Gold, the Chart of the Week: XAU/USD bulls lurking with eyes on trendline resistance

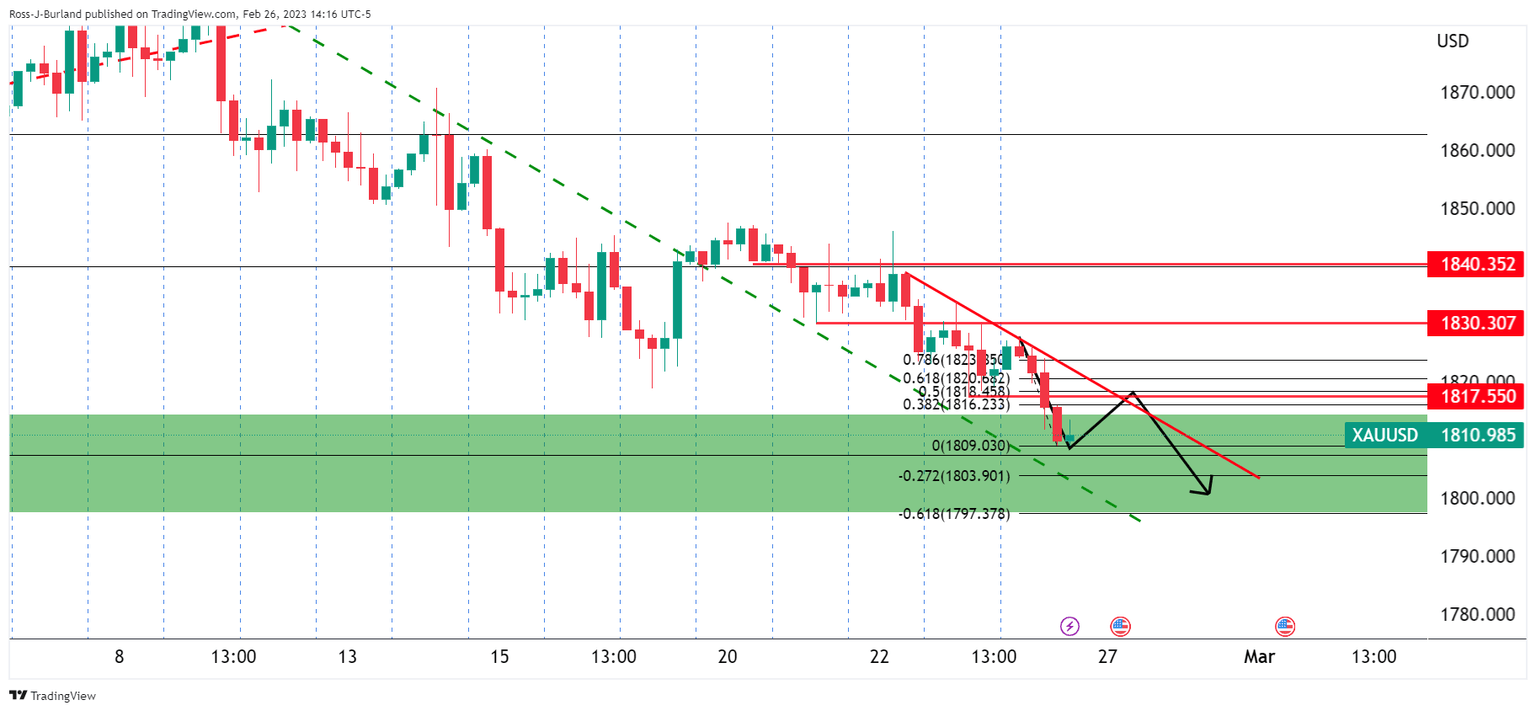

