Gold Price Forecast: XAU/USD challenges key 50-day SMA resistance ahead of Powell speech

- Gold price holds recovery from monthly lows near $3,250 early Tuesday.

- US Dollar attempts a tepid bounce as markets look to reposition ahead of Powell’s Sintra appearance.

- Gold price tests key 50-day SMA barrier at $3,320 on the road to recovery, daily RSI stays bearish.

Gold price has paused its recovery from monthly lows early Tuesday, as the US Dollar (USD) finds fresh demand while the market mood turns cautious.

Gold price awaits Powell for fresh cues on Fed rate cuts

Traders seem to resort to position adjustments on their USD shorts, bracing for US Federal Reserve’s (Fed) Chairman Jerome Powell’s appearance for fresh cues on the timing of the next interest rate cut.

Fed Chair Powell participates in a policy panel alongside other key central banks’ chiefs at the European Central Bank (ECB) Forum on central banking in Sintra on Tuesday.

Markets continue to price in a 20% chance of the Fed trimming rates this month while predicting a 77% probability of a rate cut in September.

If Powell once again signals prospects of weaker-than-expected inflation, it would ramp up the Fed’s easing bets, triggering a fresh leg down in the US Dollar.

The dovish tone could help the non-yielding Gold price recover further ground.

However, if Powell surprises with some hawkish or prudent remarks, it could double down on the recent Gold price downtrend.

Besides, the focus will be also on the US JOLTS Job Openings data and US trade talks as the July 9 deadline approaches.

The Greenback faced a double-whammy on Monday and hit over three-year lows against its major currency rivals.

Increased concerns over US fiscal health ahead of the Senate's efforts to pass President Donald Trump’s ‘big, beautiful’ spending bill weighed heavily on the US Dollar.

Meanwhile, investors remained wary over the potential US trade deals with Japan and the European Union (EU), especially after Treasury Secretary Scott Bessent warned that countries could be notified of sharply higher tariffs despite good-faith negotiations.

Furthermore, the record-rally on Wall Street indices also hit the sentiment around the Greenback, allowing Gold price to stage a decent comeback on Monday.

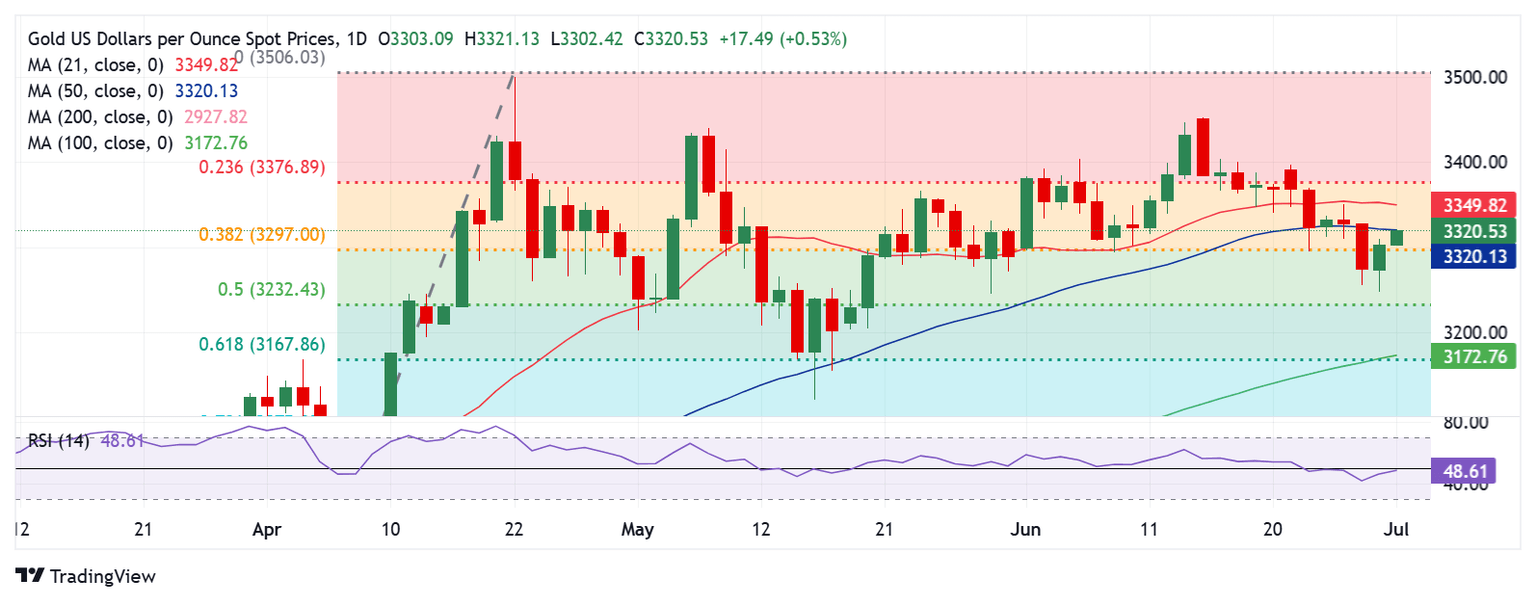

Gold price technical analysis: Daily chart

Gold price tests the 50-day Simple Moving Average (SMA) at $3,320, having found support near the $3,250 psychological level on Monday.

On the road to recovery, Gold price recaptured the 38.2% Fibonacci Retracement (Fibo) level of the April record rally at $3,297 on a daily closing basis.

However, the 14-day Relative Strength Index (RSI) holds below the 50 level, raising doubts about the prospects of a sustained recovery from monthly troughs.

If Gold price settles Tuesday above the 50-day SMA at $3,320, the turnaround could gather strength toward the 21-day SMA at $3,350.

Further north, the 23.6% Fibo level of the same ascent at $3,377 will be challenged again.

On the flip side, acceptance below $3,297, the 38.2% Fibo level will open the door toward the monthly lows of $3,248.

Economic Indicator

Fed's Chair Powell speech

Jerome H. Powell took office as a member of the Board of Governors of the Federal Reserve System on May 25, 2012, to fill an unexpired term. On November 2, 2017, President Donald Trump nominated Powell to serve as the next Chairman of the Federal Reserve. Powell assumed office as Chair on February 5, 2018.

Read more.Next release: Tue Jul 01, 2025 13:30

Frequency: Irregular

Consensus: -

Previous: -

Source: Federal Reserve

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.