Gold Price Forecast: XAU/USD aims for lower lows amid risk-on flows

XAU/USD Current price: $3,349.60

- The US July Consumer Price Index showed inflation rose at an annualized pace of 2.7%.

- US President Donald Trump’s announcements add to the broad US Dollar weakness.

- XAU/USD struggles to regain the $3,350 level, as sellers take their chances on spikes.

Gold trades with a softer tone on Tuesday, falling to a fresh one-week low of $3,331.12 in the American session. The US Dollar (USD) gathered momentum following the release of United States (US) data, finding additional legs in political headlines.

The US published the July Consumer Price Index (CPI), which rose at an annualized pace of 2.7% in July, lower than the 2.8% market forecast. The core annual reading, however, increased by 3.1%, higher than the previous 2.9% and the 3% anticipated. On a monthly basis, the CPI rose by 0.2%, while the core monthly reading resulted at 0.3%, matching expectations.

The figures support the case for a September rate cut, leading to broad USD weakness. Stocks rallied, reflecting the better mood amid potential lower costs, and weighing on the bright metal.

The USD kept falling despite some political noise. US President Donald Trump extended the 90-day pause on massive tariffs on China, while Beijing answered reciprocally. Later in the day, Trump said he is considering allowing a lawsuit against Federal Reserve (Fed) Chair Jerome Powell amid the “ horrible, and grossly incompetent, job he has done in managing the construction of the Fed Buildings.”

Kansas City Federal Reserve (Fed) President Jeffrey Schmid said that the muted impact of tariffs on inflation should be seen as evidence that monetary policy is appropriate, and not a reason to cut interest rates.

Other than that, Trump’s candidate to replace Adriana Kugler, Stephen Miran, said he believes tariffs will be borne by the countries that they are tariffing, while the next head of the Bureau of Labor Statistics, EJ Antoni, suggested not publishing the Nonfarm Payrolls report anymore. The noise is doing no good to the Greenback.

The macroeconomic calendar cools down on Wednesday, as the only relevant figure will be the final estimate of German Harmonized Index of Consumer Prices (HICP).

XAU/USD short-term technical outlook

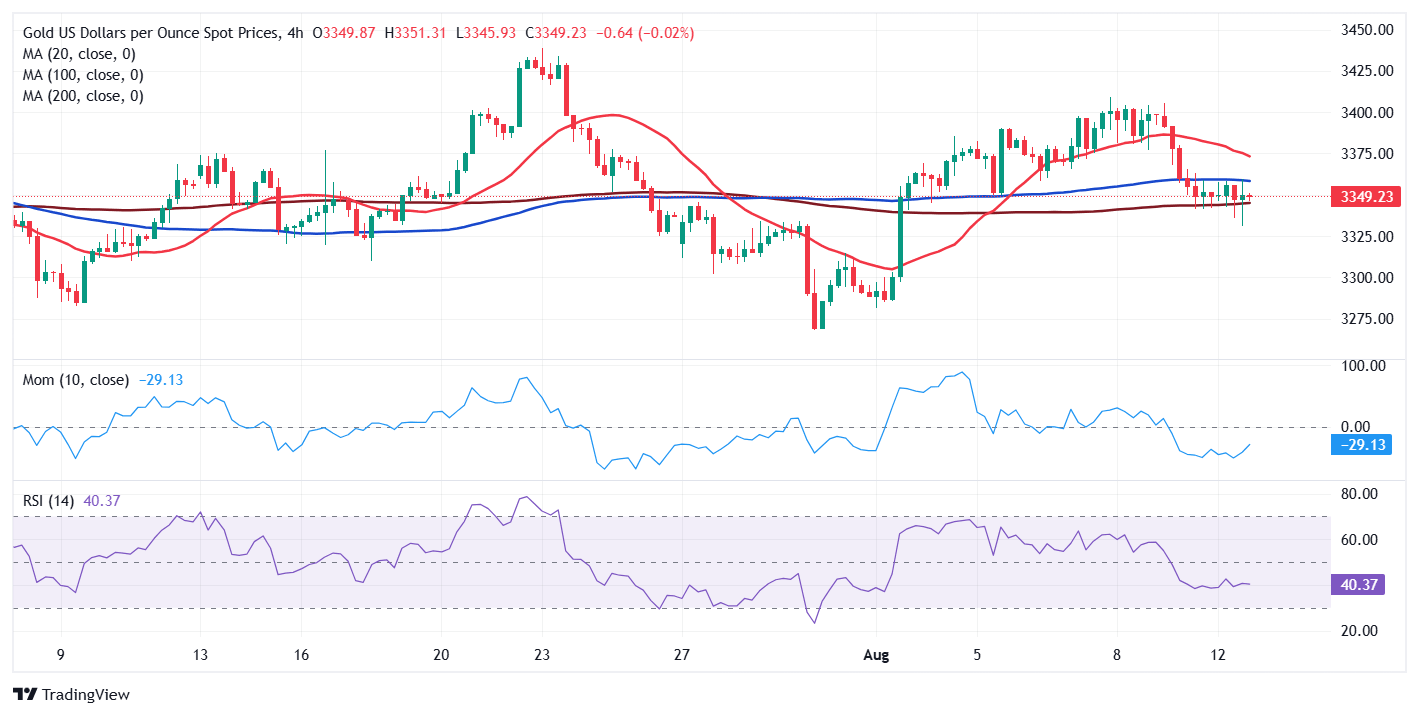

The XAU/USD pair is little changed from Monday’s close, hovering around the $3,350 level. The daily chart shows the pair is unable to advance beyond a flat 20 Simple Moving Average (SMA), although well above bullish 100 and 200 SMAs. At the same time, technical indicators suggest buyers remain sidelined: the Momentum indicator ticked modestly higher but remains below its 100 line, while the Relative Strength Index (RSI) indicator heads nowhere at around 50.

In the near term, and according to the 4-hour chart, the risk skews to the downside- Technical indicators keep grinding lower below their midlines, in line with lower lows ahead. At the same time, a flat 100 SMA at around $3,359 provides intraday resistance, while the 20 SMA gains bearish traction above the longer one.

Support levels: 3.331.10 3,312.25 3,290.00

Resistance levels: 3,359.00 3,372.30 3,389.85

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.