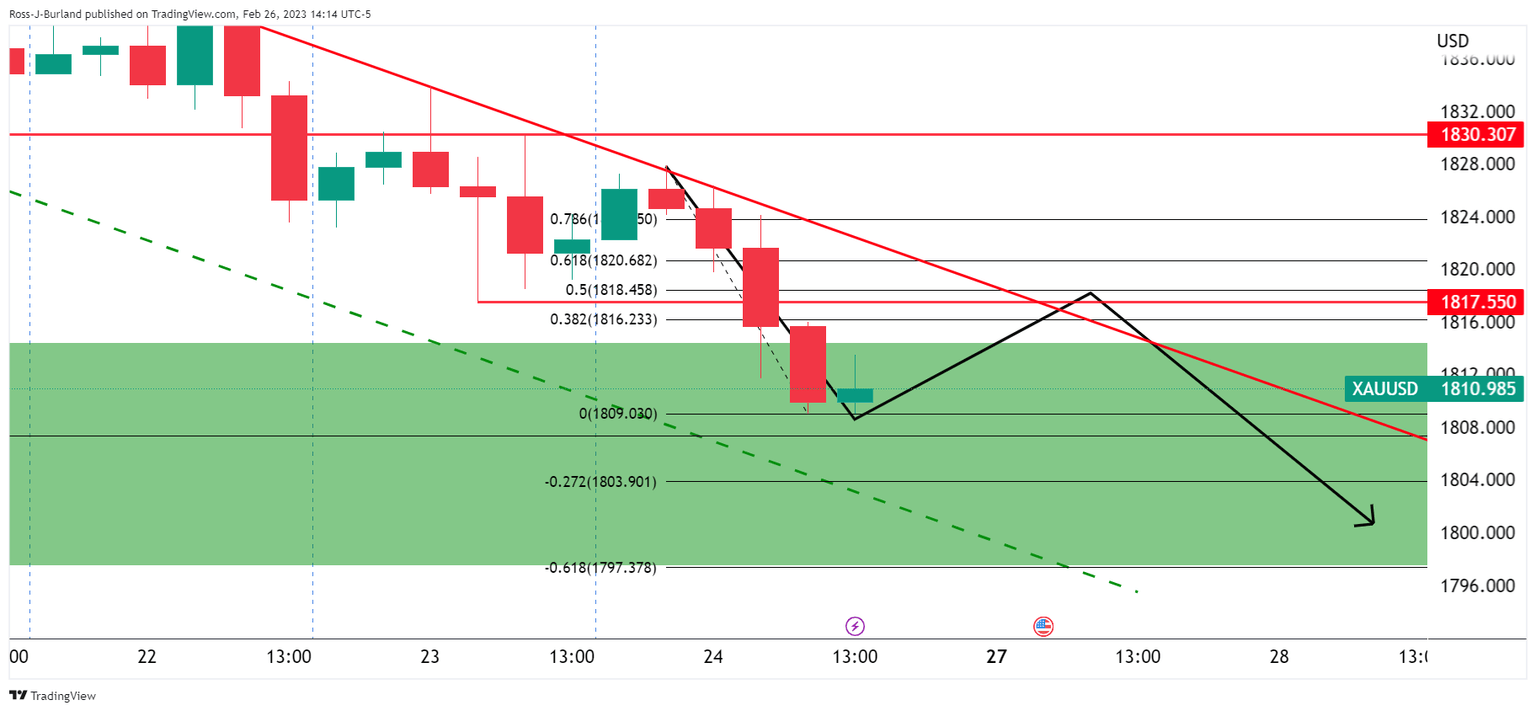

- Gold is running into a support zone that leaves upside corrections in focus for the initial balance of the week.

