Gold Price Weekly Forecast: XAU/USD is at the mercy of the Fed, ascending triangle pattern in play

- Gold has struggled to make headway amid Omicron fears and higher US inflation.

- The Fed decision is left, right and center as US yields remain of high importance.

- Mid-December's daily chart is showing an ascending triangle, which is bullish.

- The FX Poll is pointing to further trading around current levels.

Is a more contagious but less lethal covid variant good or bad? That is the question markets have been grappling with, shaking all assets including gold. The focus now returns to the Fed and its probable decision to tighten monetary policy. An ascending triangle looks promising for bulls.

This week in XAU/USD: Watching Omicron and yields

Answers within two weeks – that is what experts said when the fast-spreading covid variant received its ominous name Omicron, just a fortnight ago. While data is emerging, there is still a high dose of uncertainty about vaccine resistance and other issues.

Every upbeat piece of news – such as cases are mostly mild – boosted sentiment, pushing the dollar up and XAU/USD down. On the other hand, each warning about the strain's spread worsened the mood. According to research in Japan, Omicron spreads 4.2 faster than Delta. That previous high-profile variant was already highly contagious.

This reaction mechanism was somewhat distorted by the stocks-bonds dance. Worrying headlines also resulted in a rush to buy equities that left bonds abandoned – and yields rose. In turn, gold suffered declines.

Another somewhat confusing reaction came in response to US inflation data. Prices rose by 6.8% YoY in the US, the highest since 1982 – but investors feared a worse outcome, thus sending the dollar down and gold up.

The bottom line for the precious metal is that it stayed within range – which even became narrower. That will likely change.

Next week in gold: Fed in focus

The last week before the one leading to Christmas is packed with top-tier events. However, one stands out – the decision by the Federal Reserve. Chair Jerome Powell and his colleagues will likely accelerate the pace of tapering their bond-buying scheme – purchasing fewer dollars and signaling a rate hike coming sooner.

The Fed is reacting in response to rising inflation and a steaming-hot economy. For gold, such a move is adverse but mostly priced into XAU/USD. It is essential to note that Powell signaled it well in advance. However, any deviation from a modest acceleration from $15 to $20 billion/month could rock markets.

A surprise announcement of a $25 billion/month tapering pace would hurt the value of the precious metal. Conversely, if the Fed fears Omicron and decides against changing its policy, gold would shine.

It is also worth watching the bank's updated forecasts for interest rates, aka the "dot-plot." Members would like to tilt their bets toward raising rates once in 2022, while markets already price two moves. If officials go for a duo of increases in 2022, the dollar could rise and XAU/USD could decline.

Decisions by two other major central banks are worth watching. The ECB is set to announce an expansion of one of its bond-buying schemes, to compensate for the expiry of another one. A large increase would be gold-positive and refraining from announcing anything would be adverse for the price.

The Bank of England is on course to leave its rates unchanged amid growing economic damage from the virus. A surprise hike would weigh on gold while a no-change decision would likely be ignored.

News related to the virus remains of importance – but their impact on yields is of higher importance to XAU/USD than the reaction in the broader risk sentiment.

