Gold Elliott Wave technical analysis [Video]

![Gold Elliott Wave technical analysis [Video]](https://editorial.fxstreet.com/images/Markets/Commodities/Metals/Gold/gold-nuggets-14424039_XtraLarge.jpg)

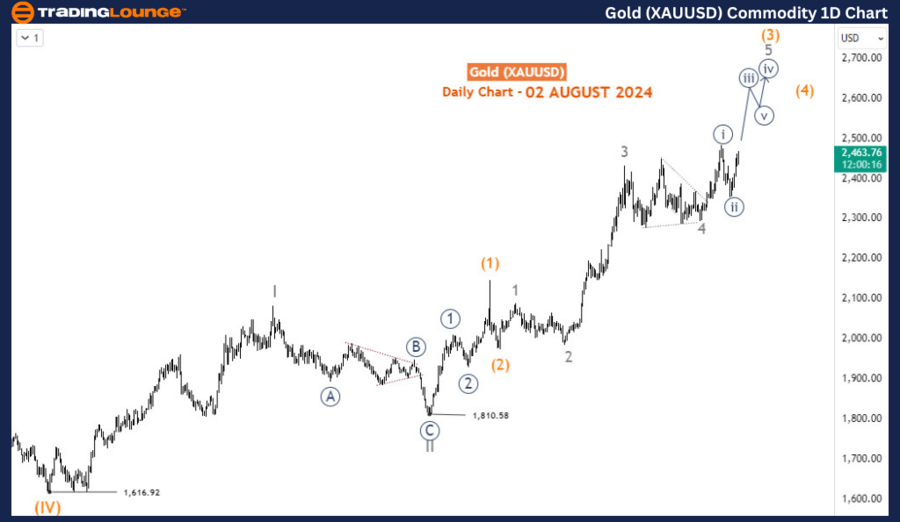

Gold Elliott Wave analysis

Function - Trend.

Mode - Impulse.

Structure - Impulse for wave (3) still emerging.

Position -Wave 5.

Direction - Wave 5 is still in play.

Gold has added to gains after breaking out of a two-month range, and it now appears poised for a fresh all-time high. Across all time frames, the market remains bullish, providing opportunities for buyers to enter on dips at various degrees, anticipating a continued rally.

Daily chart analysis

On the daily chart, Gold completed the supercycle wave (IV) of the long-term bullish trend that began in December 2015. This completion set the stage for a new impulse wave (V). Within this wave (V), waves I and II were completed in May and October 2023, respectively. Gold is currently advancing in wave (3) of 3 (circled) of III, with the potential to push beyond 2500 before this wave concludes. The sideways consolidation that occurred between April 12th and June 26th represents wave 4 of (3). The ongoing upward movement is part of wave 5 of (3), which is expected to break through previous highs and set new records. The bullish outlook for Gold remains strong, offering buyers a chance to enter positions on pullbacks.

Four-hour chart analysis

On the H4 chart, we zoom in on the sub-waves of wave 5 of (3). The price completed waves i (circled) and ii (circled) of 5 on July 17th and July 25th, respectively. The current upward movement, wave iii (circled) of 5, is underway and is projected to reach at least 2617 before the next significant pullback, provided the price stays above 2352. This suggests that Gold will likely continue to favor the buy side in the weeks ahead, presenting attractive buying opportunities.

Conclusion

In summary, Gold's building up on gains after a strong breakout indicates that it is gearing up for a new all-time high. The Elliott Wave analysis shows a bullish trend across all time frames, with the potential for further gains. Traders should look to capitalize on this by buying dips, especially as the market progresses towards key levels like 2500 and beyond.

Gold (XAU/USD) Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.