Gold Price Forecast: Fed Minutes could open floors towards $1,722 for XAUUSD

- Gold Price attempts a rebound on Wednesday but not out of the woods yet.

- King dollar to regain supremacy if Fed Minutes back aggressive tightening stance.

- XAUUSD eyes $1,722 - bearish channel target on dollar gains, recession woes.

Markets wagered almost 70% chances of global recession, which wreaked havoc on the financial markets. Raging inflation, surging energy costs and aggressive Fed tightening implied concerns surrounding an economic slowdown worldwide. “Sell everything mode” followed next and the US dollar garnered massive demand as a safe-haven asset. Recession fears compounded as Europe appeared on the brink of the worst gas crisis in decades amid a protracted Russia-Ukraine war.

Amidst unabated dollar buying, Gold Price lost over 2% on Tuesday, hitting the lowest in seven months at $1,764 after the sell-off intensified on a firm break below the $1,800 threshold. Signs of inflation peaking in the US, in the face of softer core PCE Price Index and US ISM Manufacturing price paid component, also dented gold’s appeal as an inflation hedge. The late rebound in Wall Street indices and the resultant pullback in the greenback failed to inspire XAUUSD bulls even though the US Treasury yields bled across the curve. The benchmark 10-year yields tumbled to end-May levels around 2.78%, down roughly 20 bps on the day.

Gold Price is licking its wounds after the brutal sell-off, hovering close to multi-month troughs, with more downside in the offing as recession risks are here to stay. The US dollar is likely to regain its upside traction, as the FOMC June meeting’s minutes will support the Fed’s stance to move ‘expeditiously’ in order to control inflation. Should the Fed minutes reinforce expectations of a 75 bps July rate hike while leaving doors open for a 50 bps rise in September, then it would trigger another wave of risk-aversion, bolstering the haven bids for the buck. Aggressive Fed tightening bets have heightening fears of an imminent slowdown in the economy. Ahead of that, the US ISM Services PMI will also provide some trading incentives. All in all, King dollar is poised to remain in a win-win situation in the lead-up to the Fed event.

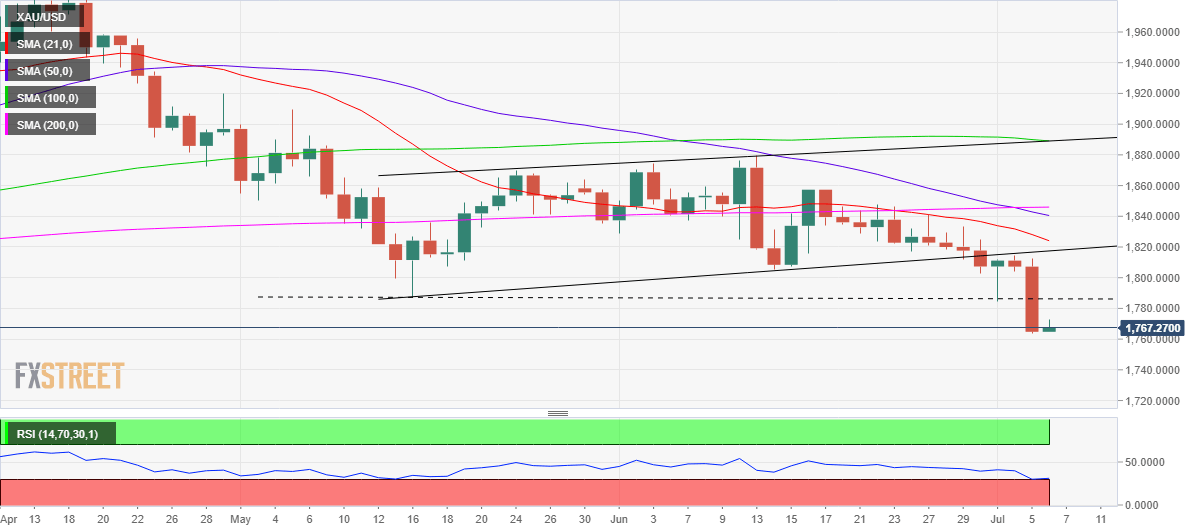

Gold Price Chart: Daily

On the daily chart, gold price is on its journey to test the rising channel measured target at $1,722 following multiple rejections near the channel support around the $1,815 region. The sustained breach of the $1,800 mark followed by the $1,785 demand area has kept sellers in the bargain position.

Selling resurgence below the $1,750 key support will prompt bears to take on the abovementioned $1,722 cap.

XAUUSD confirmed the bearish channel formation last Thursday while the death cross also remains in play, providing a double whammy to gold traders.

The 14-day Relative Strength Index (RSI) is sitting just above the oversold territory, allowing room for more downside.

Any meaningful recovery will need acceptance above the $1,785 support-turned-resistance. Further up, $1,800 the figure will be put to test.

Daily closing above the channel support now resistance at $1,817 is critical to sustaining the renewed upside in the bright metal.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.