Gold Weekly Forecast: Geopolitics, Fed policy decision to drive prices

- Gold extended its slide after failing to stabilize above $3,400.

- Fed Chairman Powell will testify on monetary policy.

- The near-term technical outlook suggests that Gold is close to turning bearish.

Gold (XAU/USD) turned south at the beginning of the week and continued to push lower after breaking below $3,400 as price action was largely driven by headlines surrounding the Iran-Israel conflict. The evolution of this weeklong crisis in the Middle East, along with Federal Reserve (Fed) Chairman Jerome Powell’s testimony, could drive Gold’s valuation in the near term.

Gold reverses direction, registers weekly losses

Gold started the week under bearish pressure and lost more than 1% on Monday. Although Israel and Iran exchanged missile strikes over the weekend, safe-haven flows failed to dominate the action in financial markets. United States (US) President Donald Trump said that many meetings were taking place and that there will be peace between Israel and Iran soon. Additionally, the Wall Street Journal reported that Iran was looking to end hostilities with Israel and resume the talks over its nuclear program.

Following Tuesday’s choppy action, Gold edged slightly higher early Wednesday after comments from Trump revived concerns over the US getting directly involved in the conflict in the Middle East. “We now have complete and total control of the skies over Iran,” Trump said and added that Ayatollah Ali Khamenei is "an easy target."

In the second half of the day, the Federal Reserve’s policy decisions helped the US Dollar (USD) gather strength and caused XAU/USD to stretch lower in the late American session.

The Fed left the policy rate unchanged at the range of 4.25%-4.5% after the June meeting, as widely expected. The revised Summary of Economic Projections (SEP) showed that policymakers are still expecting interest rates to be lowered by a total of 50 basis points (bps) in 2025.

On a hawkish note, officials’ preference shifted toward a single 25 bps rate cut in 2026, compared to two in March’s SEP. In the post-meeting press conference, Fed Chairman Jerome Powell said that tariff increases are likely to weigh on economic activity and push up inflation. Powell further noted that they are "well-positioned" to wait and learn more before considering policy adjustments.

Early Thursday, Bloomberg reported that US officials were preparing for a possible strike on Iran in the coming days. Similarly, the Wall Street Journal claimed that President Trump had approved attack plans on Iran earlier this week but wanted to wait to see if Tehran would abandon its nuclear program. As markets adopted a cautious stance in response to these headlines, Gold managed to limit its losses and closed flat on Thursday.

Nevertheless, news of Trump giving Iran a last chance to make a deal to end its nuclear program and deciding to delay his final decision on launching strikes for up to two weeks helped the risk mood improve early Friday. In turn, Gold came under renewed bearish pressure and fell to its weakest level in over a week below $3,350.

Gold investors await Powell testimony, inflation data

Fed Chairman Powell will testify on the Semiannual Monetary Policy report on Tuesday and Wednesday. According to the CME FedWatch Tool, markets virtually see no chance of a Fed rate cut in July and price in about a 35% probability of another policy hold in September.

In case Powell hints at a September rate cut, the USD could weaken against its rivals with the immediate reaction and help XAU/USD regain its traction. On the flip side, the market positioning suggests that there is room for additional USD strength if Powell downplays the SEP projections and reiterates that they will continue to prioritize inflation, citing healthy conditions in the labor market.

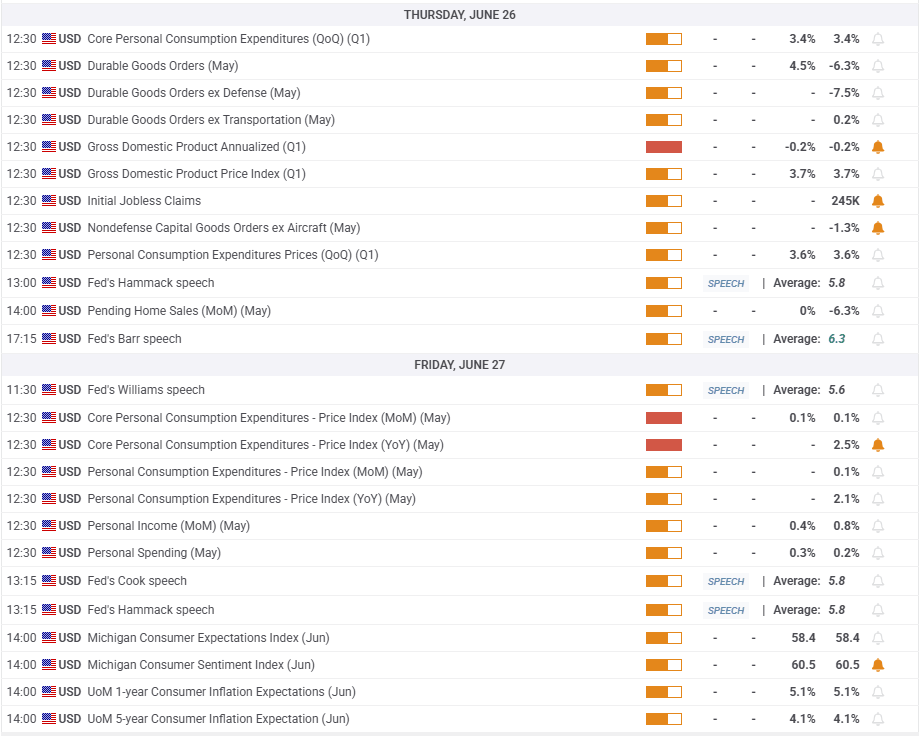

The US economic calendar will feature Personal Consumption Expenditures (PCE) Price Index data for May on Friday. In the post-meeting press conference, Powell said they estimate PCE and core PCE inflation to stand at 2.3% and 2.6%, respectively, in May. Although this comment takes away the surprise factor, a smaller-than-expected increase in the monthly core PCE Price Index reading could still hurt the USD in the near term.

