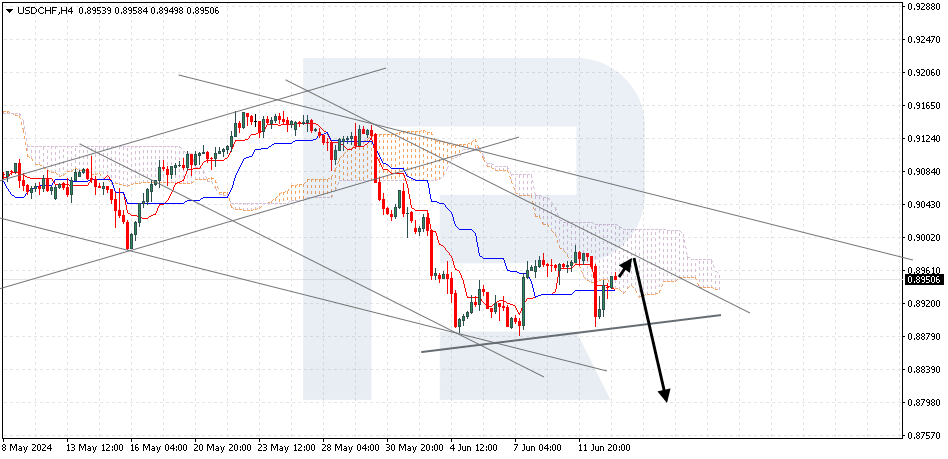

USD/CHF, “US Dollar vs Swiss Franc”

USD/CHF is rising after rebounding from the lower boundary of the Head and Shoulders reversal pattern. The pair is moving inside the Ichimoku Cloud, indicating a sideways trend. A test of the resistance area at 0.8960 is expected, followed by a decline to 0.8795. A rebound from the upper boundary of the bearish channel would signal the decline. The scenario could be cancelled by a breakout of the upper boundary of the Cloud, with the price securing above 0.9055, indicating a further rise to 0.9145. Conversely, a decline could be confirmed by a breakout below the lower boundary of the Head and Shoulders pattern, with the price establishing itself below 0.8865.

Author

RoboForex Team

RoboForex

RoboForex Team is a group of professional financial experts with high experience on financial market, whose main purpose is to provide traders with quality and up-to-date market information.