Gold Price Forecast: XAU/USD aims to run beyond the $3,500 record high

XAU/USD Current price: $3,477.16

- A holiday in the US and Canada keeps markets lifeless at the end of the day.

- US employment and economic performance data spread throughout the week.

- XAU/USD nears record highs, aims to run past the $3,500 threshold.

Spot Gold extends its bullish route, having traded as high as $3,490.01 on Monday, not far from its all-time peak at $3,500.14 clinched on April this year. The advance is backed by the broad US Dollar (USD) weakness amid trade-war headlines and ahead of first-tier releases scheduled throughout the week.

Investors turned cautious after a United States (US) court ruled that President Donald Trump's tariffs are illegal on Friday. The ruling could still be appealed at the Supreme Court, and the government has over a month to challenge the decision, so it did not have a major impact on financial markets, but it weighed on the Greenback.

Other than that, the US and Canadian markets are closed to the celebration of Labor Day, leaving assets lifeless after London opening, with XAU/USD consolidating intraday gains.

The US calendar will be quite busy this week, with the release of the August ISM Purchasing Managers’ Indexes (PMI) and different employment-related figures ahead of the Nonfarm Payrolls (NFP) report scheduled for Friday. Employment is one of the two legs on which the Federal Reserve (Fed) bases its monetary policy decisions. Powell's last public appearance at Jackson Hole came as a shock as he highlighted rising downside risks to employment and hinted at upcoming rate cuts.

XAU/USD short-term technical outlook

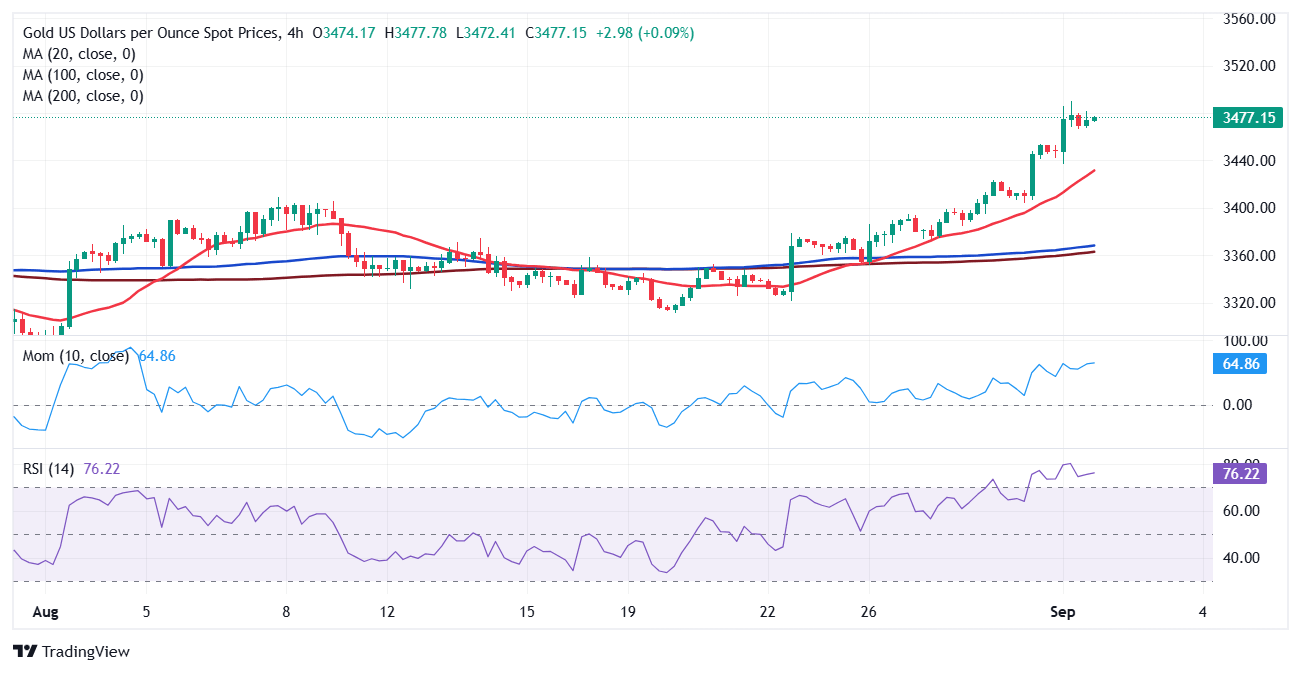

From a technical point of view, the daily chart for the XAU/USD pair shows that the risk remains skewed to the upside. It currently trades around $3,475, up for a fifth consecutive day. The bright metal develops above all bullish moving averages, with the 20 Simple Moving Average (SMA) gaining upward traction above an also ascendant 100 SMA. Technical indicators, in the meantime, have partially lost their upward strength after nearing overbought readings, yet without hinting at bullish exhaustion.

In the near term, and according to the 4-hour chart, XAU/USD is overbought, but only the Momentum indicator eased from its peak. The Relative Strength Index (RSI) indicator, in the meantime, stabilized at around 76. Finally, the 20 SMA heads sharply up, far below the current level, while far above mildly bullish 100 and 200 SMAs, in line with the dominant bullish trend.

Support levels: 3,450.60 3,433.90 3,421.10

Resistance levels: 3,490.00 3,505.00 3,520.00

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.