Gold retraces from $3,390, drops back to $3,358: Bulls face challenge at $3,375

- Markets digest disappointing Jobs Report Card.

- Dollar Index at Critical Support 98.50.

- Speculations on Federal Reserve Chief Appointment.

- Moderation in Central Bank Gold buying.

What's happening with Gold?

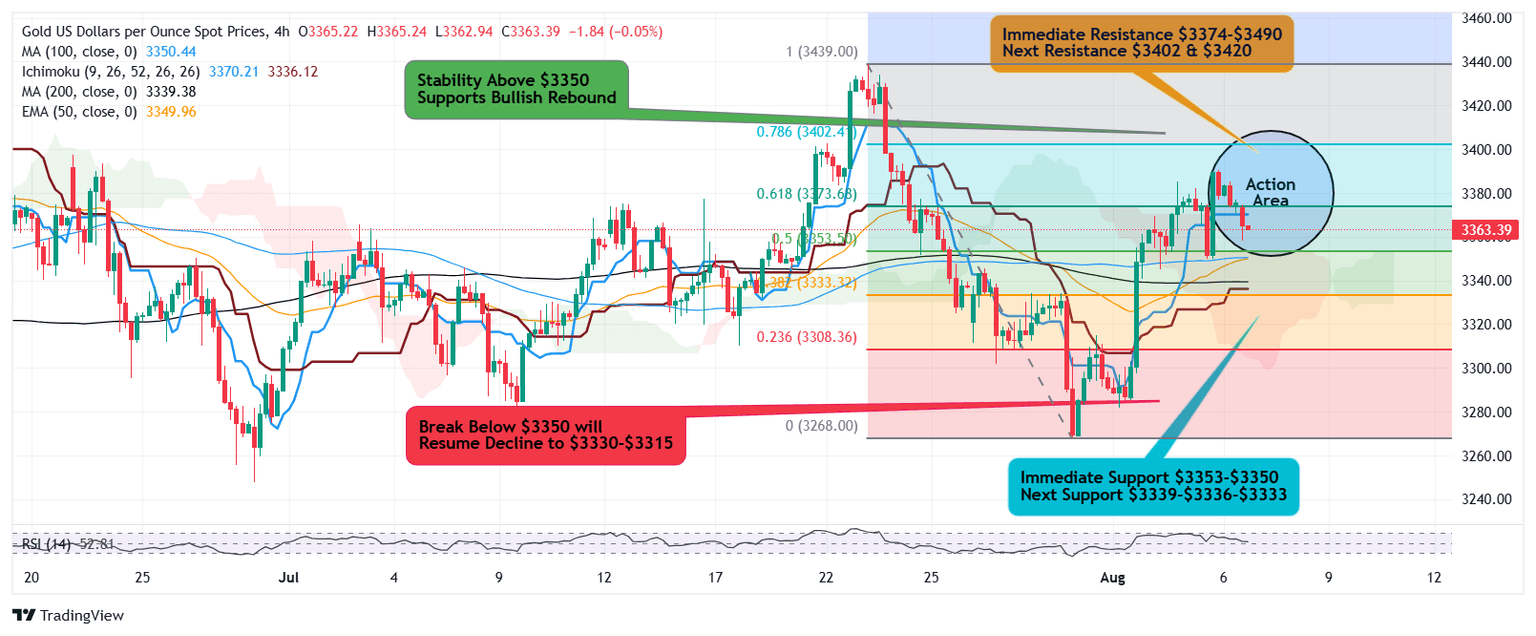

Gold surged to new recent high of $3390 on Tuesday during New York trading session and settled the day at $3380, followed by a retracement in Asian and European trading session which witnessed price drop to $3358 followed by consolidation below immediate resistance $3370-$3375.

What's driving the volatility?

Markets expect a cut in interest rate by Federal Reserve in its September meeting as a result of disappointing NFP jobs report as CME is said to be pricing 67% probability of rate cut.

Recent surge in Dollar Index may surpass 100 benchmark if 98.40 support holds strong which may keep Gold under pressure in near term, extending downward correctional wave to retest $3330-$3315 if immediate resistance of $3375 is not reclaimed.

Persistent global concerns on US tariff as well as geo political crisis keep safe haven demand pouring in off and on.

Gold continues to attract buyers on dips and retail traders remain cautious on heights as profit booking is seen to push prices on every rise.

Broadly speaking, Gold price action is witnessing pump-n-dump and dump-n-pump on a cyclical motion.

What's expected next?

Gold is sitting at a critical juncture as price stability above immediate support 4 hourly 50 EMA $3350 is very crucial for a rebound which faces immediate resistance at $3370 and 61.8% Fibonacci zone $3375.

If consolidated break above this zone is established, expect further advance to retest $3385-$3390 above which next leg higher sits at 78.6% Fibonacci zone $3402.

On the flip side, sustained break below $3350 will indicate sellers intervention calling for downward shift in momentum extending correctional move to next support $3333 followed by $3315.

Author

Sunil Kumar Dixit

SK Charting

Sunil Kumar Dixit is Chief Technical Strategist and founder of SK Charting, a research firm based in India. He tracks Precious Metals, Energy, Indices and Currency Pairs. He also participates as an expert panellist on Channel Television, Nigeria.