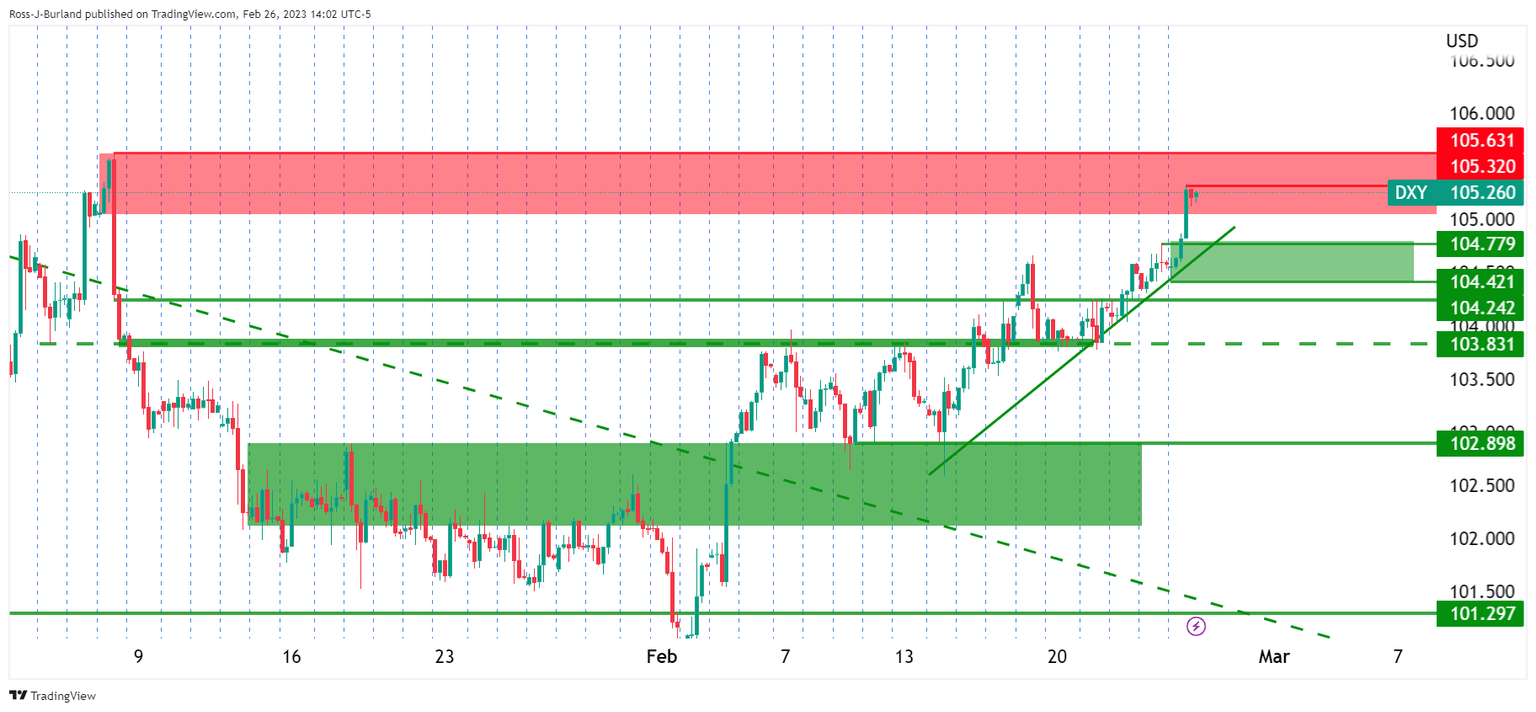

- The US Dollar is up high which also leaves a corrective bias for Gold price.

Gold price ended lower for a fifth-straight day on Friday as the market adjusted for higher for longer from the Federal Reserve due to evidence that the economy is running hot. Gold price fell from trendline resistance mid-week and extended the losses to a fresh cycle low of $1,809 while US Bond yields also climbed.

