Gold Price Forecast: Looking for support after worst week in years

- Gold ends week sharply lower; apparently it found support above $1455/oz.

- Outlook points to the downside, but some consolidation could take place after a $50 slide.

- Higher yields, stronger US dollar and risk sentiment, all weight on the metal.

USD rallies as 10-year yield jump toward 2%

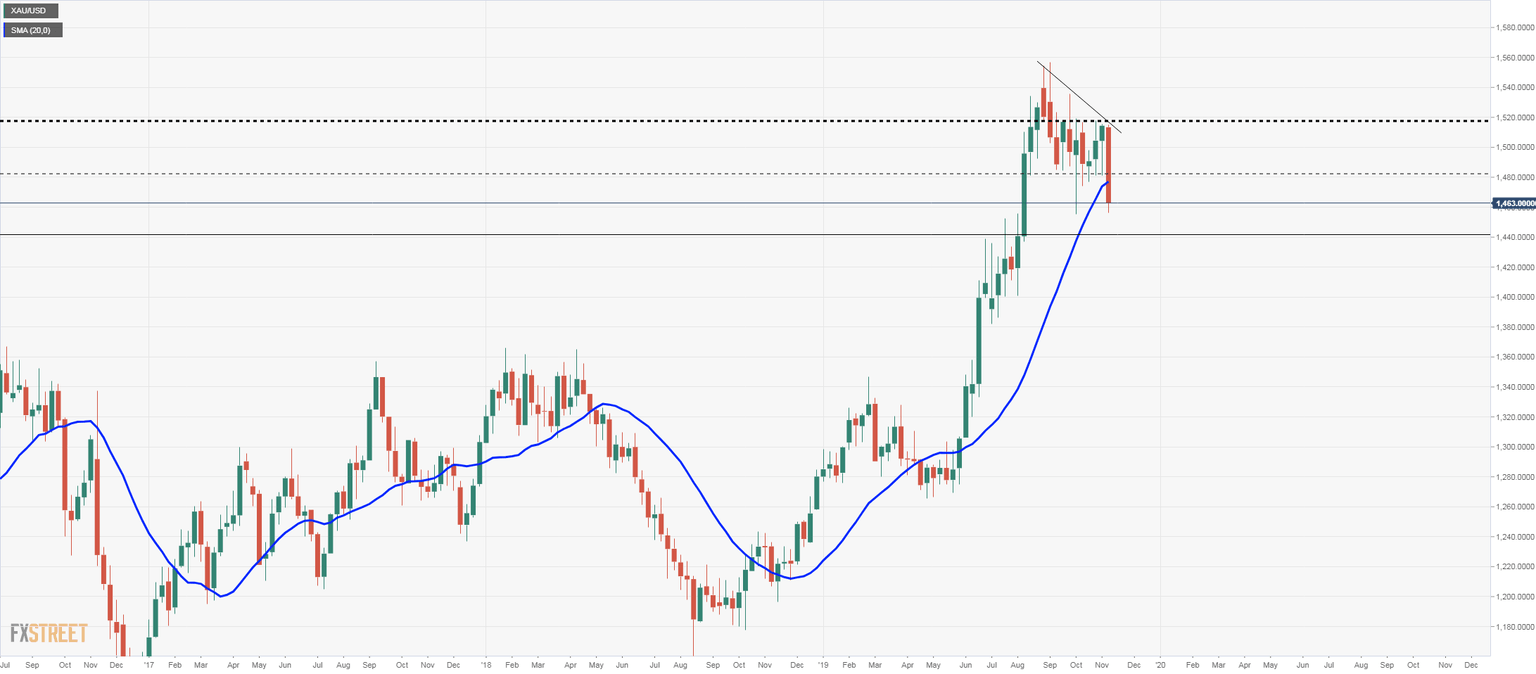

Gold opened the week testing the $1515 resistance area but it failed to break higher and made a sharp reversal, losing more than $50 over the week, the worst weekly performance in years. The slide in XAU/USD ended months of range trading with a bearish breakout.

Technical factors favored the acceleration of the decline that was triggered by an improvement in market sentiment. Optimism regarding a trade deal between the US and China boosted risk appetite.

Safe-haven assets were the worst performers of the week, including US bonds. The 10-year yield jumped from below 1.70% to near 2% and also weight on gold. Also a somewhat stronger US dollar that rebound, contributed to the decline in XAU/USD. The DXY bounced from two-month lows near 97.00 and closed the week around 98.40, amid lower rate cut expectation from the Federal Reserve.

Next week

US/China trade headlines will likely continue to have a significant impact on market sentiment. Now with some kind of agreement priced in, the risk over the next few days could be tilted on the opposite direction and could help gold find support or limit the decline. Chinese data is due next week and some economists expect to confirm signs of o moderate recovery that could help risk appetite.

Several FOMC members, including Chairman Powell, are scheduled to make public speeches. Also, here, risk are now tilted in the opposite direction as current market rates point to no rate cut in December.

Technical outlook

Short-term oversold conditions could favor some consolidation. Risks are tilted to the downside and XAU/USD still seems vulnerable. A recovery back above $1485 would remove the bearish pressure, hinting at a return to the previous range $1515/1480.

Gold Forecast Poll

The Forex Forecast Poll is a sentiment tool that highlights near- and medium-term price expectations from leading market experts. Currently, a majority of analysts are expecting gold to trade lower next week. On the medium-term, they still see a bullish trend in place but the forecasts have been revised lower.

Author

Matías Salord

FXStreet

Matías started in financial markets in 2008, after graduating in Economics. He was trained in chart analysis and then became an educator. He also studied Journalism. He started writing analyses for specialized websites before joining FXStreet.