Gold Price Forecast: XAU/USD neutral-to-bearish around $1,950

XAU/USD Current price: $1,954.42

- Market participants increase bets of a soon-to-come Federal Reserve’s pause.

- The US Dollar recovered modestly but remains the weakest G-10 currency.

- XAU/USD hovers around its daily opening, with the downside limited by broad USD weakness.

Gold prices temporarily eased on Monday, with XAU/USD currently trading at around $1,954, flat for the day after bottoming for the day at $1,945.72 a troy ounce. Financial market’s frenzy cooled down as investors gear up for first-tier events scheduled for the next week, including central banks and yet another update on the United States inflation progress.

The US Dollar recovered some of the ground lost after collapsing last week, although its gains are irrelevant, considering the sell-off the American currency suffered on the back of speculation the Federal Reserve (Fed) could end the tightening cycle sooner than anticipated.

The United States (US) Consumer Price Index (CPI) came below expected in June, posting a modest 0.2% monthly increase. The Producer Price Index (PPI) in the same month increased by 0.1%, in line with decreasing price pressures. At the same time, the Fed anticipated two more 25 basis points (bps) rate hikes. Such hikes are already priced in, and the reported inflation levels suggest the Fed could even stop after just one hike, while the chances of more than two moves have sharply decreased.

XAU/USD price short-term technical outlook

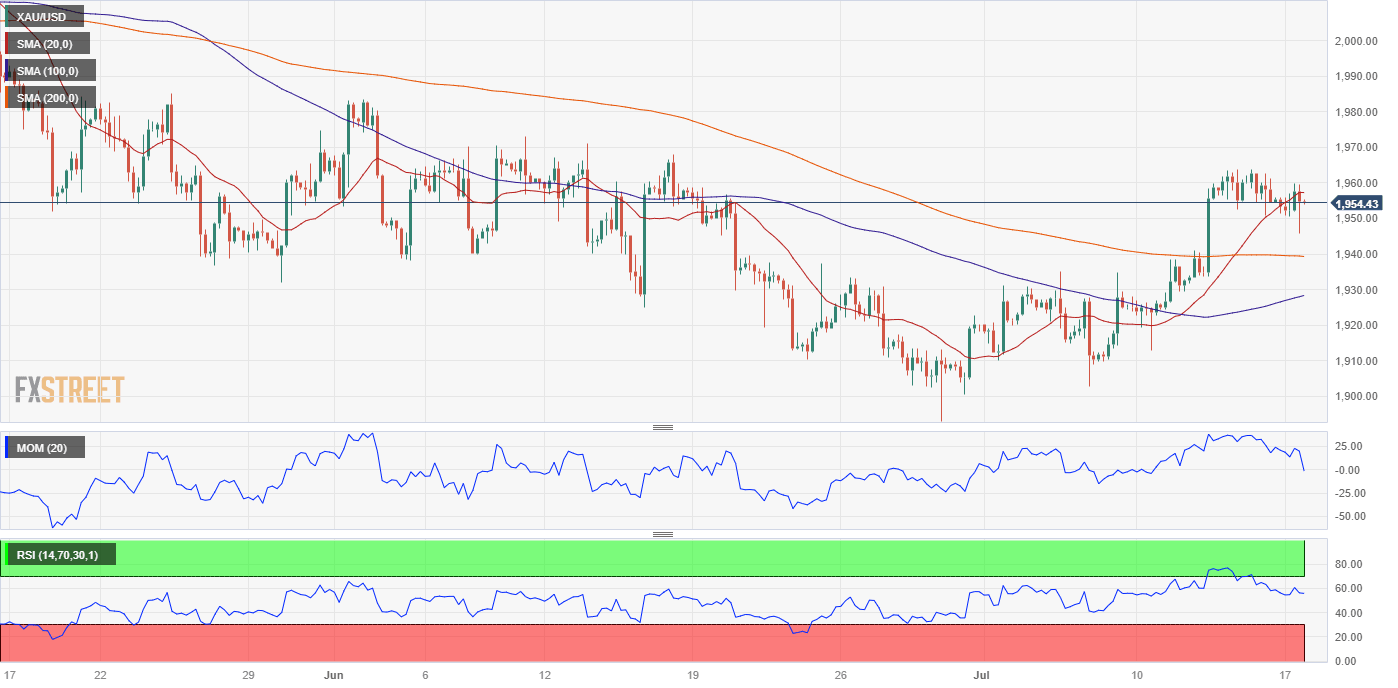

The daily chart for XAU/USD pair maintains the risk skewed to the upside. Technical indicators have lost their bullish strength but consolidate well above their midlines without signs of upward exhaustion. At the same time, the pair seesaws around a mildly bullish 100 Simple Moving Average (SMA), which develops above the 20 and 200 SMAs.

In the near term, and according to the 4-hour chart, the risk skews to the downside, although the broad US Dollar weakness will likely limit slides. XAU/USD broke below a still bullish 20 SMA, while the longer moving averages remain directionless, far below the current level. Meanwhile, the Momentum indicator heads marginally lower within negative levels, while the Relative Strength Index (RSI) indicator hovers within neutral levels.

Support levels: 1,950.70 1,940.95 1,928.60

Resistance levels: 1,967.90 1,983.40 1,996.55

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.