Gold holds steady as dovish Fed and global risks offset pullback

Gold (XAUUSD) holds steady after a brief pullback and remains near a key breakout zone. The Federal Reserve’s dovish shift has strengthened the metal’s outlook. Falling yields and prolonged low-rate expectations continue to support non-yielding assets like gold. At the same time, global risks and geopolitical tensions add to safe-haven demand. Despite short-term headwinds, the broader uptrend remains intact.

Gold supported by Fed rate cuts and ongoing global uncertainty

Gold has seen a brief pullback but remains positioned near a key breakout zone within its broader uptrend. The Federal Reserve’s dovish pivot has played a central role in supporting this trend. Last week’s 25 basis point cut marked the third reduction in 2025, with Fed Chair Powell indicating a comfortable stance going forward. This shift has lifted expectations for prolonged low rates well into 2026, supporting safe-haven demand and reducing the opportunity cost of holding gold. As yields fall, investors have rotated into metals, anticipating continued monetary easing.

Moreover, geopolitical developments continue to influence sentiment. U.S. officials suggested on Monday that a peace agreement with Ukraine is nearly complete. While key issues remain unresolved, the outlook for de-escalation may reduce immediate safe-haven demand. Still, unresolved border disputes and ongoing security concerns continue to drive demand for gold.

Meanwhile, recent remarks from Federal Reserve officials have added to the dovish outlook. New York Fed President John Williams stated that the current policy stance is appropriate as the economy moves toward 2026. Meanwhile, Governor Stephen Miran admitted that current policy remains too restrictive and signaled his intent to stay on until a successor is appointed. Although the Fed’s projections point to just one more rate cut by the end of 2026, market pricing tells a different story. Current expectations reflect at least two additional cuts, highlighting a growing gap between policymakers and market sentiment.

Gold develops third rounded base in ongoing bullish channel

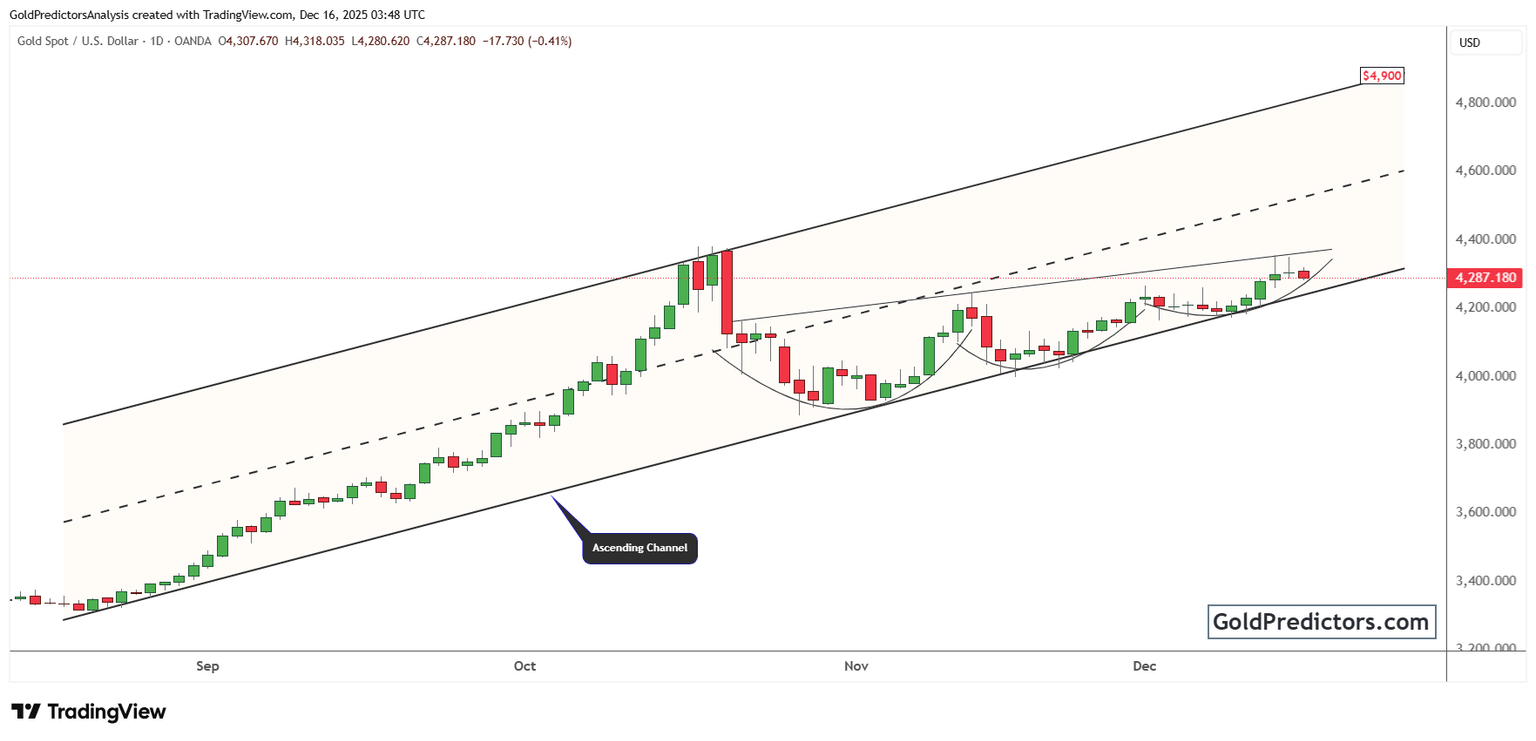

The gold chart below shows a well-formed ascending channel that has guided price action in recent months. After a sharp move higher, gold pulled back but consistently held support near the lower trendline. This correction phase created a rounded bottom and marked the beginning of a new series of higher lows. The pattern reflects a period of consolidation within a broader bullish structure, indicating continued strength in the underlying trend.

Gold has recently formed three cup-like consolidation patterns along the rising trendline. Each base held above the lower boundary, maintaining alignment with the broader bullish structure. Every formation was followed by a short rally, indicating steady upward pressure. These repeated patterns point to ongoing accumulation within the uptrend and suggest growing momentum as price approaches the mid-channel zone.

Currently, gold is trading within the third rounded base and approaching a key neckline resistance. A breakout above this level would indicate renewed bullish momentum and confirm continuation of the broader uptrend. The technical outlook remains favorable as long as price holds above support near $4,100. A confirmed breakout above the $4,350 to $4,400 zone would likely open the path toward the $4,900 region.

Gold outlook: Breakout zone in focus as bullish trend holds

Gold continues to hold firm near a potential breakout zone. The Fed’s dovish stance, falling yields, and persistent geopolitical risks have created strong support. While peace efforts may limit safe-haven flows in the short term, the broader trend remains intact. A move above key resistance could trigger the next leg higher, keeping the long-term bullish outlook in focus.

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Author

Muhammad Umair, PhD

Gold Predictors

Muhammad Umair is a financial markets analyst and investor who focuses on the forex and precious metals markets.