Gold Weekly Forecast: Can XAU/USD gain traction on a 75 bps Fed hike?

- Gold broke below $1,700 and lost more than 2% on a weekly basis.

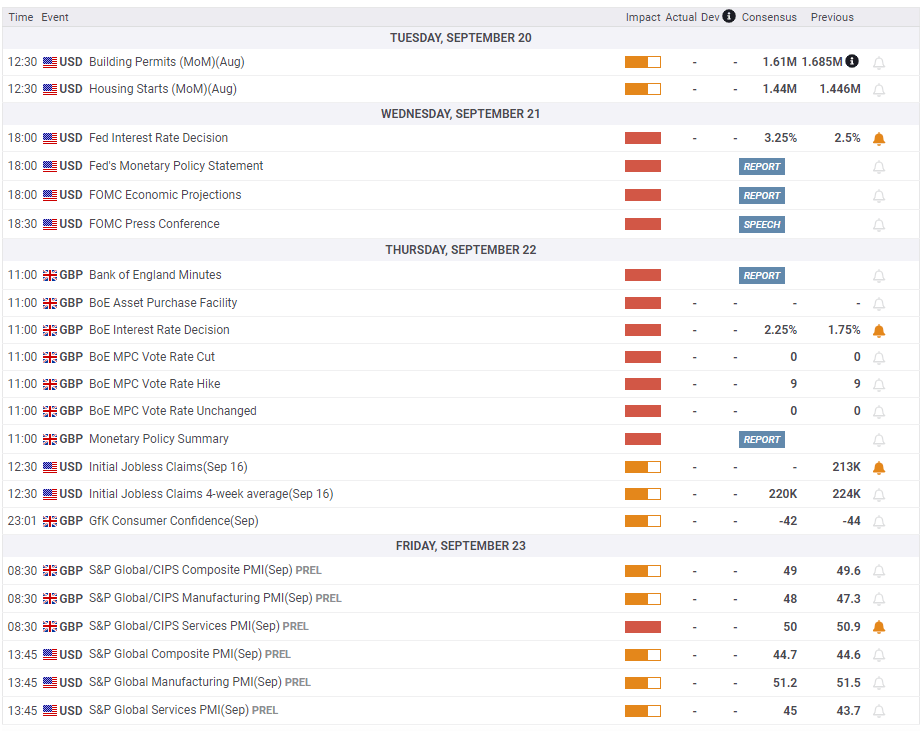

- Fed’s rate decision and dot plot are set to ramp up market volatility next week.

