Gold forecast: Ceasefire hangs by a thread – What’s next for XAU/USD?

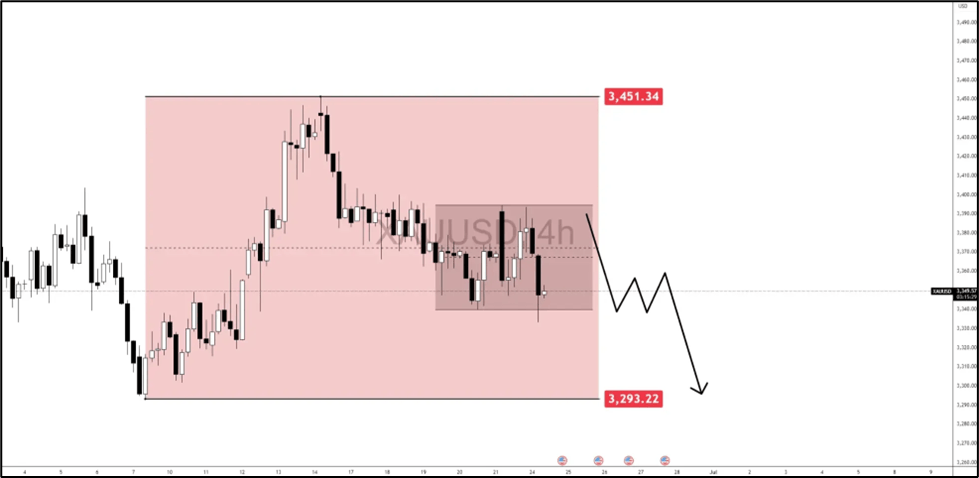

- Gold remains rangebound between $3,300 and $3,450, caught in indecision as safe-haven bids and bearish technicals battle for control.

- While a fragile ceasefire between Israel and Iran holds, initial violations and pending U.S.-Iran nuclear talks keep geopolitical risks alive.

- A confirmed break above $3,370 targets $3,400 next, while failure to hold $3,300 may drag Gold down to $3,250 or $3,200.

Gold side steps as uncertainty remains “uncertain”

Gold (XAU/USD) has not yet given any confirmation of momentum to the upside, stuck between the $3,450 and $3,300 levels as traders weigh opposing forces. After a strong rebound from last week’s lows near $3,300, the yellow metal has struggled to sustain momentum. The upside has been capped as inflation data cooled and Treasury yields steadied.

Currently, Gold is hovering at the discount level of the overall range, signaling a bearish environment. Though Gold is in a bearish territory, this is still not yet a confirmed reversal to the downside, most especially, the tensions in the middle east, Israel and Iran, has not yet fully de-escalated, giving Gold reason to push up.

Gold’s price action now reflects indecision, with neither bulls nor bears taking full control ahead of high-impact events and amidst geopolitical tensions.

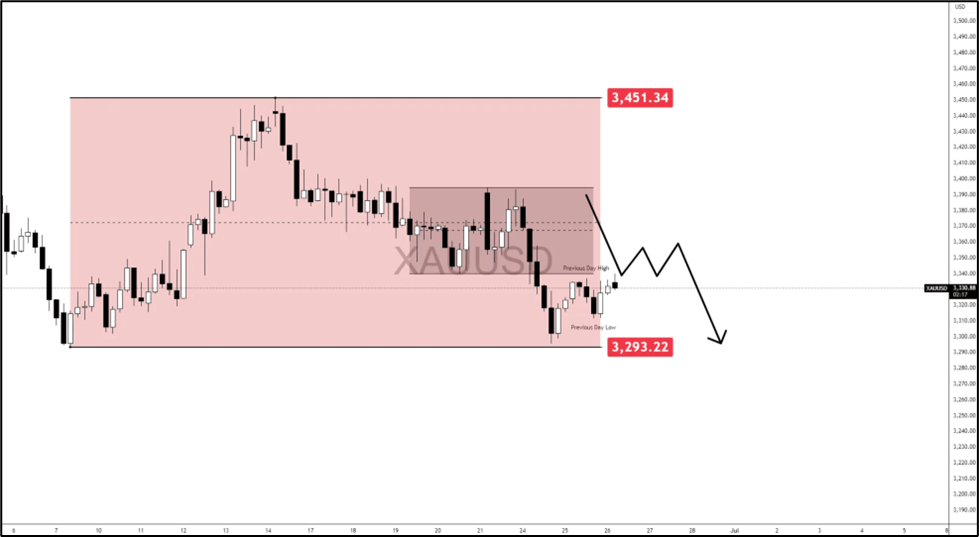

Bearish scenario on-point

This scenario was also outlined in my latest article on Gold, Gold stalls despite war headlines: Bullish and bearish scenarios to watch & Dollar, majors, indices and Gold gameplan for this week.

Before:

After:

The narrative behind this is that if the ceasefire gains traction and Iran steps back and opens door to diplomacy, risk appetite may rebound, dragging gold down. A clean break and close below $3,300 would open downside potential to the $3,250 level or even $3,200. Also, the rejection of the midrange acted as a technical catalyst that weighs Gold down.

U.S.-Iran Talks On The Way Trump announced U.S.–Iran talks scheduled for next week and mediated with Qatar’s help, focusing on nuclear and broader peace matters.

