EUR/USD Weekly Forecast: The Fed and the ECB ready to rock markets

- The Fed and the ECB are expected to move in opposite directions when they meet next week.

- Market participants await clarity about the Omicron variant and its possible effects on growth.

- EUR/USD holding near the year low and at risk of falling towards 1.1000.

The EUR/USD is little changed for a third consecutive week, trading around the 1.1300 figure, as uncertainty related to the Omicron coronavirus variant and looming central bank decisions kept market participants in a cautious mood.

Answers from central banks

At this point, speculative interest has priced in that the US Federal Reserve will likely announce a doubling of its bond-buying program tapering. The Fed decided in November that the economy was strong enough to trim financial support, particularly as inflationary pressures remain high. The central bank announced it would reduce the pace by $15 billion a month, $10 billion in Treasuries and $5 billion in mortgage-backed securities.

Powell later testified on the CARES act before Congress and said he expects to discuss accelerating tapering in the December meeting, adding that they could wrap up financial support “a few months sooner.” The market now expects the Fed to double the pace of tapering to $30 billion a month. US policymakers will keep rates on hold, but pulling off support programs is the first step towards tightening, which means the chances of one or two rate hikes in 2022 have increased.

On the other hand, the European Central Bank has maintained a wait-and-see stance, with President Christine Lagarde noting that a rate hike would be unlikely in 2022, and warning that the central bank must not rush into premature tightening. On Thursday, market players were surprised with reports suggesting ECB governing council members are converging on a debate over a limited and temporary increase of the Asset Purchases Programme (APP) in the December meeting. Headlines also indicated that the central bank is considering tweaks to its PEPP reinvestment plans, with market talks indicating that it might add geographical flexibility to the reinvestments or might extend the reinvestment time under the emergency programme.

It is worth mentioning that inflation stands at multi-decade highs in the EU and the US. On Friday, Germany confirmed its November annual inflation at 6% YoY, while the US Consumer Price Index in the same period was confirmed at 6.8%, upwardly revised from 6.2%.

It is not the first time the market has witnessed central bank imbalances, but the fact that the ECB and the Fed could move in opposite directions will likely introduce big noise, with the greenback making the most out of it.

Omicron and growth

Regarding the Omicron coronavirus variant, little knowledge has been added these days. The strain is notably more contagious than its preceding versions, and early studies suggest it may produce milder symptoms and be less deadly. However, and as cases continue to scale, European governments have announced some restrictive measures, most of them involving the use of a “green pass” to access certain places and forcing unvaccinated people to take the shots to access a more normal life.

Developments around the Omicron strain could make or break investors’ belief in future growth. Fears that tougher measures could delay the economic comeback have weighed on the market’s mood. It will take a couple of weeks to understand the new variant and have a clearer picture of how it may affect global growth. If, as suspected, Omicron is less deadly, the resulting optimism may partially offset the impact of decreased financial support.

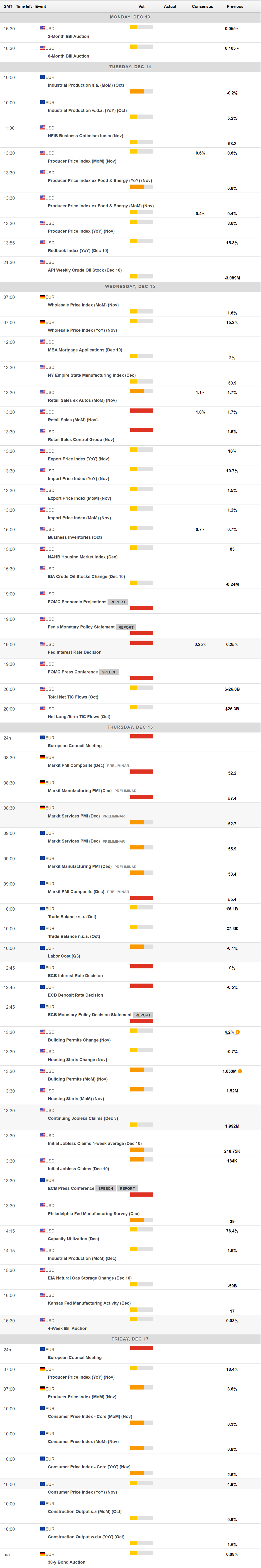

Beyond central bank decisions, the macroeconomic calendar next week will include November US Retail Sales, seen going up by 1% MoM, and the December preliminary Markit PMIs.

