Gold Price Forecast: XAU/USD remains vulnerable amid firmer US dollar, bearish technicals

- Gold price bears the brunt of the strong US dollar amid risk-aversion.

- Hawkish Fed expectations and Delta strain worries keep the DXY underpinned.

- Symmetrical triangle breakdown on the 4H chart points to more downside.

After posting a weekly gain, gold price started out a fresh week on the wrong footing and closed below the $1780 level. Resurfacing fears over inflation, Delta covid strain and Fed’s hawkish expectations boosted the US dollar, keeping gold price under pressure. Gold price meandered in weekly lows, holding onto the $1770 support area amid a sharp drop in the US Treasury yields across the curve. Fears heightened over the rapid spread of the Delta variant, as investors assessed new travel restrictions in Europe, which weighed on the market mood and lifted the dollar’s haven demand while knocking off the risk-sensitive US yields. Several Fed policymakers have turned hawkish on the world’s most powerful central bank’s monetary policy stance even though the recent PCE inflation data disappointed.

In Tuesday’s trading so far, gold price is holding the lower ground, consolidating within Monday’s trading range. The US dollar clings to the recent gains, gaining some support from a minor uptick in the Treasury yields. Markets continue to remain wary amid Delta strain concerns and mixed messages from the Fed officials. If risk aversion deepens heading into the US CB Consumer Confidence release, the greenback could see increased buying interest at gold’s expense.

Gold Price Chart - Technical outlook

Gold: Four-hour chart

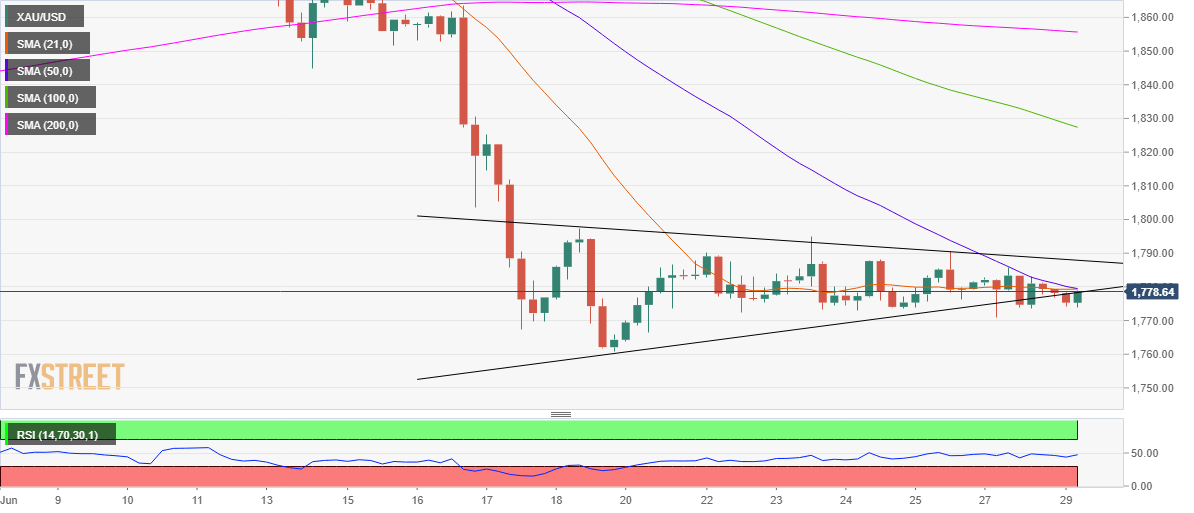

On the four-hour chart, gold price charted a symmetrical triangle breakdown in the US last session, opening floors for a test of the previous month’s low of $1766.

Should the May low give way, the two-month low of $1761 could be retested.

The Relative Strength Index (RSI) continues to hold below the central line, despite the latest uptick, signaling that any upside attempt is likely to remain short-lived.

An impending bear cross in the said time frame, with the 50-Simple Moving Average (SMA) on the verge of cutting the 21-DMA from above, further adds credence to a potential move southward.

Alternatively, if gold bulls decisively take out strong resistance at $1779-$1780, a run towards the $1790-$1795 supply zone cannot be ruled. The buyers will then look to challenge the $1800 psychological mark.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.