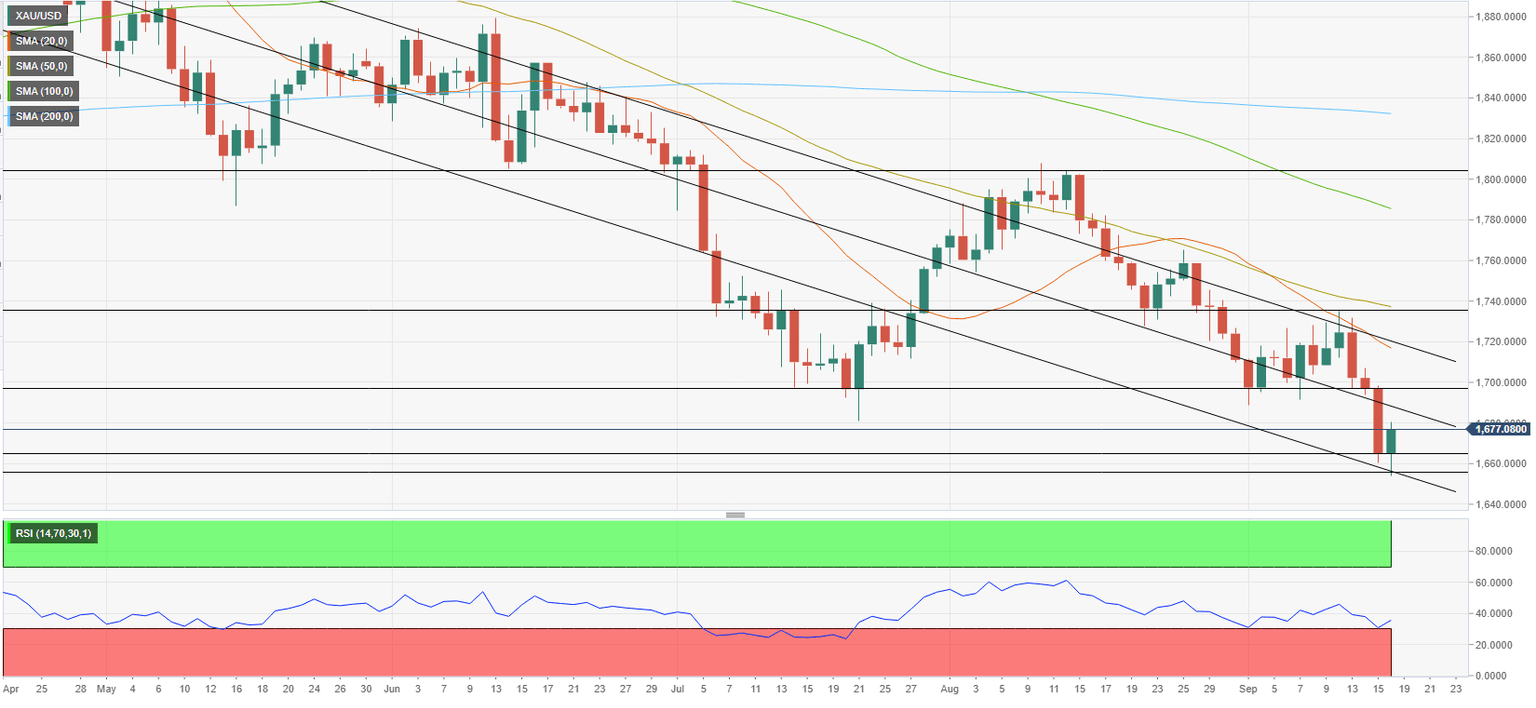

- XAU/USD’s technical outlook shows bearish bias stays intact with some room for correction.

Gold started the new week on a bullish note and climbed to its highest level in two weeks near $1,730 on Monday. For the remainder of the week, however, XAU/USD came under heavy bearish pressure and dropped to a fresh multi-year low below $1,660 before staging a rebound ahead of the weekend. The Fed’s policy decision next week will be the key market driver as gold’s technical outlook shows that the bearish bias stays intact despite Friday’s gains.

What happened last week?

Amid a positive shift in risk sentiment, the greenback struggled to find demand on Monday and the US Dollar Index opened with a bearish gap. During the American trading hours, however, gold erased a portion of its daily gains as the US Treasury bond yields gained traction. The 10-year Treasury note auction resulted in a high yield of 3.33%, up from 2.75% in the previous auction, and helped yields push higher.

On Tuesday, the US Bureau of Labor Statistics reported that inflation in the US, as measured by the Consumer Price Index (CPI), declined to 8.3% on a yearly basis in August from 8.5% in July. This reading came in stronger than the market expectation of 8.1%. More importantly, the annual Core CPI, which strips volatile food and energy prices, climbed to 6.3% from 5.9% in July. With the initial market reaction to hot inflation data, hawkish Fed bets dominated the financial markets. The dollar gathered strength against its major rivals and the 10-year US Treasury bond yield climbed to its highest level since mid-June, above 3.4%. In turn, XAU/USD ended up losing more than 1% on a daily basis on Tuesday.

Although the dollar rally lost its steam on Wednesday, gold failed to stage a rebound. The only data from the US revealed that the annual Producer Price Index (PPI) declined to 8.7% in August from 9.8% in July. Wall Street’s main indexes recovered modestly following Tuesday’s CPI-inspired sell-off, but the 10-year US T-bond yield managed to hold near 3.4%, not allowing XAU/USD to stretch higher.

The dollar continued to outperform its rivals amid the souring market mood and gold fell below $1,700 on Thursday. Following the mixed macroeconomic data releases from the US, US yields started to push higher and XAU/USD slumped below key $1,680 support, triggering a technical sell-off. Gold lost nearly 2% on Thursday and touched its weakest level since April 2020 at $1,654 early Friday before staging a technical correction.

The US Census Bureau’s monthly publication showed that Retail Sales in the US rose by 0.3% on a monthly basis in August. Additionally, the US Department of Labor reported that there were 213,000 initial jobless claims in the week ending September 10, down from 218,000 in the previous week. On a negative note, the Philadelphia Fed Manufacturing Index dropped to -9.9 in September from 6.2 in August and missed the market expectation of 2.8 by a wide margin.

On Friday, the University of Michigan’s Consumer Sentiment Survey for September revealed that consumers’ one-year inflation expectation declined to 4.6% and the five-year inflation expectation edged lower to 2.8% from 2.9%. The 10-year US T-bond yield turned negative on the day after this report and gold gathered recovery momentum, rising toward $1,680.

Next week

On Wednesday, the Federal Reserve will announce its interest rate decision and publish the updated Summary of Projections, the so-called dot plot. According to the CME Group FedWatch Tool, markets are currently pricing in a 20% probability of a 100 basis points (bps) rate hike. The market positioning suggests that US T-bond yields could edge lower if the Fed opts to hike the policy rate by 75 bps to the range of 3%-3.25%, causing the dollar to lose interest.

In June, the dot plot showed that the terminal rate in 2023 was expected to be 3.8%. The new dot plot is likely to reveal that the policy rate is likely to rise to 4% by the end of the year. In case the terminal rate is now forecast to rise toward 4.5% next year and stay there before starting to decline in 2024, the potential negative impact of a 75 bps rate hike on the dollar is likely to remain short-lived.

