Gold Price Forecast: XAU/USD gears up for a bullish breakout

XAU/USD Current price: $2,927.84

- US inflation, as measured by the Consumer Price Index, eased in February.

- Trade war concerns keep investors on their toes, weighs on the US Dollar.

- XAU/USD aims to break higher after a long week consolidative phase.

Spot Gold kept trading within familiar levels throughout the first half of Wednesday, finding buyers on approaches to the $2,900 mark yet meeting sellers ahead of the $2,930 level. The US Dollar (USD) broad weakness maintained the bright metal afloat yet fell short of boosting demand.

Wall Street opened with a positive tone but quickly turned into the red after the United States (US) reported softer-than-expected February inflation figures. The US Consumer Price Index (CPI) was up 0.2% MoM in February, while the annual figure printed at 2.8%. Finally, core annual inflation rose 3.1%, with all figures coming below expected.

Easing price pressures temporarily boosted speculation the American economy was doing good enough to skip President Donald Trump’s inspired chaos. However, trade-war-related concerns weighed more. The US Dollar came under renewed selling pressure after the American opening, pushing XAU/USD to the upper end of its recent range.

Market participants, however, maintain the focus on trade tensions. Levies on all steel and aluminium imports into the US pay levies of 25% as of today, with Canada and Europe announcing retaliatory measures. Canada announced new trade duties on some $21 billion worth of US goods, while the European Commission launched levies worth around $29 billion on US industrial and agricultural products starting April 1.

XAU/USD short-term technical outlook

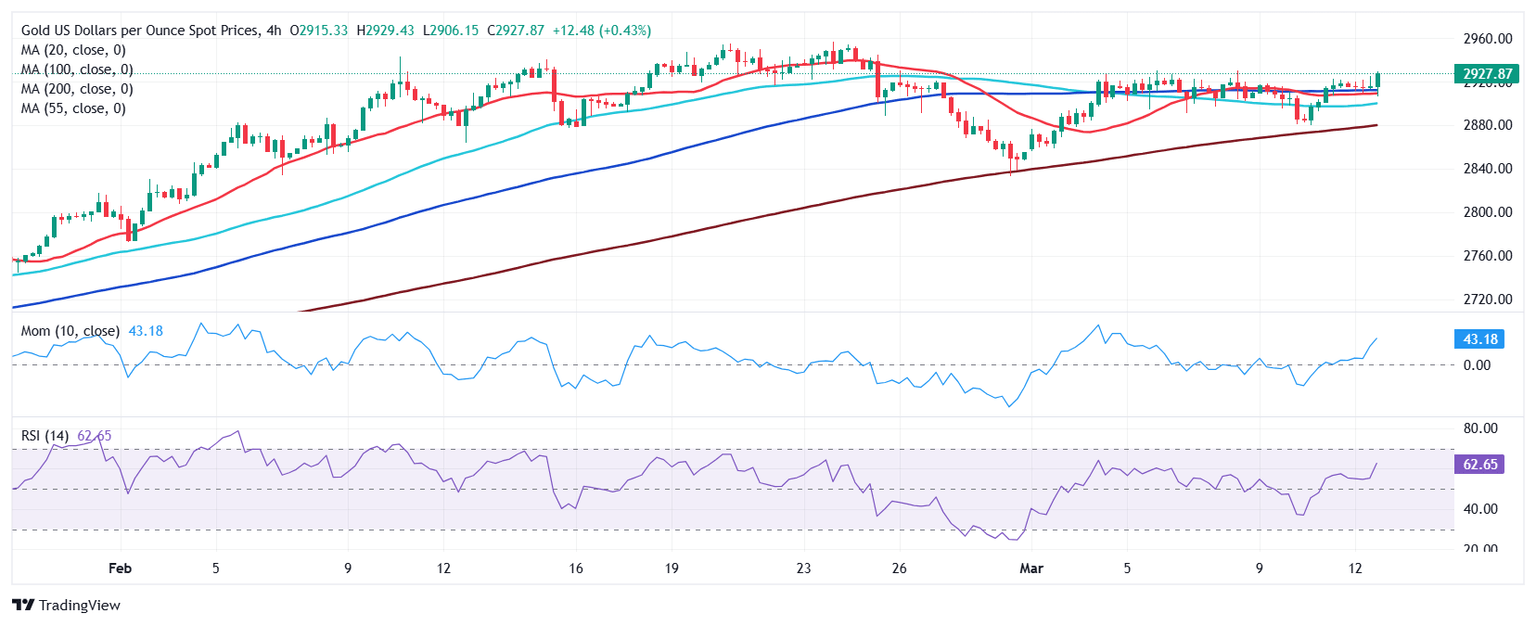

The daily chart for the XAU/USD pair shows it is pressuring the upper end of the aforementioned range, albeit with limited bullish strength. The pair rests above a flat 20 Simple Moving Average (SMA), which provides support at around $2,912.50. The same chart shows, however, that the Momentum indicator remains stuck around its 100 line. At the same time, the 100 and 200 SMAs head firmly north far below the current level, in line with the dominant bullish trend. Finally, the Relative Strength Index (RSI) indicator advances at around 60, also supportive of a bullish continuation.

In the near term, and according to the 4-hour chart, XAU/USD bullish momentum increased. The pair is developing above all its moving averages, with converging 20 and 100 SMAs providing support around the daily low. The 200 SMA keeps heading north far below the shorter ones, while technical indicators aim north well above their midlines, in line with an upcoming leg higher.

Support levels:2,912.50 2,893.35 2,881.80

Resistance levels: 2,929.90 2,941.40 2,956.10

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.