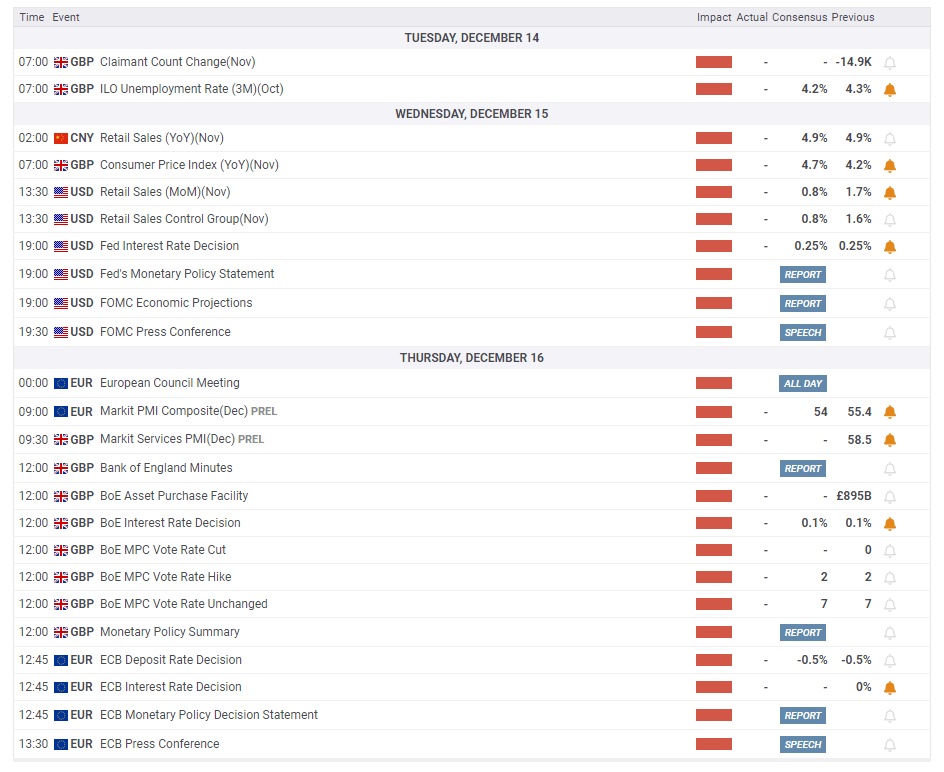

Here are the key events for gold on the economic calendar:

XAU/USD technical analysis

The 50, 100 and 200-day Simple Moving Average nearly converge at $1,792. This phenomenon makes that level of high importance, as a tight cap. It also provided support in July. Looking down, XAU/USD is trading alongside an uptrend support line since August.

Together, these two lines form an ascending triangle – which is bullish according to technical textbooks. On the other hand, failure to break above $1,792 and downside momentum could push the price below the uptrend support line and trigger a rapid downfall.

Considerable support awaits at $1,760, followed by $1,745 and $1,720.

Resistance above $1,792 is at $1,810, followed by $1,735 and $1,880.

Gold price: Daily chart

Gold sentiment

The Fed is set to bring forward rate hike expectations. Contrary to the reaction to inflation data, that could be bearish for gold. It would take an especially dovish decision and softer yields to send prices above the ascending triangle.

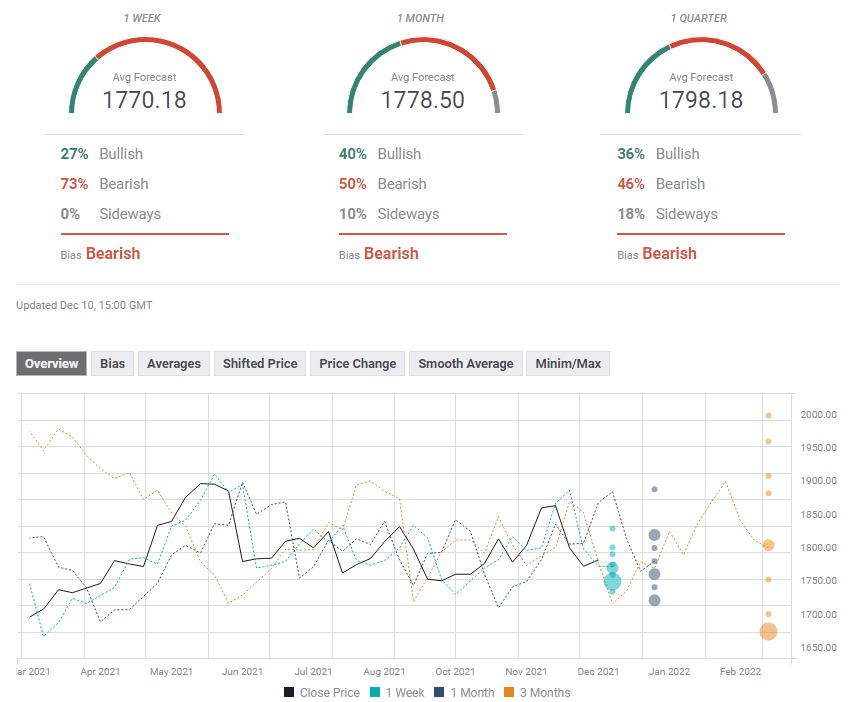

The FX Poll is showing that experts are bearish on all time frames, but see the price as ascending as time passes by.

Related Reads

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.

-637747475779428336.png&w=1536&q=95)