Gold Price Forecast: XAU/USD consolidates gains, higher weekly highs still likely

XAU/USD Current price: $3,304.80

- Mounting trade tensions and the United States tax bill undermine the market mood.

- S&P Global will release estimates of the May PMIs for most major economies.

- XAU/USD consolidates gains above $3,300, prepares to extend weekly gains.

Gold extended gains beyond the $3,300 mark on Wednesday, still backed by broad US Dollar (USD) weakness. The XAU/USD pair reached a fresh one-week high of $3,320.70, retreating towards the current $3,310 price zone after Wall Street’s opening.

The USD keeps falling on the back of unresolved global trade issues and fresh tax-related concerns. The United States (US) announced a 90-day pause in retaliatory levies a couple of weeks ago, bringing relief and risk appetite back to financial markets. However, as time goes by, deals are nowhere near. Mounting tensions between the country and China and Japan are taking their toll on sentiment.

Meanwhile, US President Donald Trump’s tax bill advances in Congress. The bill aims to make permanent the 2017 tax cuts from Trump’s first term. It would reduce some taxes, while raising others and changing spending amounts. The House is set to discuss it on Thursday.

Thursday will also bring the preliminary estimates of May S&P Global Purchasing Managers’ Index (PMI) for most major economies. The US Manufacturing PMI is foreseen at 50.1 while services output is expected at 50.8, little changed from April’s figures. Still, signs of further contraction in business output will likely add to the broad USD weakness.

XAU/USD short-term technical outlook

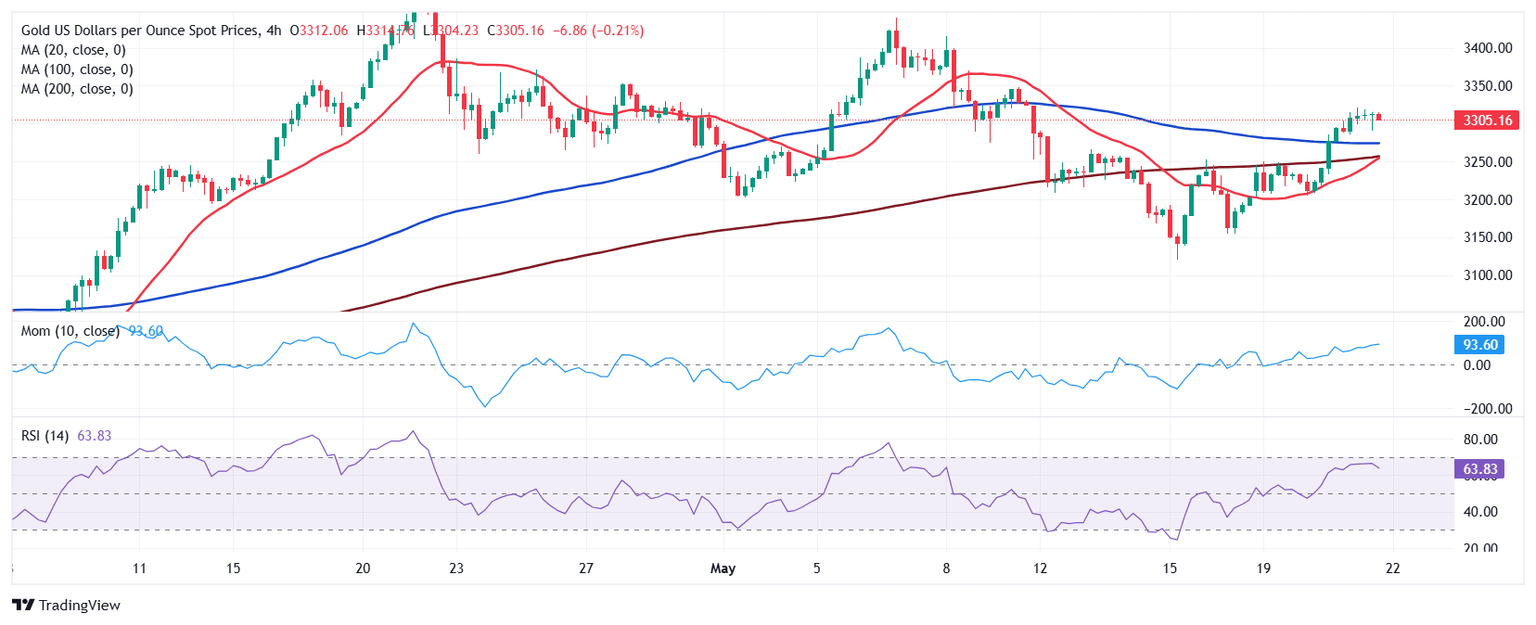

The daily chart for the XAU/USD pair shows it extended its advance beyond its 20 Simple Moving Average (SMA), which now acts as support at around $3,289.20. The 100 and 200 SMAs keep advancing well below the current level, while the Momentum indicator maintains its bullish slope above its 100 level, all of which supports another leg higher. The Relative Strength Index (RSI) indicator, however, turned flat at around 54, hinting at some consolidation before the next directional movement.

The 4-hour chart shows the XAU/USD pair consolidates above all its moving averages, with the 20 SMA extending its advance below still flat 100 and 200 SMAs. Technical indicators, however, have lost their upward strength. The Momentum indicator heads marginally lower within positive levels, while the RSI indicator seesaws around 64, reflecting the ongoing pause.

Support levels: 3,289.20 3,271.55 3,252.40

Resistance levels: 3,325.00 3,342.95 3,358.40

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.