EUR/USD technical outlook

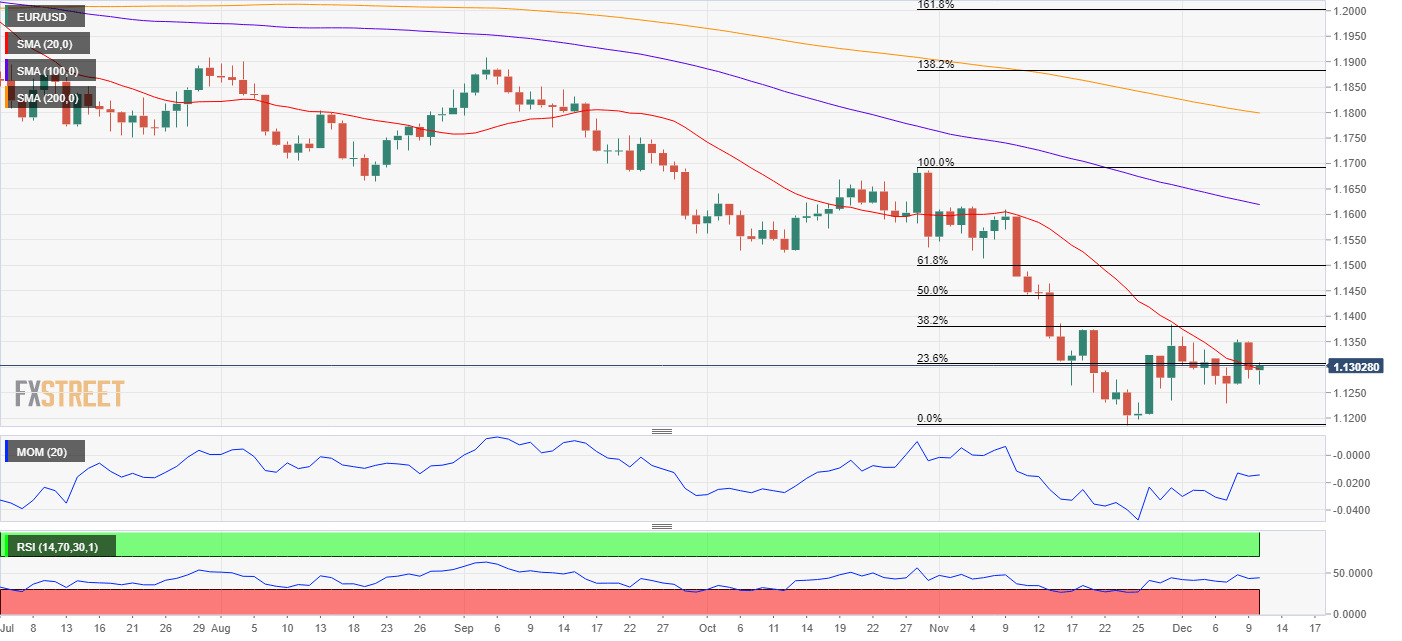

The EUR/USD pair set a lower low on a weekly basis but held above the yearly low at 1.1185. The overall technical picture indicates that further declines are likely, considering central bank imbalances. A strong static support level is the 1.1160 price zone, a probable bearish target as long as the pair remains below the 38.2% retracement of its November slide at 1.1380. A break below it exposes the 1.1000 psychological threshold, a level that could be reached before year-end.

The weekly chart shows that EUR/USD remains well below all of its moving averages, and the 20 SMA crossing below the 100 SMA, is a sign of prevalent selling interest. The Momentum indicator is maintaining its bearish slope well into negative levels as the RSI indicator consolidates in oversold territory.

The case for a bearish extension is not that clear in the daily chart, as higher daily openings maintain the Momentum indicator is heading north above its midline. Given that the pair cannot sustain intraday gains, however, chances tilt in favour of further downside. In the aforementioned chart, the RSI indicator has turned lower, currently at around 41, as the pair struggles with a firmly bearish 20 SMA, adding to the bearish case.

Should the pair rally past 1.1380, the next relevant resistance level comes in at 1.1470, a long term static resistance area.

EUR/USD sentiment poll

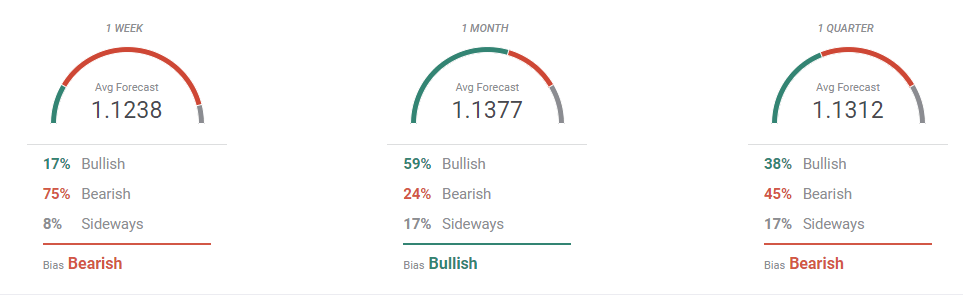

The FXStreet Forecast Poll hints at another leg south for EUR/USD. 75% of the polled experts see the pair down in the near term perspective, with the pair averaging 1.1238. Bears decrease drastically in the monthly view, down to 24%, while bulls account for 59%, with the pair seen then recovering above the 1.1300 threshold. Finally, bears retake control in the quarterly view, although, on average, the pair is seen holding around 1.1300.

The Overview chart, however, hints at persistent bearish strength. The weekly moving average is mildly bearish, but the longer ones are heading firmly lower. The same chart shows that the pair is seen at 1.1600 the most in the case of a recovery, while there’s an increased potential of a test of the 1.1000 critical level.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.