Gold Price Forecast: XAU/USD pulls back before the next leg north

- Gold price retreats from eight-day highs near $3,390 early Wednesday.

- The US Dollar enters a downside consolidation phase amid concerns over the Fed appointments and more easing.

- Gold price closed Tuesday above the key $3,380 resistance amid a bullish RSI and Bull Cross on the daily chart.

Gold price is off eight-day highs at $3,391 reached in Tuesday’s American session as traders look to cash in on the recent recovery rally ahead of US President Donald Trump's decision on Federal Reserve (Fed) appointments.

Gold price down but not out amid Fed concerns

In a CNBC interview late Tuesday, Trump said that he would announce decisions soon on a short-term replacement for Fed Governor Adriana Kugler, who announced her resignation on Friday.

The US president further noted that he has shortlisted four candidates to replace current Fed Chair Jerome Powell, whose term as chair ends in May 2026, and that he will decide on a nominee by the end of the week.

The next 48 hours appear crucial for markets as investors remain wary over the Fed’s independence amid intensifying bets of a September interest rate cut and resurfacing US economic jitters.

Data from the Institute for Supply Management (ISM) showed on Tuesday, the Services PMI fell to 50.1 in July, down from 50.8 in June and falling way short of the market forecasts of 51.5.

These factors continue to keep the bearish undertone intact around the US Dollar (USD) as it consolidates in multi-day lows against its major currency rivals.

However, expectations of further policy easing by major central banks, including the Fed, the Reserve Bank of Australia (RBA), the Bank of England (BoE) etc., and upbeat trade headlines revive risk flows, weighing negatively on the safe-haven Gold price alongside a pause in the USD declines.

All eyes now remain on the speeches from several Fed policymakers, Trump’s announcements on trade and Fed appointments for fresh trading impetus in Gold price.

Until then, some profit-taking and broader market sentiment will likely play their part in driving Gold price action.

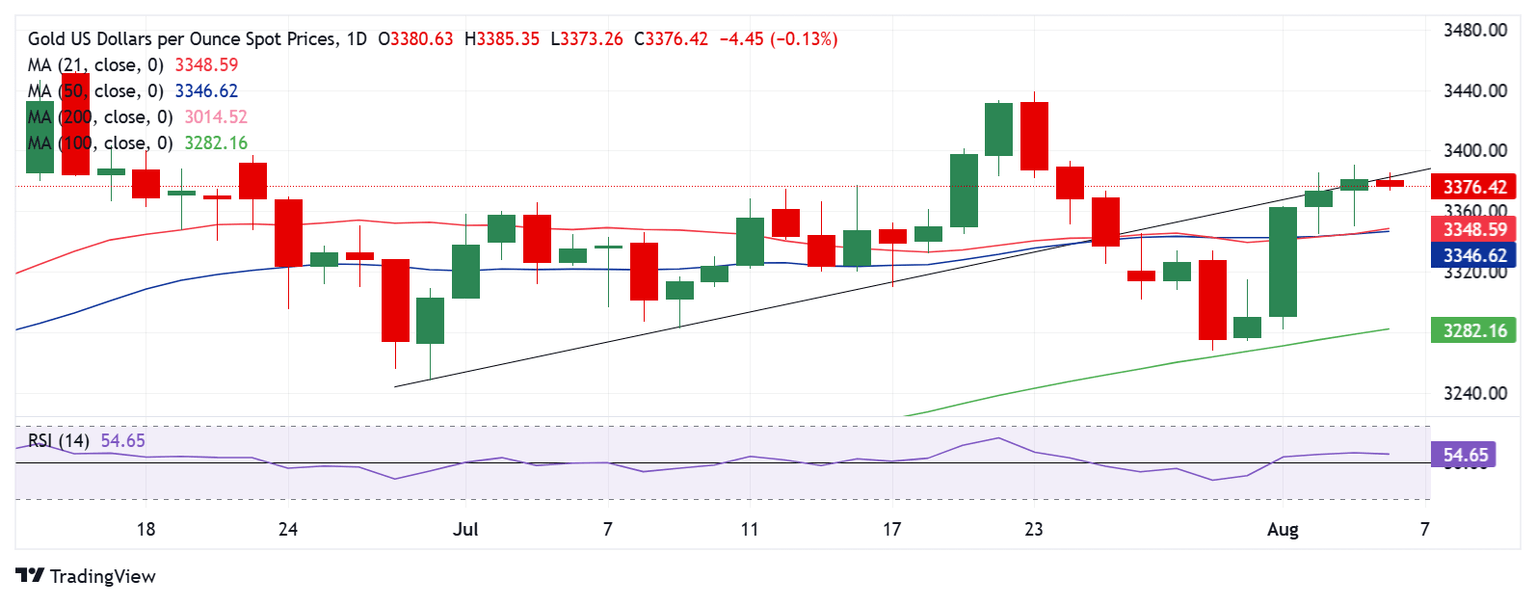

Gold price technical analysis: Daily chart

The short-term technical outlook for Gold price remains constructive.

The 14-day Relative Strength Index (RSI) is holding firm above the midline, currently near 55, suggesting that any downside in Gold price will likely be short-lived.

Adding credence to the bullish potential, the 21-day closed above the 50-day SMA on Tuesday, confirming a Bull Cross. Further, Gold price yielded a daily candlestick closing above the rising trendline support at $3,380.

If the upside regains traction, the immediate resistance is seen at the $3,400 threshold. The next bullish target is placed at the $3,440 static resistance, followed by the June 16 high of $3,453..

On the flip side, strong support is placed at the 21-day SMA and 50-day SMA confluence near $3,348. A sustained move below that level will unleash additional downside toward the $3,300 round figure. Deeper declines will challenge the 100-day SMA at $3,282.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.