Qatar’s mediation was pivotal in securing Iran’s support for the ceasefire after discussing terms with both Tehran and President Trump.

Both sides acknowledged the truce, but initial violations were reported: Iran fired missiles at Beersheba and Israel responded with strikes on Iranian facilities - each accusing the other of breach.

Technical outlook

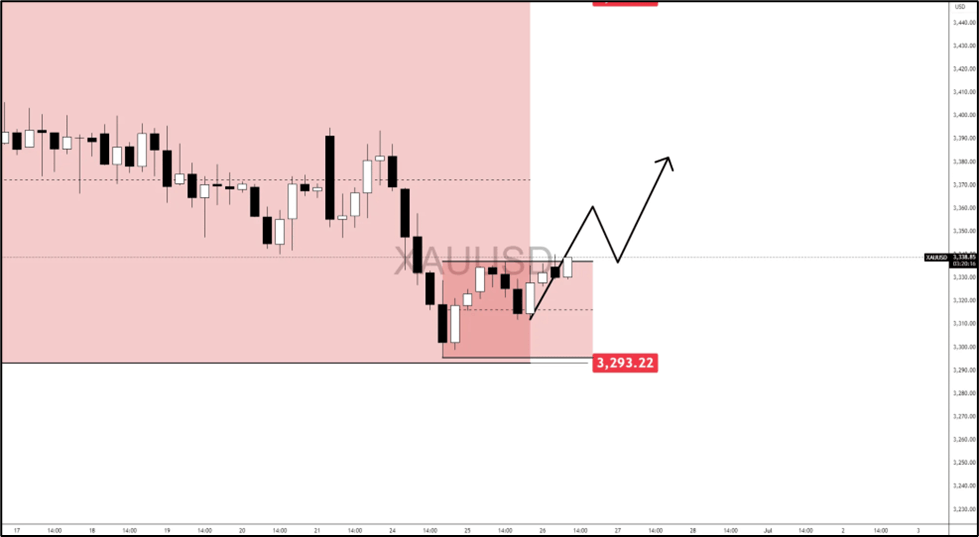

Bullish scenario

If Gold gains ground above the $3,330 level and a push through above the previous mid-range or equilibrium level, we might see further traction on Gold.

Another confluence that could lift Gold is if the tensions between Israel & Iran escalates and oil gets affect, this could raise safe-haven inflow on Gold.

Targets:

- $3,370 - Midrange Level.

- $3,400 - Psych Level / Immediate High.

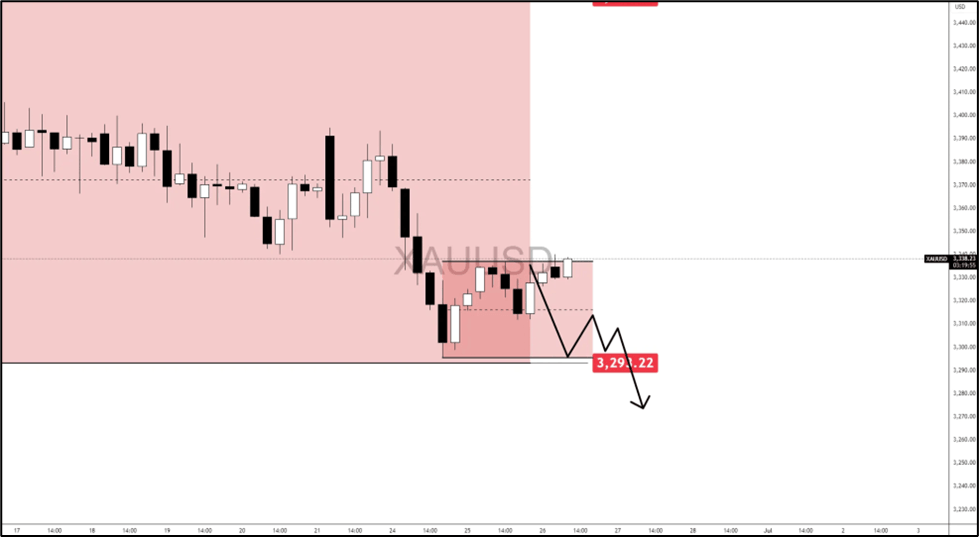

Bearish scenario

If Gold does not get an upside follow-through with a series of bullish candles above $3,340, Dollar gains traction, which is unlikely for now, and Gold breaks below $3,310 - $3,300 level, this could send the bullion for a renewed downside.

Targets:

- $3,300 - Psych Level / Near Immediate Low.

- $3,250 - May 29 - Significant Low.

Final thoughts

While Gold remains fundamentally supported by long-term macro themes like central bank buying and inflation uncertainty, near-term direction will be decided by upcoming U.S. data and the Fed’s policy signals.

A breakout from the current range could provide a cleaner directional bias. Until then, patience is key.

A confirmed break on either side will likely invite strong momentum. Bias remains neutral to bullish unless $3,300-$3,400 is broken convincingly.

Author

Jasper Osita

Independent Analyst

Jasper has been in the markets since 2019 trading currencies, indices and commodities like Gold. His approach in the market is heavily accompanied by technical analysis, trading Smart Money Concepts (SMC) with fundamentals in mind.