Gold Price Forecast: XAU/USD sellers return amid China concerns and light trading

- Gold price snaps a two-day recovery, ticking lower below $2,650 early Monday.

- The US Dollar firms up with Treasury bond yields, as sentiment turns sours on China woes, geopolitics

- Gold price drops back to test 21-day SMA at $2,632 on US Columbus Day.

Gold price is back in the red early Monday after staging a solid comeback late last week. The US Dollar (USD) is building on its previous gains, benefiting from a negative shift in risk sentiment at the start of the week.

Gold price reels from China’s stimulus pessimism

Asian traders are stuttering after China’s fiscal stimulus announcement on Saturday has left them unimpressed. China’s Finance Minister Lan Foan reiterated on Saturday their broad plans to revive the ailing economy but failed to offer any details or provide specifics on the stimulus plan. Reuters had reported previously that China was considering issuing special sovereign bonds worth about CNY 2 trillion this year as part of fresh fiscal stimulus.

This disappointment was followed by China’s consumer and factory-gate price inflation data on Sunday, which showed the extension of the disinflation trend in the world’s biggest consumer, sapping investors’ confidence.

Additionally, intensifying geopolitical tensions between Israel and Iran and also between China and Taiwan remain a cause for concern for investors, and hence, they scurry for safety in the USD at the expense of the Gold price.

CNN News reported that at least four Israeli soldiers were killed and more than 60 people were injured by a drone attack in north-central Israel on Sunday. Meanwhile, “China's military launched a new round of war games near Taiwan on Monday, saying it was a warning to the "separatist acts of Taiwan independence forces", drawing condemnation from the Taipei and US governments,” per Reuters.

Taiwanese Defence Ministry said in a statement that “we will not escalate conflict in our response.”

The downside, however, appears cushioned in Gold price, courtesy of the heightened odds that the US Federal Reserve (Fed) will lower interest rates by 25 basis points (bps) at its November 6-7 policy meeting. Markets currently price in about an 86% chance of such a move next month, according to the CME Group’s FedWatch Tool.

The progress in the US disinflation trend and the recent dovish remarks from Fed policymakers continue to suggest that the low-interest-rate regime is here to stay, keeping Gold buyers alive and kicking.

Looking ahead, the broader market sentiment and the USD dynamics will influence the Gold price action amid holiday-thinned conditions, as US traders observe Columbus Day. However, thin liquidity could likely exaggerate Gold price movement.

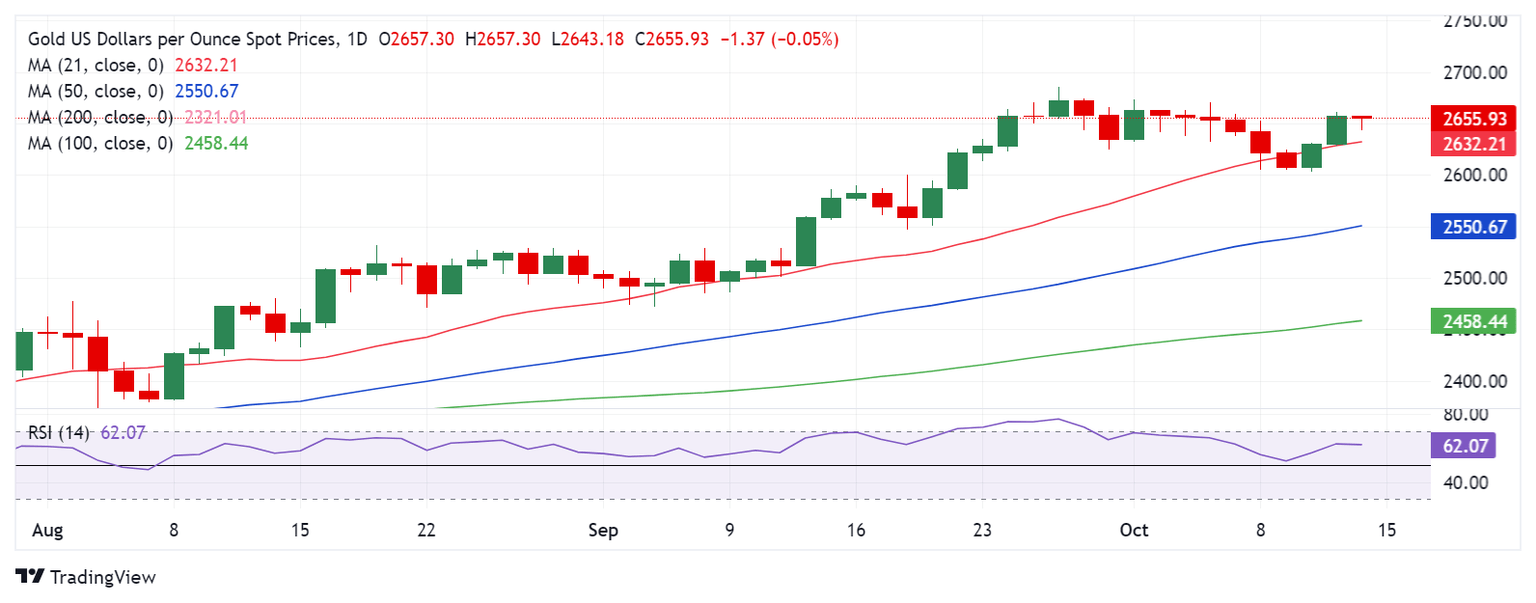

Gold price technical analysis: Daily chart

After finding a strong foothold above the key 21-day Simple Moving Average (SMA) support, now at $2,632 on Friday, Gold price is struggling to sustain at higher levels.

The 14-day Relative Strength Index (RSI), however, holds firm above the midline, suggesting that any dip in Gold price could be a good buying opportunity in the near term.

That said, if buyers regain control, the next bullish target for Gold price is seen at Friday’s high of $2,661, followed by the intermittent high at $2,670.

Further up, the record high at $2,686 will come into play.

On the downside, the immediate support is seen at the 21-day SMA at $2,632, below which the three-week lows near the $2,600 threshold will be tested.

A sustained break below the latter could extend the downside toward the September 20 low of $2,585.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.