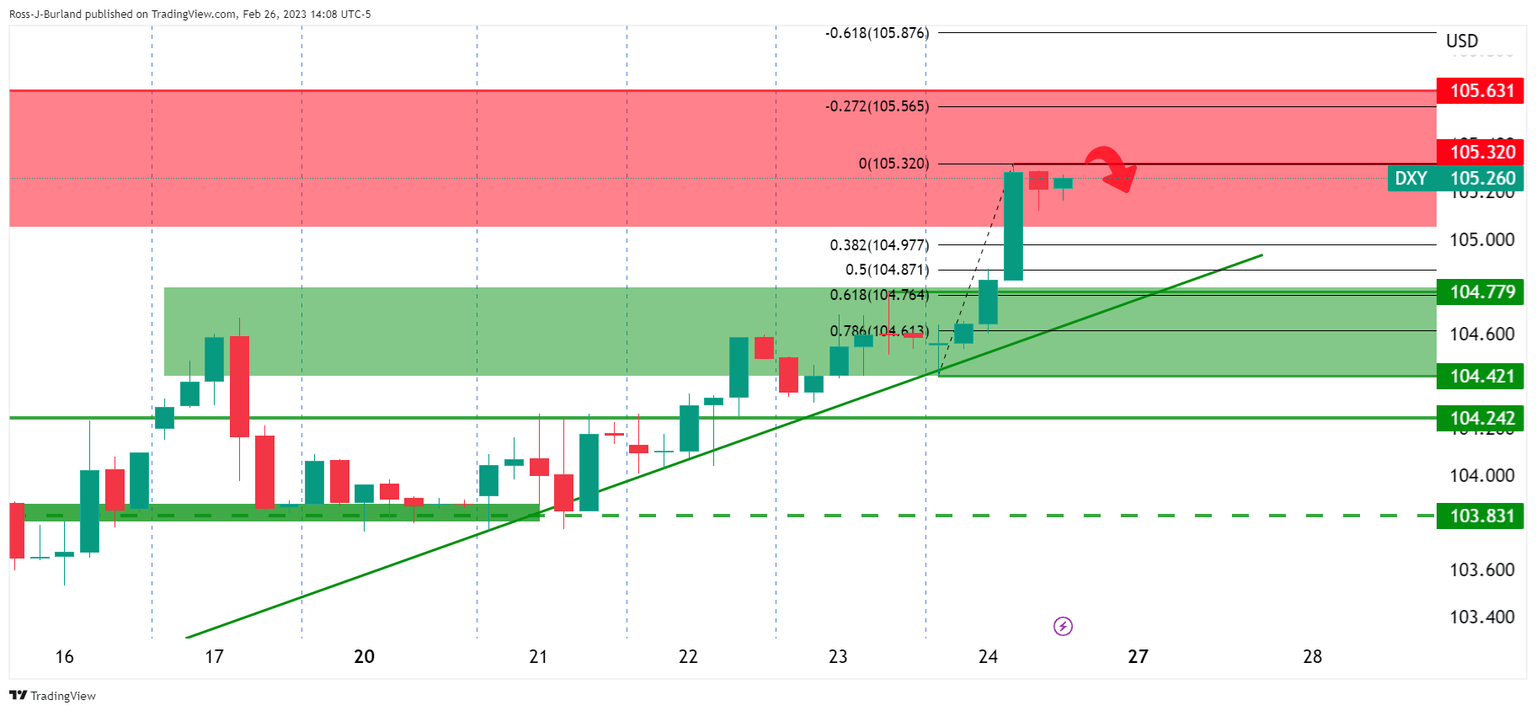

The US 10-year note yield reached a high of 3.978% and ended the day paying 3.947%, up from the day's low of 3.854%. The US Dollar index reached a high of 105.32 and ended the day up high after Personal Consumption Expenditures (PCE) Price Index, the Federal Reserve's preferred inflation measure, rose by an annualized 5.4% in January, up from 5.3% in December and ahead of a 4.9% consensus estimate.

All in all, this leaves the outlook data dependent and markets will need to wait for the Nonfarm Payrolls report a little longer than this week as it falls on the 2nd Friday of this month. Instead, ISM surveys will be on the watchlist for this week and data already released point to a rebound for the ISM mfg index in Feb following five months of consecutive declines that saw the series drop to a post-Covid low of 47.4 in Jan, analysts at TD Securities said. ''Separately, we look for the ISM services index to stabilize around its current level after the notable Dec-Jan zigzag in the series. We might revise our projection as more data is released next week.''

Gold and DXY technical analysis

The US Dollar is up high and a correction would be anticipated for the initial balance to start the week.

This puts the focus on the upside for the Gold price to revisit prior support and test the trendline resistance as illustrated o the above 4-hour charts.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.