Gold Price Forecast: For how long can XAUUSD defend $1,842 support?

- Gold Price trades water near $1,850, as USD steadies, despite firmer yields.

- Global growth and inflation concerns help keep a floor under yellow metal.

- XAU/USD defends 1,842 key support, eyes ECB, US inflation for next big move.

Gold Price lacked a clear directional bias and settled almost unchanged on Wednesday, having enjoyed good two-way volatility. In the first half of the day, built on the previous rebound and clocked fresh three-day highs of 1,860 before reversing sharply to test the $1,850 demand area.

The safe-haven US dollar kept the upper hand on the narrative that central banks’ policy tightening to combat inflation could trip the global economy into recession. Expectations of aggressive rate hikes weighed on the bond market, fuelling the upsurge in the US Treasury yields across the curve. The benchmark 10-year yields held fort above the 3% level, capping the upside attempts in the non-yielding gold. The bright metal, however, found a floor amid heightening tensions about the global economic outlook, especially after the GDP forecast downgrade by the World Bank and the OECD this week.

Gold Price is supported at $1,850 in the lead-up to the ECB showdown, as the dollar steadies amidst a cautious market mood and firmer yields. The ECB is widely expected to announce an end to its QE program on July 1 while hinting at a July rate hike. Investors ramped up aggressive ECB tightening bets after Wednesday’s upward revision to the Eurozone Q1 GDP data. Therefore, if ECB Chief Christine Lagarde’s guidance on the future rate hike will hold the key for markets. A more hawkish than expected Lagarde could likely limit the upside in the non-interest-beating yellow metal. Although any reaction to the ECB announcements will be limited, as traders look forward to Friday’s US inflation data for the next big move in the bullion.

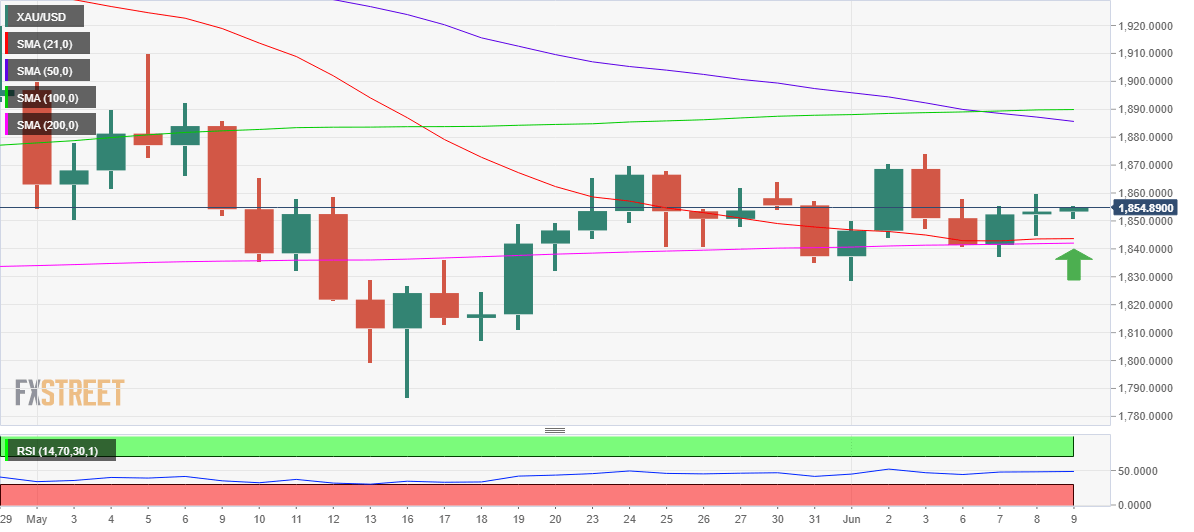

Gold Price Chart: Daily chart

As observed on the daily chart, gold price is looking to extend the bounce off the $1,850 level, as of writing,

Bulls have managed to defend the confluence of the horizontal 21 and 200-Daily Moving Averages (DMA) at $1,842 so far this week.

Wednesday’s doji candlestick after the previous rebound, however, warrants caution for gold optimists.

This combined with a flatlined 14-day Relative Strength Index (RSI) below the 50.00 level could also keep the upside attempts in check.

On the downside, a selling resurgence could challenge the abovementioned $1,842 support once again.

Bears will then attack Tuesday’s low of $1,837, below which a test of the previous week’s low of $1,829 remains on the cards. The $1,820 round level will be the line in the sand for buyers.

On the upside, XAU bulls will need to find a strong foothold above Monday’s high of $1,858.

The previous week’s high of $1,870 will be tested on gold’s northward trajectory towards the monthly top of $1,874.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.