Market participants will continue to pay close attention to headlines surrounding the Iran-Israel conflict. If Iran agrees to return to negotiations over the nuclear programme, Gold could remain under selling pressure. On the other hand, in the event of a further escalation of the conflict, with Iran refusing to negotiate and the US threatening military intervention, the precious metal is likely to stay resilient.

Gold technical analysis

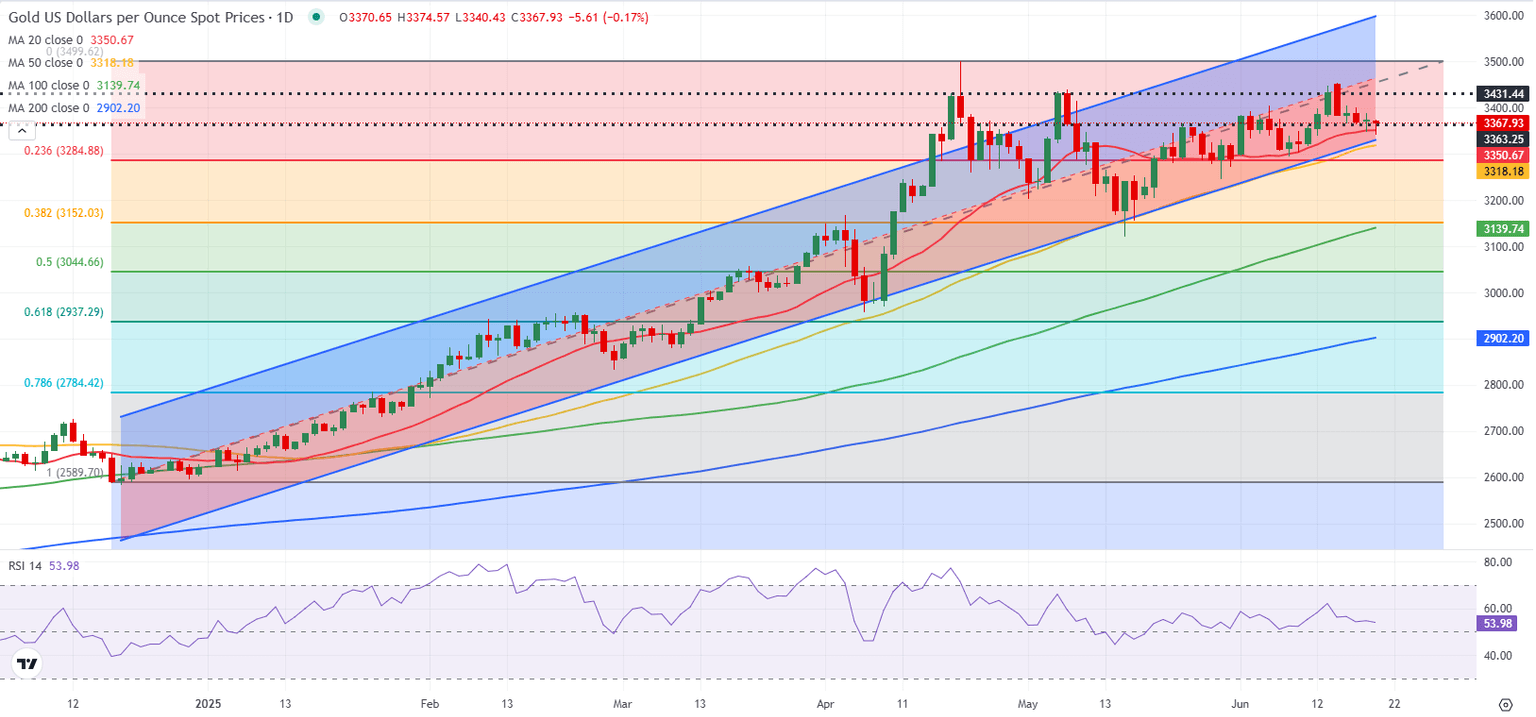

The Relative Strength Index (RSI) indicator on the daily chart retreats toward 50 and Gold closes in on the lower limit of the six-month-old ascending regression channel, currently located at $3,330. This level is also reinforced by the 50-day Simple Moving Average (SMA).

A daily close below $3,330 could attract technical sellers. In this scenario, $3,300-$3,285 (static level, Fibonacci 23.6% retracement) aligns as the next support region before $3,200 (static level, round level).

Looking north, the first resistance level could be seen at $3,400 (static level, round level) before $3,460 (mid-point of the ascending channel) and $3,500 (all-time high set on April 22).

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.