Gold Price Forecast: XAU/USD pressures fresh record highs near $3,530 as fears persists

XAU/USD Current price: $3,527.12

- Turmoil around United Kingdom government bonds pushed investors into safety.

- The US ISM Manufacturing PMI improved to 48.7 in August, still missing expectations.

- XAU/USD maintains the upward pressure at fresh record highs near $3,530.

Gold prices soared, with XAU/USD surpassing the $3,500 mark for the first time early on Tuesday, as investors seek safety ahead of United States (US) data releases. The run to safety accelerated amid turmoil in the United Kingdom (UK), although the bright metal retreated temporarily amid widespread US Dollar (USD) demand.

UK government bonds plunged, particularly long-term ones, with the yield on the 30-year gilt reaching 5.68%, its highest level since 1998. Political and fiscal uncertainty ahead of the Autumn Budget presentation can partially explain the latest bond run. The UK Chancellor is expected to announce spending cuts and tax hikes to meet her fiscal plans, while debt piles in the UK.

Aggressive USD bids triggered a short-lived pullback, with buyers returning around $3,470 in the American session. As a result, the bright metal soared to a fresh record high above $3,525, still pressing higher at the time of writing.

The US Institute for Supply Management's (ISM) Manufacturing Purchasing Managers Index (PMI) printed at 48.7 in August, improving from the 48 posted in July but missing the expected 49. Beyond the mildly discouraging headline, the report also showed that the Employment Index edged higher to 43.8 from 43.4 in the month. At the same time, the Prices Paid Index, the inflation component, retreated to 63.7 from 64.8.

The S&P Global Manufacturing PMI, in the meantime, was confirmed at 53 in August, slightly below the 53.3 previously estimated. “US manufacturing operating conditions improved to the greatest degree in over three years during August amid a surge in production and solid growth in new order books,” the official report states. It was the strongest improvement in manufacturing performance since May 2022.

The focus now shifts to US employment-related data. The country will release the July JOLTS Job Openings report on Wednesday, and the ADP Employment Change survey on Thursday, ahead of the Nonfarm Payrolls report scheduled for Friday.

XAU/USD short-term technical outlook

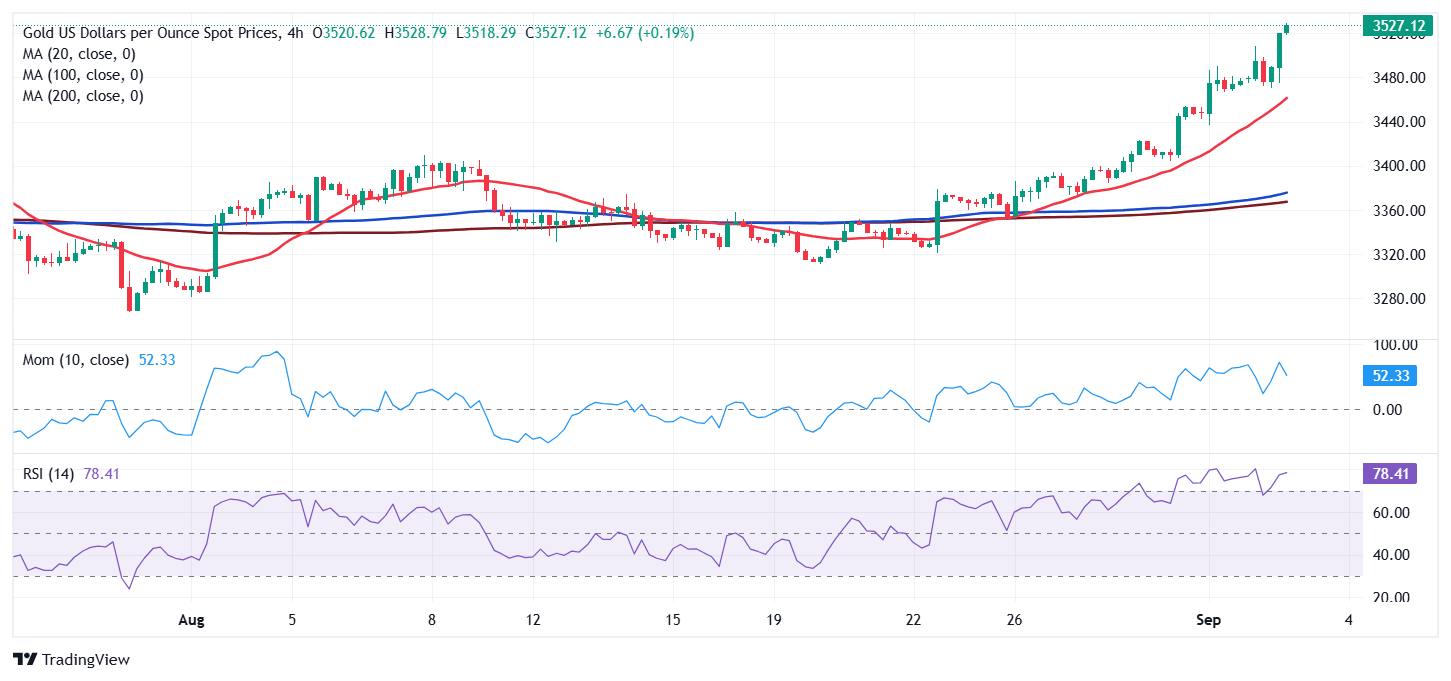

Gold nears the $3,530 mark at the time of writing, and technical readings in the daily chart suggest buyers are not ready to give up. The XAU/USD pair develops above all its moving averages, with the 20 Simple Moving Average (SMA) currently grinding higher at around $3,380. At the same time, technical indicators suggest additional gains are likely, as they maintain their firm upward slopes despite being in overbought territory.

The 4-hour chart shows that the XAU/USD pair trades far above all its moving averages, with the 20 SMA accelerating north roughly $70 below the current level, as the 100 and 200 SMAs turn modestly bullish well below the shorter one. Technical indicators, in the meantime, eased modestly from their recent peaks, but remain within extreme overbought readings. The bright metal is likely to resume its advance after a brief consolidative phase.

Support levels: 3,516.30 3,501.00 4,486.90

Resistance levels: 3,530.00 3,545.00 3,560.00

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.