FOMC Chairman Jerome Powell’s press conference will also be watched closely by market participants. If Powell voices heightened concerns over recession risks in 2023, the greenback could find it difficult to gather strength. Any comments on supply chain pressures easing or conditions in labor market loosening could also weigh on the dollar. Nevertheless, Powell is likely to reassure markets that they are committed to battling inflation and remark that they are yet to see convincing signs of inflation having peaked.

The dollar’s latest rally suggests that we could see a ‘buy the rumor sell the fact’ action following the Fed’s policy announcements. The Fed is widely expected to stay on an aggressive tightening path and there isn’t much room for a hawkish surprise at this point. Markets already gave up on expectations that the US central bank could start easing the policy in the second half of the year. Having said that, it’s not easy for investors to bet against the dollar, given the relatively healthy state of the US economy. Hence, even if the dollar were to weaken in the near term following the Fed event, it would probably take a significant dovish shift in the policy outlook for the currency to steadily lose value against its major rivals.

On Friday, S&P Global will release the preliminary Manufacturing and Services PMI reports for the US. The market reaction to PMI figures is likely to be straightforward with stronger-than-forecast prints hurting XAU/USD and vice versa.

The Bank of England (BoE) will also announce its interest rate decision on Thursday. The market consensus points to a 50 bps rate hike, but some experts see a strong chance the bank could opt for a 75 bps increase instead. A hawkish BoE outcome could trigger a strong rally in GBP/USD, given the pair’s extremely oversold conditions. The capital outflow out of the dollar, in that case, could help gold gain traction in an indirect way.

Gold technical outlook

Gold touched the lower limit of the descending regression channel coming from March on Friday and the Relative Strength Index (RSI) indicator on the daily chart rebounded from 50, suggesting gold is in a correction phase while staying bearish.

On the upside, $1,680 (mid-point of the descending channel, former support) aligns as the next hurdle ahead of $1,700 (psychological level, static level). A daily close above the latter could attract additional buyers and open the door for an extended recovery toward the upper end of the regression channel at $1,720, where the 20-day SMA is also located.

Interim support is located at $1,665 (static level) ahead of $1,654 (September 16 low) and $1,640 (static level from April 2020).

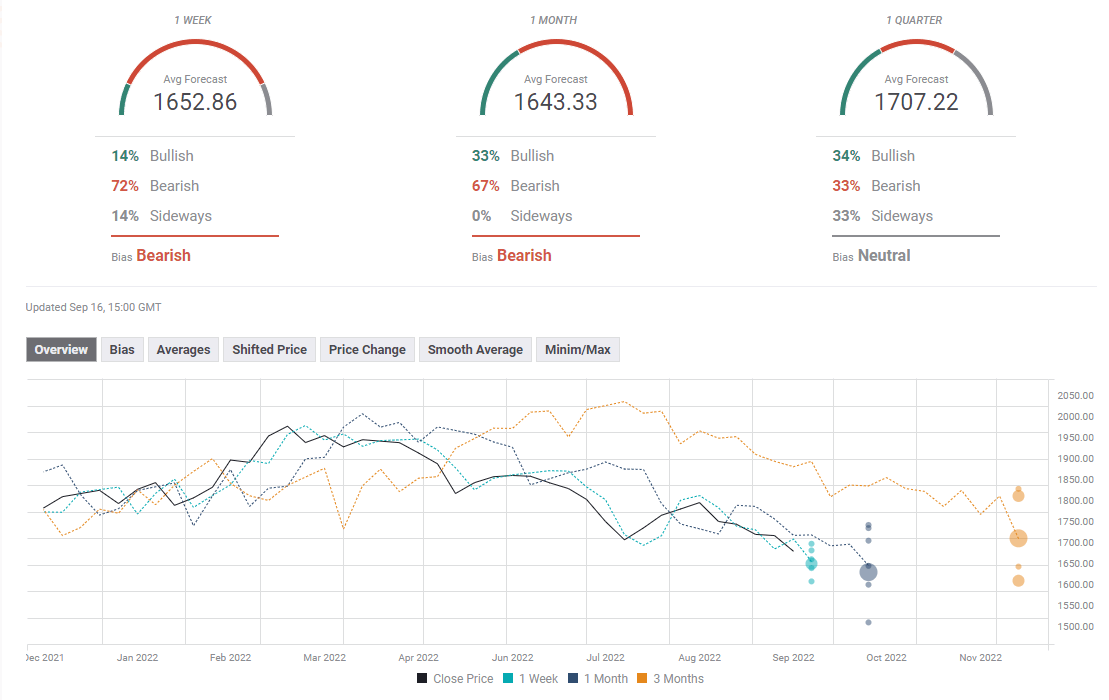

Gold sentiment poll

The FXStreet Forecast poll points to an overwhelmingly bearish bias in the short term and the one-week average target sits near $1,650. The one-month outlook paints a similar picture with an average target of $1,643.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.