Gold Price Weekly Forecast: Bulls defend key support as focus shifts to US debt talks

- Gold price struggled to find direction but held above $2,000.

- US banking woes, debt ceiling news to drive the action next week.

- XAU/USD's near-term technical outlook points to a loss of bullish momentum.

Following a bullish start to the week, Gold price lost its traction and declined toward $2,000 ahead of the weekend but managed to stabilize above that key level. Investors will keep a close eye on headlines surrounding US debt ceiling negotiations and banking stocks next week.

What happened last week?

Following the heavy sell-off witnessed in the previous Friday, XAU/USD staged a technical correction on Monday. The US Federal Reserve's (Fed) Senior Loan Officer Opinion Survey showed that survey respondents reported, on balance, tighter standards and weaker demand for commercial and industrial (C&I) loans to large and middle-market firms, as well as small firms, over the first quarter.

Early Tuesday, the data from China, the biggest gold consumer in the world, revealed that the trade surplus expanded to $90.2 billion in April. This reading came in much higher than the market expectation of $71.6 billion and helped XAU/USD build on Monday’s technical gains. Ahead of Wednesday’s highly-anticipated April inflation report from the US, however, investors refrained from taking large positions and the trading action turned subdued in the second half of the day.

The US Bureau of Labor Statistics reported on Wednesday that inflation in the US, as measured by the change in the Consumer Price Index (CPI), ticked down to 4.9% on a yearly basis in April from 5% in March. Further details of the publication revealed that the Core CPI inflation, which excludes volatile food and energy prices, edged lower to 5.5% from 5.6% as expected. The US Dollar (USD) came under bearish pressure mid-week and Gold price extended its rally toward $2,050. As the lack of progress in the US debt ceiling talks caused investors to adopt a cautious stance, however, the USD found its footing and limited the pair’s upside.

On Thursday, PacWest, one of the regional banks that were impacted negative by the banking crisis, said in a securities filing on Thursday that its deposits dropped nearly 10% last week. The financial heavy Dow Jones Industrial Average lost nearly 0.7% on the day and the USD continued to benefit from risk aversion, forcing XAU/USD to close in negative territory.

With the benchmark 10-year US Treasury bond yield staging a rebound on Friday, Gold price continued to push lower toward $2,000 but managed to hold above that key level. The University of Michigan (UoM) weekly report showed the Consumer Confidence Index declined to 57.7 (preliminary) in May from 63.5 in April. The long-run inflation component of the survey climbed to 3.2%, the highest reading since 2011.

Next week

Although gold had been one of the preferred havens for investors whenever fears over a deepening banking crisis in the US escalated, XAU/USD’s recent action suggests that the yellow metal has lost some of its appeal. Nevertheless, investors might refrain from betting against the yellow metal in case there are fresh developments pointing to ongoing issues in small or medium-sized US banks.

Market participants will also pay close attention to headlines surrounding debt ceiling negotiations in the US. If US lawmakers fail to raise the debt limit, the US could reportedly default on its federal debt as soon as June 1 due to weaker-than-expected tax collection in April. Hence, talks are likely to continue toward the end of the month. If there is an agreement as early as next week, however, a near-term risk rally could be witnessed. Consequently, the USD is likely to weaken against its rivals. It’s worth mentioning that US T-bond yields are likely to push higher in that scenario and make it difficult for XAU/USD to gather bullish momentum. On the other hand, a cautious market stance amid a lack of progress in talks should support the USD and weigh on the pair.

On Tuesday, Retail Sales data from China and the United States will be featured in the economic calendar. A stronger-than-forecast growth in Retail Sales in China should trigger a positive reaction in XAU/USD and vice versa. In the US, Retail Sales are expected to rise by 0.7% in April. Since this data is unlikely to have a meaningful impact on the Federal Reserve’s rate outlook, the market reaction should be muted.

The weekly Initial Jobless Claims and April Building Permits will be other mid-tier data releases from the US next week.

