Gold Price Forecast: XAU/USD finding buyers on intraday dips

XAU/USD Current price: $2,914.01

- US Dollar seesawing between gains and losses as investors assess Trump's words.

- The market mood improved despite global trade uncertainties triggered by the US.

- XAU/USD keeps bouncing from sub $2,900 levels, bearish correction complete.

Following a slide towards $2,891 right after Wall Street’s opening, Gold price regained the $2,900 mark and trades around $2,910 as the United States (US) President Donald Trump offers a press conference.

The US Dollar (USD) spent the day within familiar levels, seesawing between gains and losses, slightly firmer across the FX board throughout the first half of the day amid a risk-averse environment. An improved mood, however, is weighing on the American currency, as the rally in government bonds stalled and yields recovered some of yesterday’s losses. The 10-year Treasury note currently offers 4.30%, up 2 basis points (bps) in the day.

Market players shrugged off discouraging US macroeconomic data released on Tuesday, as Consumer Confidence plummeted according to the CB monthly survey. Yet, at the same time, investors stand on their toes ahead of trade-related headlines. The US government is not only working with tariffs but also with potential rate mineral deals with Russia and Ukraine.

Looking ahead, the US will publish next Friday the January Personal Consumption Expenditures (PCE) Price Index, the Federal Reserve's (Fed) favorite inflation gauge. Annual inflation, as measured by the PCE index, is foreseen at 2.5%, down from the 2.6% posted in December, while the core reading is also seen declining, from 2.8% to 2.6%. Such figures should be seen as good news and revive speculation the Fed could deliver a rate cut in the first semester of the year.

XAU/USD short-term technical outlook

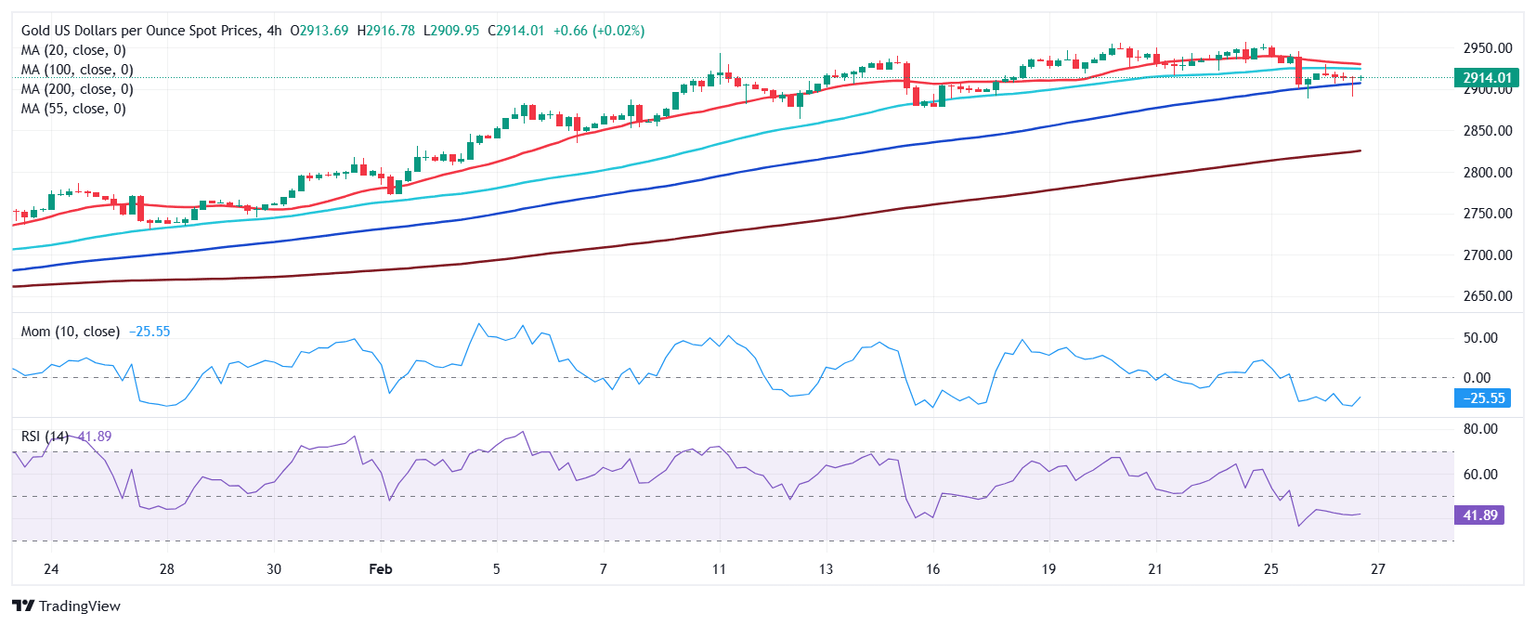

From a technical point of view, the XAU/USD pair’s daily chart shows buyers are still taking their chances on dips. The pair bounced from around a firmly bullish 20 Simple Moving Average (SMA) which extends its advance beyond also bullish 100 and 200 SMAs. At the same time, technical indicators have pared their corrective slides from overbought levels and stabilized above their midlines, supporting the dominant bullish trend.

The near-term picture, however, shows a limited bullish potential. In the 4-hour chart, XAU/USD recovered twice from intraday dips below a bullish 100 SMA but remains below a mildly bearish 20 SMA. Finally, technical indicators remain below their midlines, although recovering modestly, not enough to anticipate additional gains. Gold needs to run past 2,936.20 to recover its near-term bullish poise.

Support levels: 2,903.80 2,879.95 2,863.60

Resistance levels: 2,921.50 2,636.20 2,949.45

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.