Gold price forecast: Bullish and bearish scenario amid Israel-Iran conflict and US tariff tensions

- Gold holds steady above $3,300 despite recent pullbacks, signaling potential recovery amid global uncertainty.

- Ceasefire between Israel and Iran remains fragile, while U.S.–China tariff tensions and rate cut bets boost gold's safe-haven appeal.

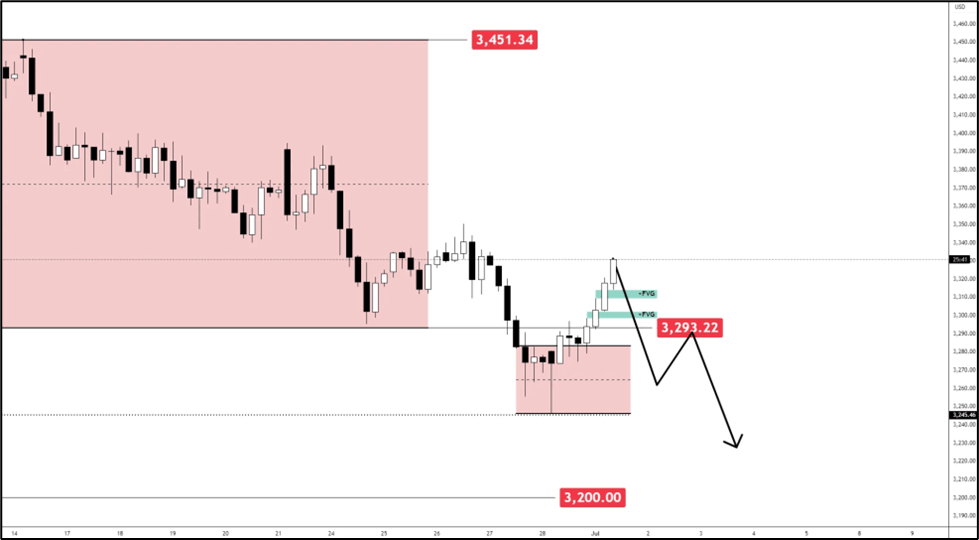

- Technically, bulls eye $3,370–$3,400 if $3,300 holds, but a break below $3,270 could shift bias back to the downside.

The Big Picture: Gold’s resilient pulse amid uncertainty

Gold continues to trade within a volatile but supportive environment. While prices recently pulled back from all-time highs above $3,250, the metal is now finding support above $3,300 level. Despite on a steep pullback, gold is still holding its ground with potential recovery for a renewed strength as it finds follow-through.

Two primary themes dominate: (1) risk-off sentiment tied to Middle East instability and trade tensions, and (2) a weakening U.S. dollar ahead of key macro decisions.

Geopolitical Fuel: Israel-Iran tensions + tariff risks

Despite last week’s announcement of a potential ceasefire between Israel and Iran, underlying tensions haven’t disappeared. Market participants remain skeptical of the ceasefire’s durability, and even a hint of renewed escalation could rapidly restore safe-haven demand. Israel-Iran ceasefire remains fragile as both parties violate agreements.

Meanwhile, U.S.–China trade relations are back under the spotlight. With a July 9 deadline approaching, uncertainty over reciprocal tariffs is mounting. President Trump has pressured the Fed to act preemptively by cutting interest rates, adding fuel to expectations of further dollar softness—another bullish catalyst for gold.

Key drivers this week:

- Breakdown or re-escalation of the Israel-Iran ceasefire.

- Trade rhetoric intensifying as the July 9 tariff deadline approaches.

- Fed commentary and market pricing around potential rate cuts.

All of these point to a market that is trigger-sensitive—and gold remains the first responder.

Technical outlook

In my last analysis on Gold - Gold forecast: Ceasefire hangs by a thread – What’s next for XAU/USD? - I outlined potential cases for Gold.

Bullish and Bearish Scenario

Gold pulled back with potential ceasefire - But talks quickly dissipated.

