Gold Weekly Forecast: Sellers hesitate, but bullish momentum remains weak

- Gold failed to make a decisive move in either direction.

- The near-term technical outlook highlights XAU/USD’s indecisiveness.

- In the absence of high-impact data releases, markets will scrutinize US tariff headlines.

Gold’s (XAU/USD) trading range narrowed as investors assessed macroeconomic data releases from the United States (US), while keeping the uncertainty surrounding the US’ trade regime in the back of their minds. The Federal Reserve (Fed) will be in the blackout period ahead of the July 29-30 policy meeting and the US economic calendar won’t offer any high-impact data releases, possibly making it difficult for Gold to find direction in the short term. Still, any developments in the trade front or regarding Trump’s threats to fire Fed Chair Jerome Powell could move the needle.

Gold struggles to gather bullish momentum

The US Bureau of Labor Statistics reported on Tuesday that annual inflation, as measured by the change in the Consumer Price Index (CPI), rose to 2.7% in June from 2.4% in May. On a monthly basis, the CPI and the core CPI, which excludes volatile food and energy prices, increased 0.2% and 0.3%, respectively. These figures caused investors to second guess Fed rate cut prospects in September and boosted the US Dollar (USD). In turn, XAU/USD closed the second consecutive day in negative territory.

After stabilizing in the European session on Wednesday, Gold benefited from falling US Treasury bond yields and registered daily gains. Citing multiple sources with direct knowledge of the matter, CBS News reported that US President Donald Trump asked Republican lawmakers whether he should fire Fed Chairman Jerome Powell. This headline weighed on the USD and caused US T-bond yields to turn south. Meanwhile, the data from the US showed that the Producer Price Index (PPI) rose by 2.3% on a yearly basis in June. This reading followed the 2.6% increase recorded in May and came in below the market expectation of 2.5%.

Nevertheless, improving risk mood didn’t allow Gold to preserve its bullish momentum on Thursday. Investors grew optimistic about the US economic outlook after Trump noted late Wednesday that they were very close to a trade agreement with India and added that a deal could also be reached with Europe.

In the second half of the day, upbeat macroeconomic data releases from the US further supported the USD and caused XAU/USD to continue to push lower. Weekly Initial Jobless Claims declined to 221,000 from 228,000 in the previous week and Retail Sales rose by 0.6% in June, beating the market forecast for an increase of 0.1%.

Later in the day, dovish comments from Fed Governor Christopher Waller, who said late Thursday that he continues to believe that the Fed should cut its interest rate target at the July meeting, limited the USD's gains and helped XAU/USD erase a portion of its daily losses.

Gold investors search for next catalyst

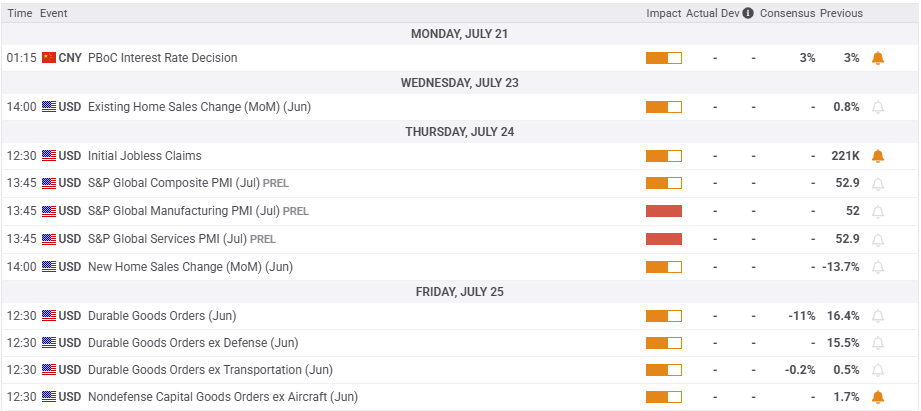

The economic calendar will offer some interesting data releases in the second half of the week, but these are unlikely to have a long-lasting impact on Gold’s valuation.

On Thursday, S&P Global will release the preliminary Purchasing Managers’ Index (PMI) reports for July. In case the Manufacturing PMI and Services PMI come in near or above June’s readings of 52.0 and 52.9, respectively, the USD could preserve its strength and weigh on XAU/USD. Conversely, the USD could come under pressure and help XAU/USD stretch higher if any of the headline PMIs drop below 50.0, indicating a contraction in the respective sector’s economic activity.

On Friday, Durable Goods Orders for June will be the last data release of the week from the US. The market reaction to this data is likely to be straightforward and remain short-lived, with a disappointing print hurting the USD and a positive surprise supporting the currency.

