Gold Price Forecast: XAUUSD at a critical juncture, US inflation holds the key

- Gold Price is testing bearish commitments at the key $1,842 support.

- US dollar is sitting at three-week highs amid firmer yields, cautious market.

- XAU/USD could see a decisive downside break on hotter US inflation.

Gold Price once again found strong bids just below the critical support at $1,842 and staged a decent comeback to finish a tumultuous Thursday with mild losses at $1,848. The bright metal remained choppy while keeping its familiar range around the $1,850 price zone. Risk-off flows dominated financial markets. Global growth concerns continued to overwhelm investors, especially after the European Central Bank (ECB) hinted towards a 50 bps rate hike in September to curb elevated inflation expectations. Investors fretted that aggressive tightening outlook by major central banks to quell higher inflation could tip the global economy into recession. Therefore, the safe-haven demand for the US dollar shot through the roof alongside the ongoing strength in the Treasury yields, knocking the bright metal back into the red zone. However, looming growth risks combined with the pre-US inflation release anxiety triggered a broad sell-off in Wall Street indices, particularly in the tech stocks, helping XAUUSD find a floor.

Gold Price is nursing losses below $1,850, as traders gear up for the all-important US inflation release, which will provide fresh hints on the Fed’s rate hike guidance. With the ECB decision out of the way, the main event risk to end this week, is likely to have a significant impact on the market sentiment, as well as, the dollar valuations. The US Consumer Price Index (CPI) is seen steady at 8.3% YoY in May while the core CPI is seen easing to 5.9% YoY vs. 6.2% previous.

Should the inflation print surprise markets to the upside, it could flag rapid and bigger Fed rate hike bets, fuelling a fresh upswing in the dollar at gold’s expense. Gold price could rebound firmly on a surprise drop in the US CPI, reviving the debate of peak inflation and lifting pressure off the Fed to act aggressively in September.

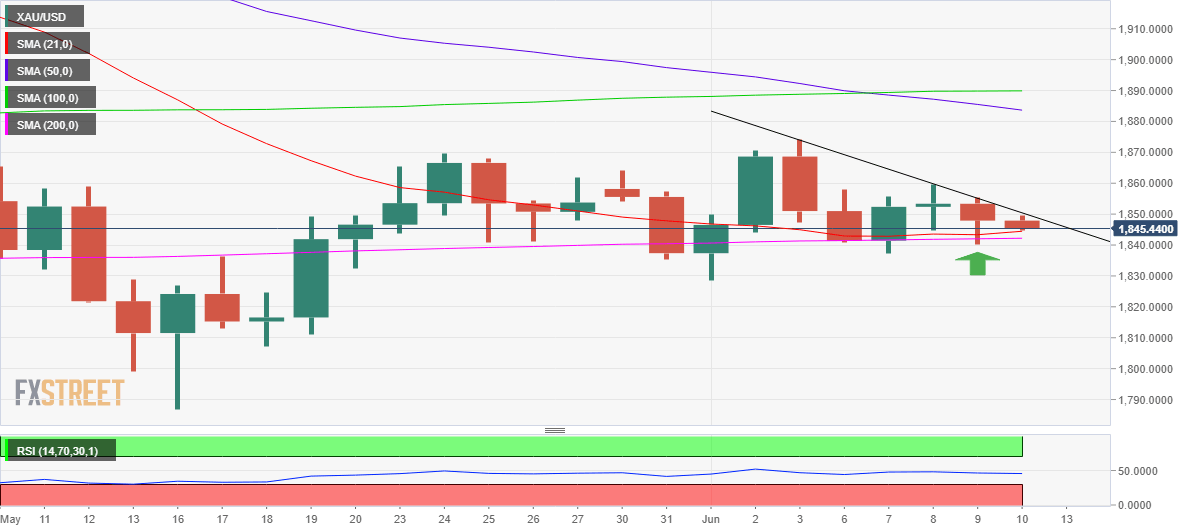

Gold Price Chart: Daily chart

The daily chart shows that the gold price rebounded after testing bids below the confluence of the horizontal 21 and 200-Daily Moving Averages (DMA) at $1,842.

As well predicted here, Wednesday’s doji candlestick signaled caution for bulls, as bears fought back control.

Traders now lookout for critical support and resistance levels heading into the US inflation showdown.

The 14-day Relative Strength Index (RSI) is inching slightly lower, suggesting that bears are likely to remain in charge going forward.

Sellers await a firm daily closing below the abovementioned $1,842 support to initiate a fresh downswing towards the $1,820 round level.

Ahead of that bears will challenge Tuesday’s low of $1,837, followed by the previous week’s low of $1,829.

Alternatively, the immediate upside now remains capped by the falling trendline resistance at $1,850.

Any further upside will XAU bulls will need to find acceptance above this week’s high of $1,860.

The previous week’s high of $1,870 will guard the further upside, as bulls will then keep their sight on the monthly top of $1,874.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.