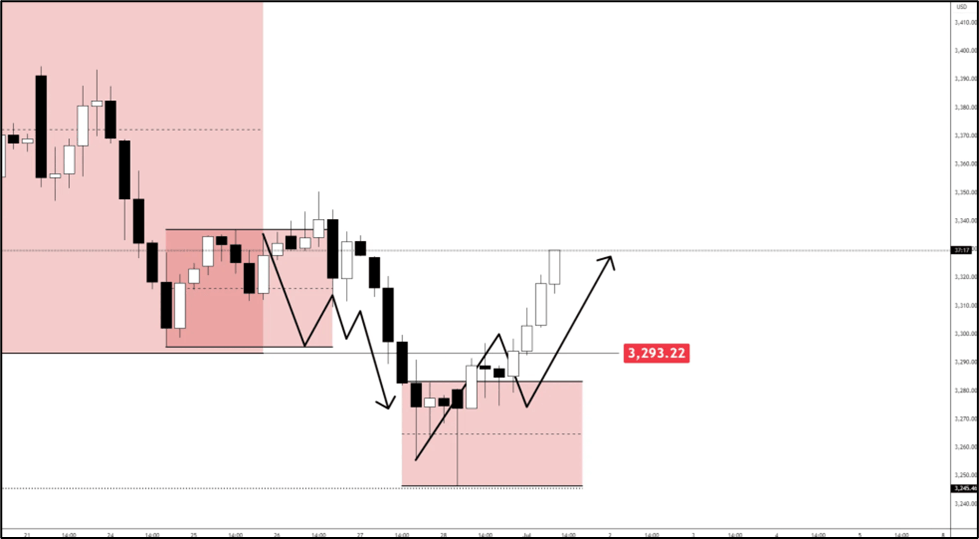

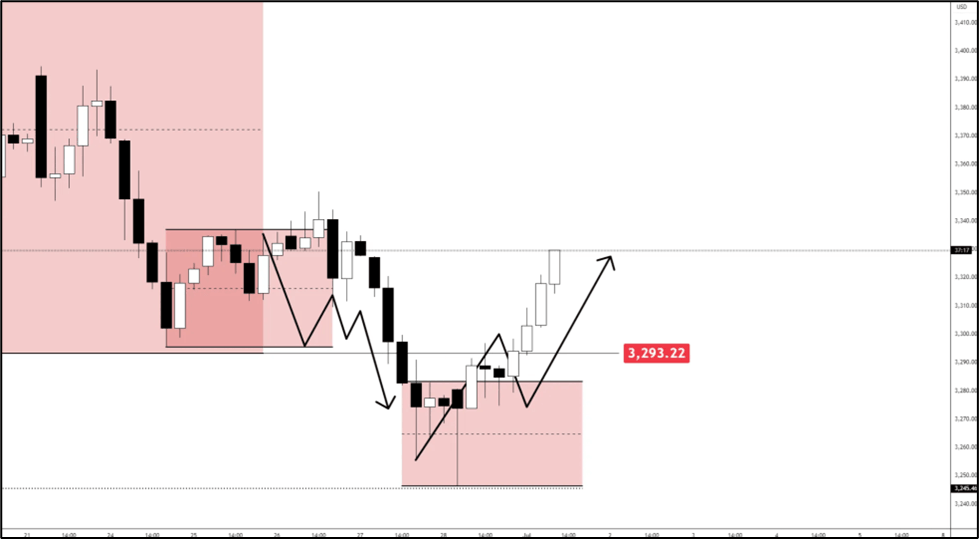

Gold pushed down further after another round of potential talks between Israel and Iran resurfaced. But it seems that both parties are still not willing to reconcile which poses a higher risk in the Middle-East, making Gold attractive again.

