Gold Price Forecast: XAU/USD stable above $1,830

XAU/USD Current price: $1,835.33

- Geopolitical tensions and price pressures continue to undermine the market mood.

- FOMC Meeting Minutes unlikely to shock investors as Fed path is clear.

- XAU/USD maintains a neutral-to-bearish stance as investors wait for fresh clues.

Financial markets struggled for a clear direction early Wednesday as investors await the Federal Open Market Committee (FOMC) Meeting Minutes. XAU/USD peaked at $1,845.99 a troy ounce mid-European session but quickly retreated amid prevalent US Dollar demand. The bright metal currently trades around $1,835, unchanged on the day.

Geopolitical tensions and stubborn inflation are at the top of investors’ concerns these days. On the one hand, China reaffirmed its support to Russia as Western nations condemned the latter’s invasion of Ukraine. On the other, signs of continued price pressures in the United States suggest the US Federal Reserve (Fed) will continue with its monetary tightening for longer than previously expected.

XAU/USD stays afloat ahead of Fed’s document as stock traders decided to fight back. US indexes pared their weekly slump, and trade mixed around their opening levels. Meanwhile, US Treasury yields retain a soft tone, down for the day and helping to limit the US Dollar's bullish potential in the near term.

XAU/USD price short-term technical outlook

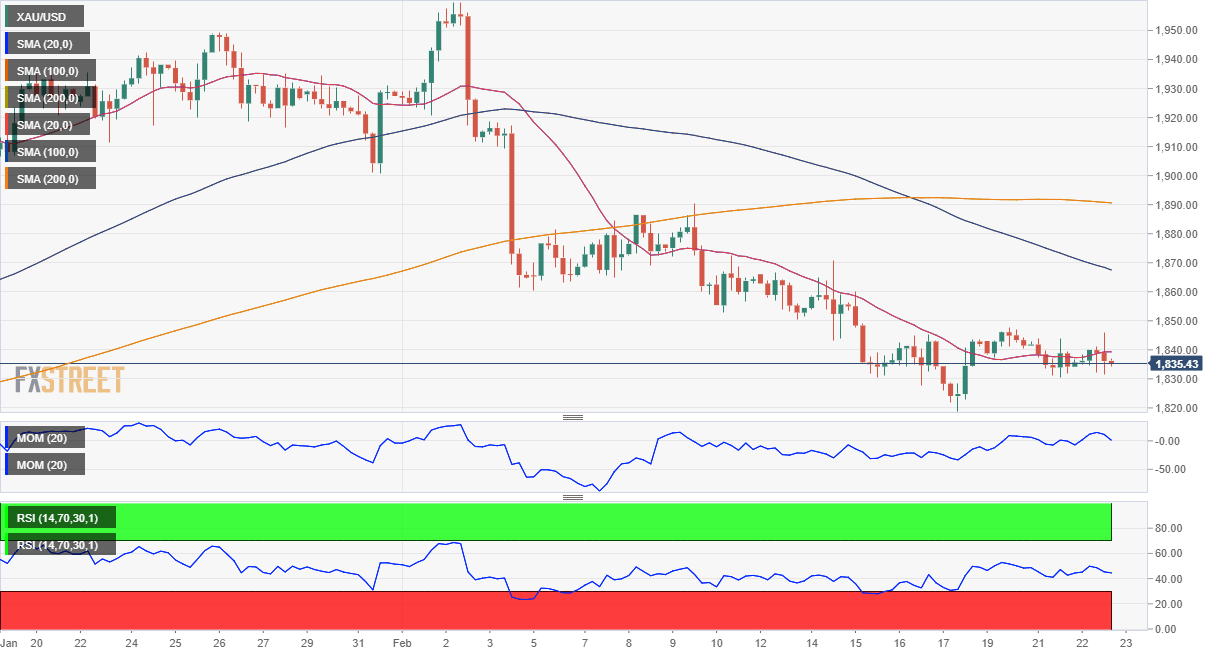

The XAU/USD pair trades near a weekly low of $1,830.22, partially losing its bearish strength but still at risk of falling. The daily chart shows that the pair keeps developing below a firmly bearish 20 Simple Moving Average (SMA) while above the longer ones. Technical indicators, in the meantime, hold within negative levels without clear directional strength.

In the near term and according to the 4-hour chart, XAU/USD is neutral-to-bearish. The pair is quickly retreating on spikes above a flat 20 SMA since early Tuesday. At the same time, the pair stands below a firmly bearish 100 SMA, which currently hovers around $1,869.00. Finally, technical indicators stand directionless just below their midlines, skewing the risk to the downside, although without confirming it.

Support levels: 1,824.60 1,811.30 1,797.45

Resistance levels: 1,838.90 1,854.00 1,870.50

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.