Gold Weekly Forecast: Bearish pressure builds up as focus shifts to Fed policy decisions

- Gold broke below $3,300 and registered its largest one-week loss since February.

- Growing optimism about a de-escalation of the US trade tensions hurts Gold’s appeal as a safe haven.

- The next big trigger for Gold could be the Federal Reserve’s monetary policy decisions on May 7.

Gold (XAU/USD) extended its correction from the record-high it set at $3,500 on April 22 and registered its largest one-week loss since February, pressured by a steady improvement in market sentiment as trade war fears eased somewhat. The Federal Reserve’s (Fed) monetary policy announcements on May 7 could help investors decide whether Gold can regain its shine.

Gold declines sharply as buyers fail to defend $3,300

Markets adopted a cautious stance at the beginning of the week and helped Gold post moderate gains on Monday. Over the weekend, the Financial Times reported that the Port of Los Angeles, the main route of entry for goods from China, expects scheduled arrivals in the week starting May 4 to be a third lower than a year before. Meanwhile, a spokesperson for China's Foreign Ministry noted on Monday that they have not engaged in any trade talks with the US.

Investors refrained from taking large positions ahead of Wednesday’s key macroeconomic data releases from the US and made it difficult for XAU/USD to build on Monday’s rebound. In the meantime, the Wall Street Journal reported late Monday that United States (US) President Donald Trump was planning to soften the impact of his automotive tariffs by preventing duties on foreign-made cars from stacking with other tariffs and easing levies on foreign parts used in car manufacturing. Additionally, US Treasury Secretary Scott Bessent suggested on Tuesday that they were having productive talks with Asian trading partners.

The US Bureau of Economic Analysis reported on Wednesday that the US Gross Domestic Product (GDP) contracted at an annualized rate of 0.3% in the first quarter, according to its initial estimate. Other data showed that the core Personal Consumption Expenditures (PCE) Price Index, the Federal Reserve's (Fed) preferred gauge of inflation, rose 2.6% on a yearly basis in March, remaining well above the Fed's target of 2%. The immediate market reaction to mixed US data helped XAU/USD limit its losses, but positive headlines on US trade policy triggered another leg lower in the pair. US President Donald Trump said late Wednesday that there was a very good probability that they will reach a deal with China and added that they have "potential" trade deals with India, South Korea and Japan.

Although US Trade Representative Jamieson Greer told reporters that no official talks with China were underway, he noted that he expects to conclude initial tariff deals with some trading partners within weeks. After closing below $3,300 on Wednesday, Gold continued to push lower on Thursday and touched its weakest level in two weeks near $3,200.

Early Friday, China’s Commerce Ministry noted that the door is open to trade talks after the US has taken the initiative to convey to China that they are willing to discuss tariffs.

Later in the day, the US Bureau of Labor Statistics (BLS) announced that Nonfarm payrolls (NFP) rose by 177,000 in April, beating the market expectation of 130,000. On a negative note, the BLS downwardly revised March’s NFP increase to 185,000 from 228,000 initially estimated. Other details of the employment report showed that the Unemployment Rate and annual wage inflation held steady at 4.2% and 3.8%, respectively. Gold corrected higher on Friday but failed to gather momentum to end the week deep in negative territory.