Gold price technical outlook

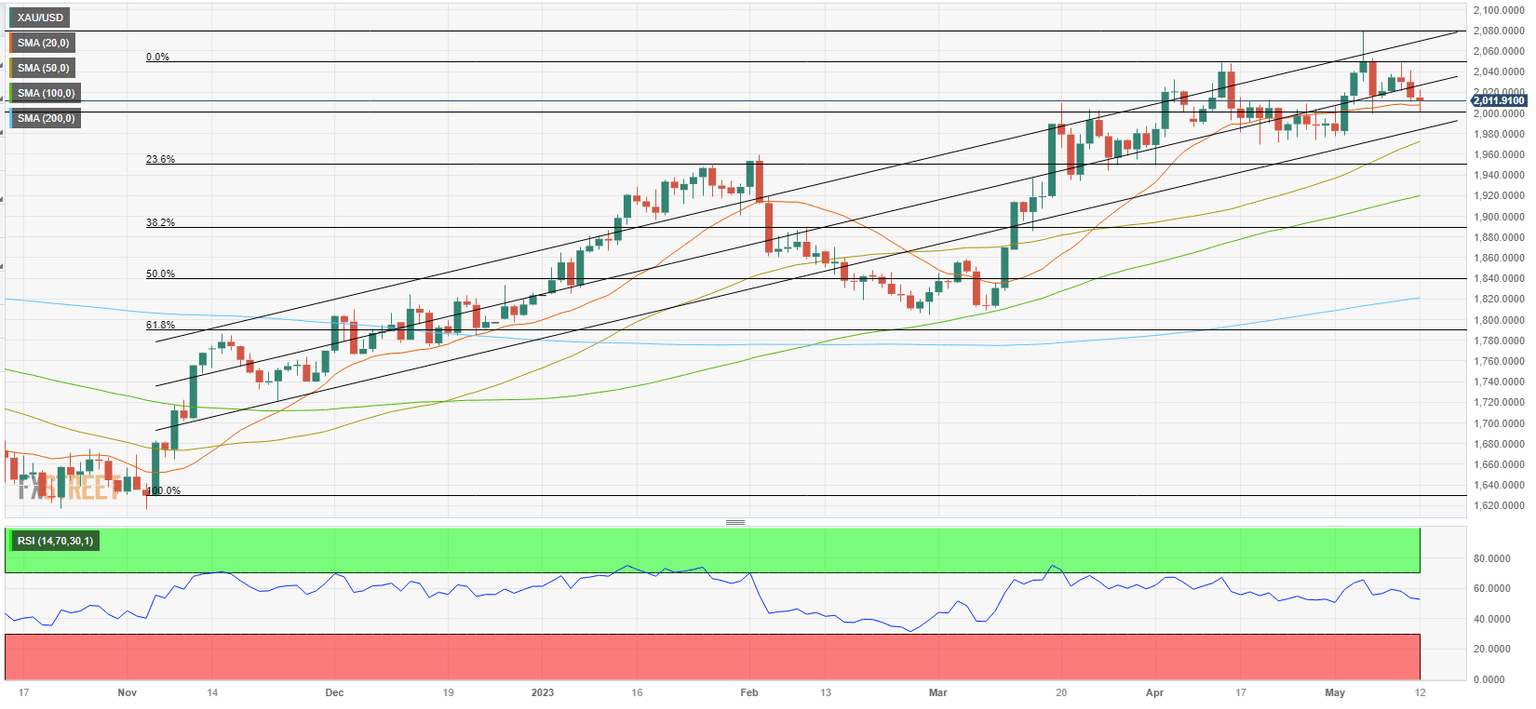

The Relative Strength Index (RSI) indicator on the daily chart retreated toward 50 and XAU/USD ended the week in the lower half of the ascending regression channel coming from November, reflecting a loss of bullish momentum.

On the downside, $2,000 (psychological level, static level) aligns as key support. With a daily close below that level, Gold price is likely to face next support at $1,975/$1,980 (lower limit of the ascending channel, 50-day SMA) before targeting $1,950 (Fibonacci 23.6% retracement of the latest uptrend).

If XAU/USD manages to rise above $2,030 (mid-point of the ascending channel) and stabilize there, it could gather bullish momentum and push higher toward $2,050 (static level) and $2,080 (all-time high, upper limit of the ascending channel).

Gold price forecast poll

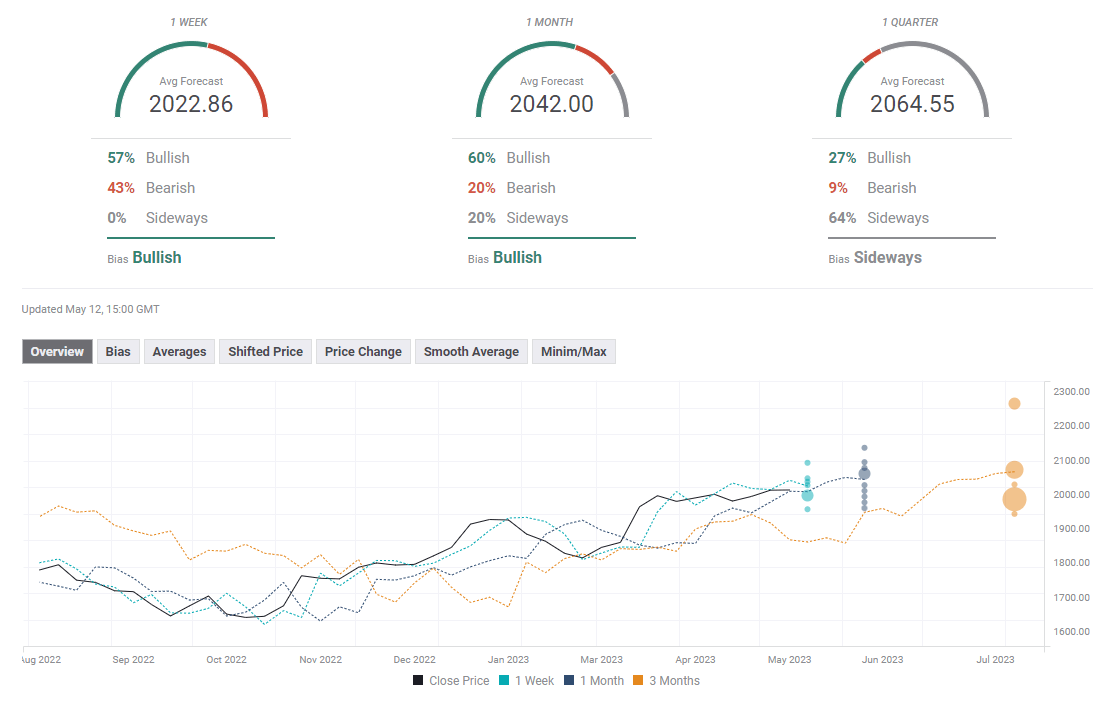

FXStreet Forecast Poll points to a slightly bullish bias in the short term with the one-week target aligning just above $2,020. The majority of polled experts cling to the bullish view over the one-month outlook as well.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.