The bullish scenario mentioned in the previous webinar - Forex, indices, Gold weekly gameplan: Technical analysis and price action outlook - is now materializing with the narrative: If Gold gains ground above the $3,330 level and a push through above the previous mid-range or equilibrium level, we might see further traction on Gold with a confluence that could lift Gold is if the tensions between Israel & Iran escalates

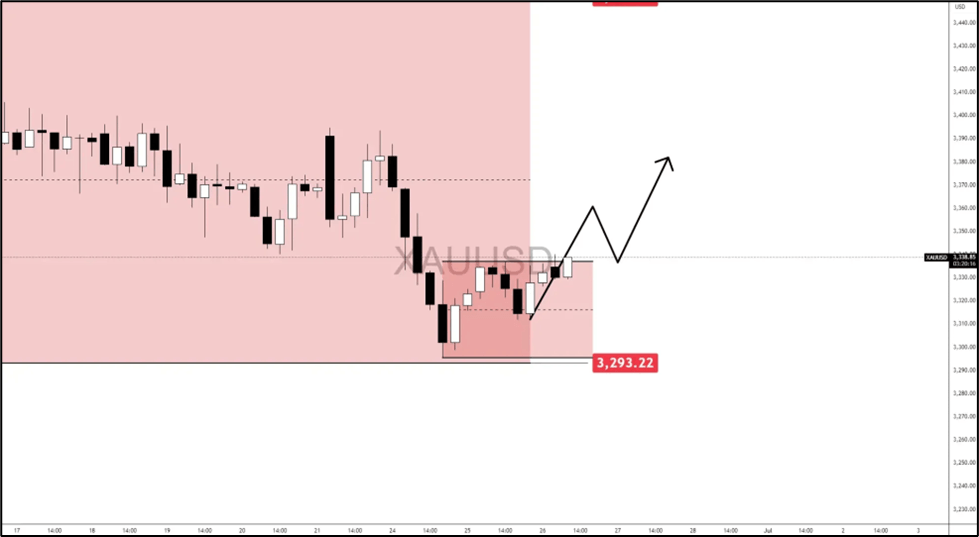

Bullish Scenario

Gold is now back inside the previous range where it broke off after breaking out of the small range below $3,300. Upside opportunity increases as long as:

- Gold stays above $3,300.

- Returns on the equilibrium level at $3,370.

- Does not break below $3,270.

Fair Value Gap entries can be taken as opportunities for long on the 4-Hour.

Targets:

- $3,370 Equilibrium.

- $3,400 Psych Level.

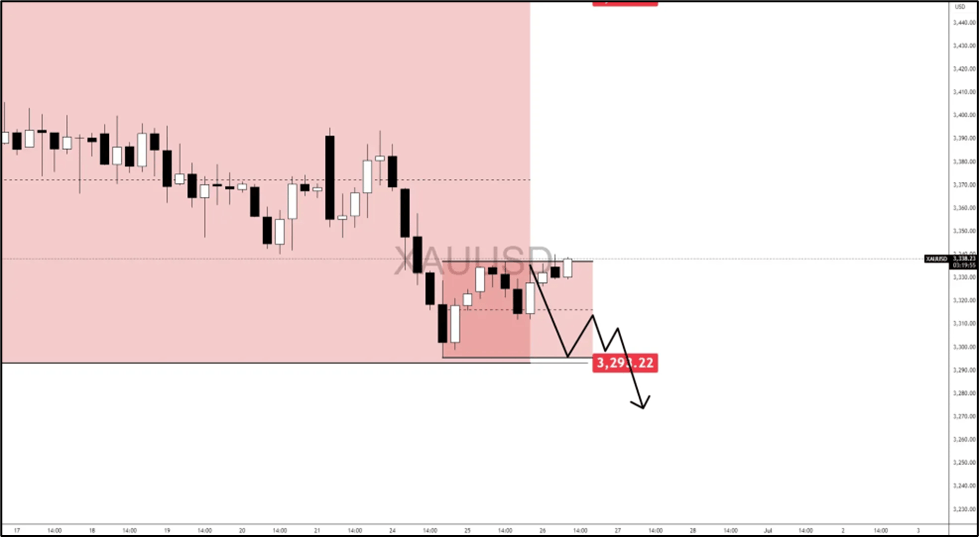

Bearish Scenario

Bearish case would be likely if:

- Tensions ease

- 4-Hour FVGs get invalidate

- Price breaks below $3,300-$3,270 leve

Author

Jasper Osita

ACY Securities

Jasper has been in the markets since 2019 trading currencies, indices and commodities like Gold. His approach in the market is heavily accompanied by technical analysis, trading Smart Money Concepts (SMC) with fundamentals in mind.