Gold Price Forecast: Recession fears weighing on XAU/USD

XAU/USD Current price: $1,904.57

- Softer-than-expected United States data spurred concerns about a recession.

- US stock markets plunged following the release of the December PPI.

- XAU/USD trims daily gains and nears $1,900 as risk aversion kicks in.

Spot gold jumped to $1,925.82 a troy ounce on Wednesday, as the broad US Dollar weakness that persisted throughout the first half of the day was later exacerbated by United States data. US figures suggested the American economy could already be in a recession, as December Retail Sales contracted by 1.1% MoM, while Industrial Production declined 0.7% in the same month. Furthermore, the Producer Price Index (PPI) rose at an annual pace of 6.2%, falling from 7.3%. Easing inflationary pressures are lately seen as good news but also reflect decreased purchasing power.

The bright metal retreated towards the current $1,906 price zone as the Greenback gathered momentum following Wall Street’s opening. Stock markets are on the back foot, with indexes sharply down amid recession fears spurring risk aversion, pushing the US Dollar higher alongside demand for government bonds. Yields tumbled, with the 10-year note currently offering 3.42%, down 11 basis points for the day.

XAU/USD price short-term technical outlook

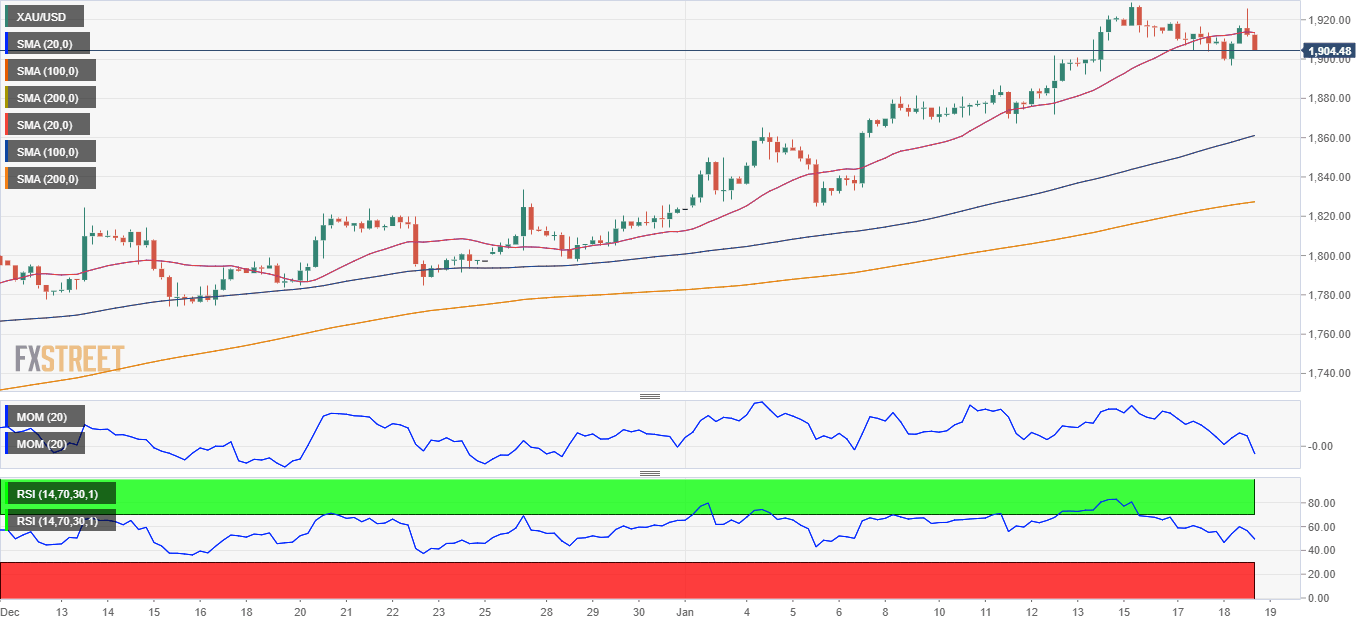

The XAU/USD pair trades flat for the day, with no signs of giving up further ground. The daily chart shows that technical indicators corrected extreme overbought readings before turning flat well into positive territory without signaling more weakness ahead. At the same time, the 20 SMA heads north almost vertically, far below the current level while above the longer ones, reflecting buyers' strength.

The 4-hour chart suggests the pair could fall further in the near term. It was unable to sustain gains above a mildly bullish 20 SMA and is back below the indicator, although still far above a bullish 100 SMA, currently at around $1,858.15. Finally, technical indicators turned south and pierced their midlines, maintaining their firmly bearish slopes within neutral levels. A break below the daily low at $1,890.54 could see the current corrective decline extending towards the $1,850 region.

Support levels: 1,896.50 1,884.60 1,874.15

Resistance levels: 1,919.30 1,930.00 1,941.85

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.