The Fed will be in the blackout period ahead of the July 29-30 monetary policy meeting. Nevertheless, investors will pay close attention to fresh developments surrounding the clash between US President Trump and Fed Chairman Powell.

In case Trump focuses on Powell’s management of the funds in the renovation project and tries to fire him based on that issue, the USD could come under pressure and allow XAU/USD to gain traction. On the flip side, news of the US finding a middle ground in trade relations with major partners, or the Trump administration backing off from Powell, could be supportive for the USD and open the door for another leg lower in XAU/USD.

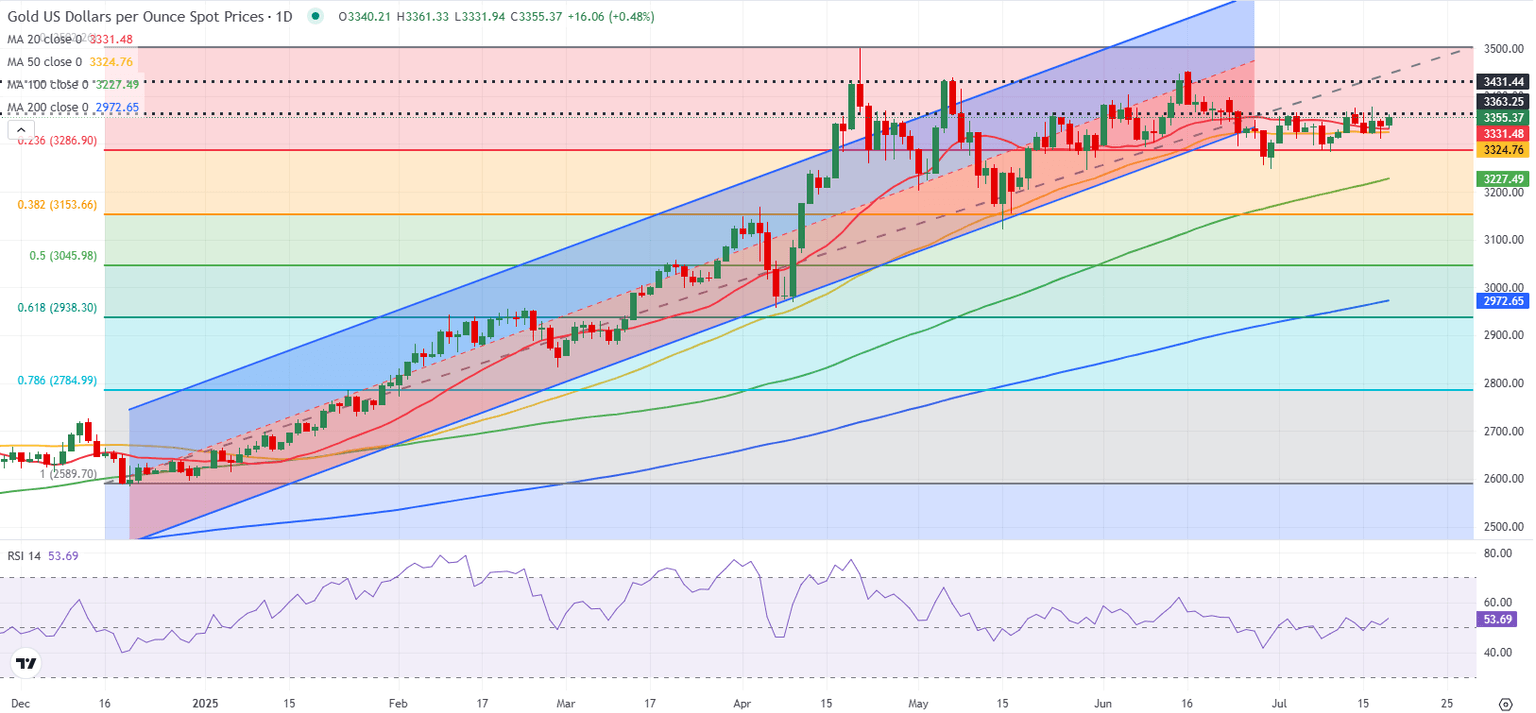

Gold technical analysis

The Relative Strength Index (RSI) indicator on the daily chart fluctuates in a narrow band at around 50, and Gold struggles to pull away from the 50-day and the 20-day Simple Moving Averages (SMAs), highlighting a lack of directional momentum.

On the upside, $3,400 (static level, round level) aligns as the next resistance level before $3,450 (static level) and $3,500 (all-time high, end-point of the January-June uptrend).

Looking south, the first support level could be spotted at $3,285 (Fibonacci 23.6% retracement) before $3,200-$3,205 (round level, 100-day SMA) and $3,150 (Fibonacci 38.2% retracement).

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.