Gold investors await Fed policy decisions

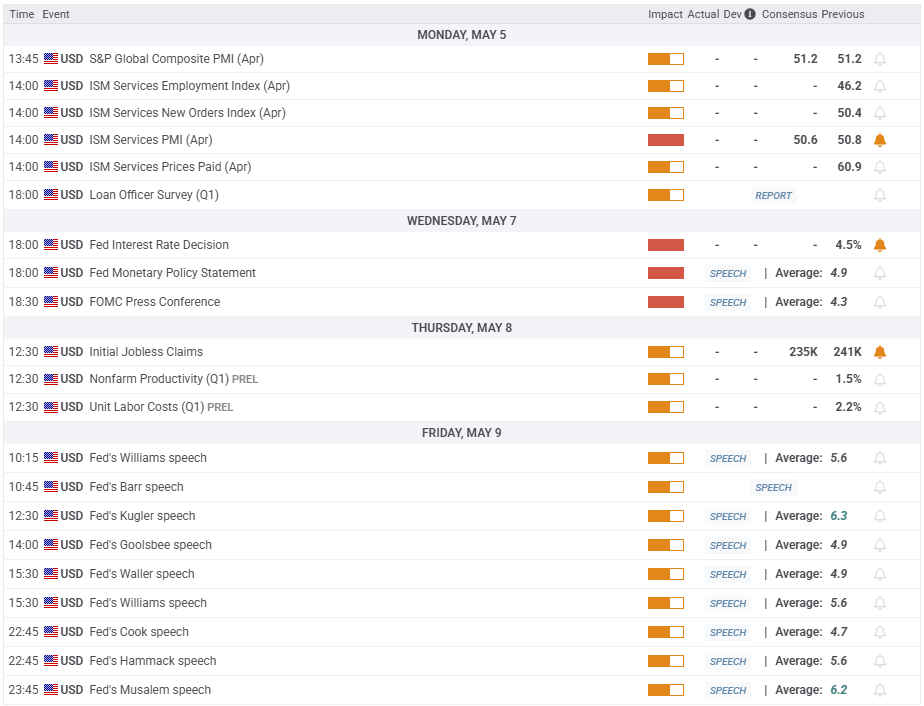

The US economic calendar will feature the ISM Services PMI report for April on Monday. In case the headline PMI comes in well below 50 and shows a noticeable contraction in the service sector’s business activity, the USD could have a hard time finding demand, opening the door for a rebound in XAU/USD. Nevertheless, investors are unlikely to jump the gun with this data and wait for the Fed’s monetary policy announcements before taking large positions.

The Fed is widely anticipated to leave the interest rate unchanged at the range of 4.25%-4.5% after the May 6-7 policy meeting. Market participants will scrutinize changes in the policy statement and pay close attention to comments from Fed Chairman Jerome Powell in the post-meeting press conference.

If the Fed hints that the heightened uncertainty surrounding the inflation outlook due to trade policy would likely require them to remain patient with regards to rate adjustments, the USD could gather strength and trigger a leg lower in XAU/USD. On the flip side, Gold could gain traction if the Fed puts more emphasis on the weakening economic outlook and labor market conditions, feeding into expectations for a 25 basis points (bps) reduction in the policy rate in June.

Similarly, market participants could lean toward a June rate cut and help Gold turn north if Powell suggests that they will prioritize supporting the labor market. Conversely, XAU/USD is likely to come under renewed bearish pressure in case Powell voices his concerns over inflation remaining sticky for longer than anticipated.

In the meantime, investors will continue to assess the latest developments regarding the US-China trade conflict. If the market mood remains upbeat, with the US and its trading partners moving toward deals, Gold is likely to have a hard time attracting buyers. On the other hand, XAU/USD could benefit from safe-haven flows if there are signs of negotiations falling apart.

Gold technical analysis

The Relative Strength Index (RSI) indicator on the daily chart holds slightly above 50 and Gold is yet to make a daily close below the 20-day Simple Moving Average (SMA) after briefly dipping below this level on Thursday, suggesting that the bearish reversal is not yet complete.

On the downside, $3,200 (static level, round level) aligns as interim support before $3,150-$3,160 (Fibonacci 38.2% retracement level of the latest uptrend, lower limit of the ascending regression channel coming from December) and $3,100-$3,090 (static level, 50-day SMA).

Looking north, first resistance could be spotted at $3,290-$3,300 (Fibonacci 23.6% retracement, static level, mid-point of the ascending channel) before $3,400 (upper limit of the ascending channel) and $3,500 (record high).

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.