How a US government shutdown could impact financial markets

After the failure of Democrats and Republicans to reach an agreement to continue funding the US Federal government, a shutdown now looms. The deadline to reach a deal is midnight tonight, while there is a chance of an 11th hour deal, there does not seem to be much common ground between both sides.

Both sides are sticking to their demands: Democrats are under pressure from the progressives in their party to stand up to Trump, and the White House has threatened to fire federal employees rather than furlough them if the shutdown happens.

If a shutdown does happen, it would be the second shutdown under President Trump, the first coming in his first term between 2018-2019. Republicans are holding firm that the Democrats will eventually cave, so there are hopes that a deal can be reached, and any government shutdown will be temporary.

How a government shutdown could impact financial markets

A government shutdown does not affect the government’s ability to pay its debt to bondholders, so it should not have a direct impact on the US’s creditworthiness or bond yields. Also, shutdowns have been regular, and since 1976 there have been 20 shutdowns, with most being resolved quickly. The longest was 35 days in 2018.

This potential shutdown, if resolved quickly, should not have a meaningful impact on growth. However, in an unusual move, the White House said at the weekend that it would not only furlough Federal employees, but it could also fire them permanently. This could push up the unemployment rate and impact the Non Fram payrolls figures in future months, which may ultimately lead to a deterioration in the labour market, and a faster pace of Federal Reserve rate cuts.

The impact on stocks

If there is a shutdown this week, then it may trigger a brief spike in volatility, especially since the Vix index is lower than the average of the past 12 months at 16. However, shutdowns historically have had only a brief impact on equity market returns. Stocks have not fallen 50% of the time during shutdowns, and in most cases US indices were higher 3 and 6 months after the shutdown.

US stock market performance may not be derailed by a potential shutdown. Momentum remains to the upside for US stocks as we near the funding deadline, and momentum has been the biggest driver of US stocks so far this year, ahead of other factors including liquidity and size. Thus, it will take a serious deterioration in the US political situation to disturb the bullish momentum in markets as we move into the final three months of the year. There are other factors that could cushion US stocks from the fallout from the government shutdown including Fed interest rate cuts for this year and next. Interest rate cut bets for 2026 may even increase if the shutdown negatively impacts the US labour market.

NFP report might be impacted

A delay to the release of the Non-Farm Payrolls report this week could trigger some volatility as this report was considered the last piece of the puzzle before the October Fed rate cut. However, we do not think that it will derail a rate cut next month, and the Fed Fund Futures market is still pricing in a 90% chance of a cut next month.

Overall, while a government shutdown could increase short-term volatility for stocks, we do not think that it will damage the positive outlook for risk as we move into Q4.

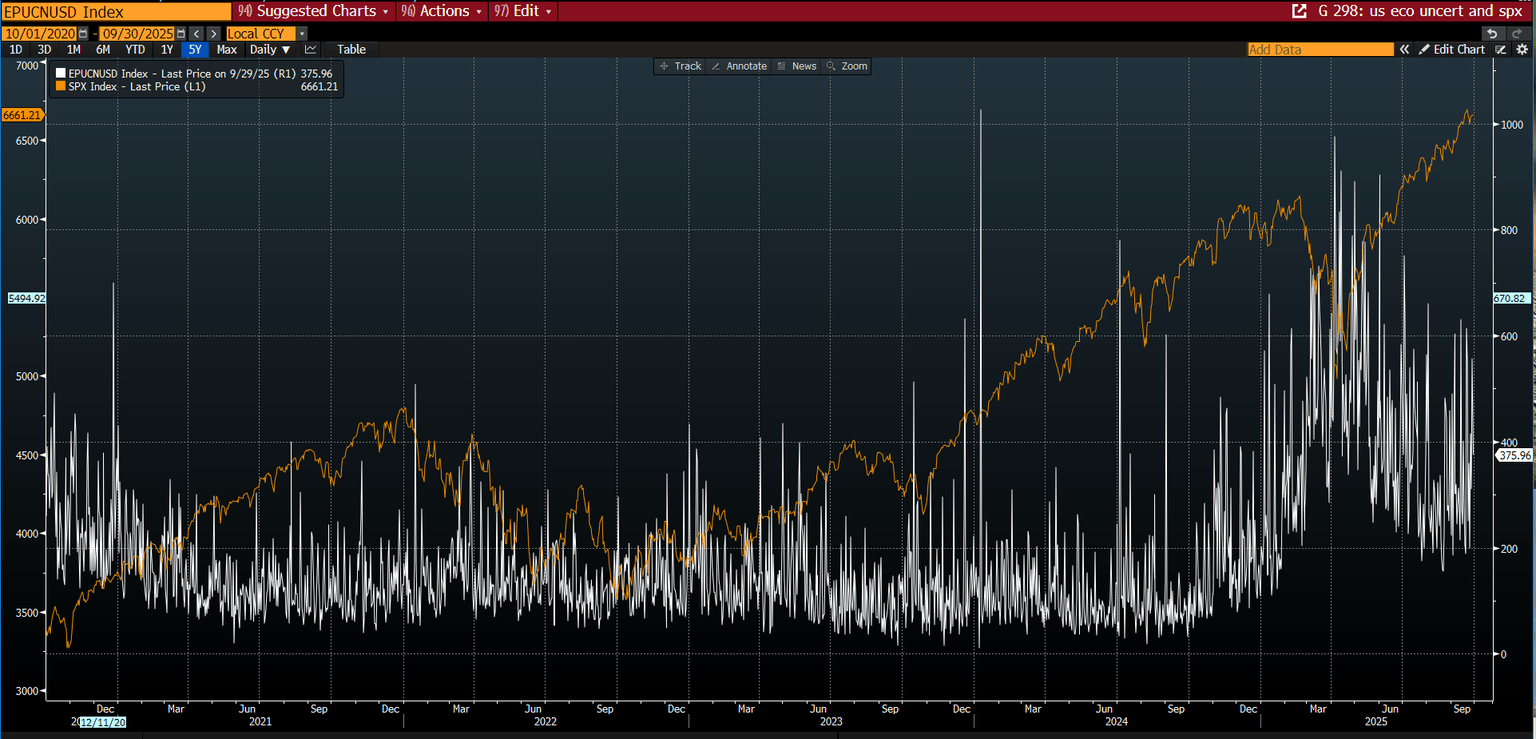

Chart 1: US political uncertainty index and the S&P 500, 5-year chart. US stocks are good at absorbing political turmoil.

Source: XTB and Bloomberg

Author

Kathleen Brooks

XTB UK

Kathleen has nearly 15 years’ experience working with some of the leading retail trading and investment companies in the City of London.