Gold Price Forecast: XAU/USD hold on to higher ground above $3,330

XAU/USD Current price: $3,341.79

- Tariffs-related headlines brought near-term relief on Monday.

- The United States will release some interesting figures on Tuesday.

- XAU/USD loses its positive momentum, but a steeper decline is out of the table.

Spot Gold trades firmly above the $3,300 level, marginally down on a daily basis. The mood was generally positive throughout the first half of the day, as speculative interest welcomed tariffs-related news. United States (US) President Trump said on Sunday that 50% levies on European imports would be delayed until July 9, following talks between Trump and European Commission President Ursula von der Leyen.

Most Asian and European indexes closed in the green, reflecting the better mood, although American markets were out on holidays, as the US celebrated Memorial Day. A scarce macroeconomic calendar added to the ongoing quietness across financial markets.

Things will turn a bit more interesting on Tuesday, as the US will release April Durable Goods Orders and May Consumer Confidence, alongside other minor figures. Recent US data showed the economy remains resilient despite concerns about the impact of tariffs on growth and inflation.

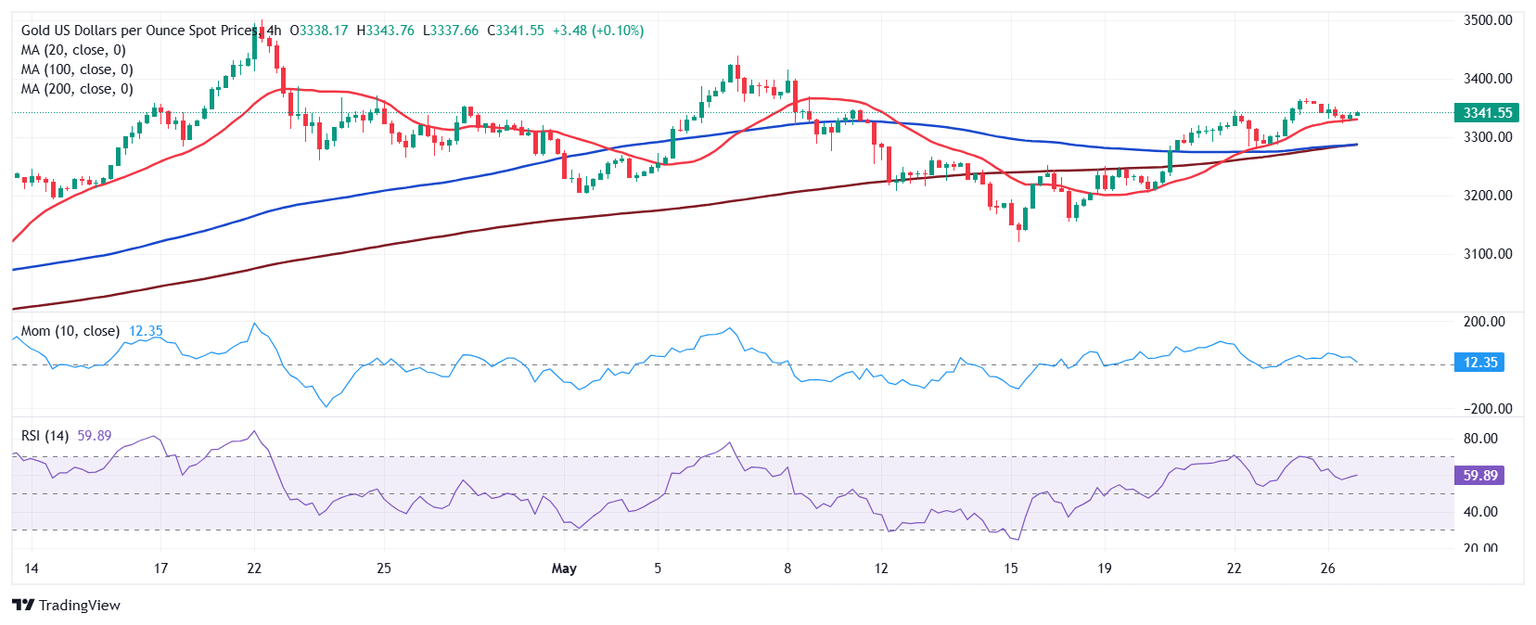

XAU/USD short-term technical outlook

The daily chart for the XAU/USD pair shows it has lost its upward momentum, but also that the bearish case has no support. The pair keeps developing above all its moving averages, with a flat 20 Simple Moving Average (SMA) providing support at around $3,288.75. At the same time, technical indicators turned south, with the Momentum indicator heading lower below its 100 level. Still, the pair would need to lose the $3,300 mark to actually discourage buyers and attract additional selling interest.

In the near term, and according to the 4-hour chart, however, bulls retain control. Technical indicators are holding within positive levels, although lacking directional strength. At the same time, the 20 SMA maintains a modest bullish slope above the 100 and 200 SMAs, while providing near term support at around the intraday low i n the $3,320 region.

Support levels: 3,322.35 3.208.65 3,288.75

Resistance levels: 3,351.70 3,365.80 3,381.20

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.