Gold Price Forecast: Bears gearing up for a breakout

XAUUSD Current price: $1,826.25

- S&P downwardly revised its economic growth forecasts for the EU and the US.

- US indexes struggle to advance after the release of mixed data.

- XAUUSD is slowly gaining bearish traction, with sellers now aligned at lower levels.

Spot gold advanced throughout the first half of the day, but trimmed gains and trades near a daily low of $1,820.63 a troy ounce, as the greenback gathered momentum ahead of the US opening. Concerns revolve around potential recessions, as S&P downwardly reviewed economic growth. It now expects the EU economy to advance a modest 2.6%, while foresees US growth at 1.6%, well below the estimated potential growth rate of around 2%. It also sees a low-growth recession in 2023 in the world’s largest economy.

The American currency lost traction following the release of mixed US data and eased, particularly against high-yielding currencies. XAUUSD, however, remained under pressure. The dollar is feeling the heat of an economic setback, while modest gains in Wall Street seem to be further undermining demand for the US currency. Nevertheless, the market mood is sourly limiting the bullish potential of USD rivals.

Mixed US data undermined the market sentiment. US Durable Goods Orders were up 0.7% MoM in May, beating expectations, although Pending Home Sales in the same month plunged 13.6% YoY, much worse than anticipated. Also, the June Dallas Fed Manufacturing Business Index contracted to -17.7 from -7.3, missing the -3.1 expected.

Gold Price short-term technical outlook

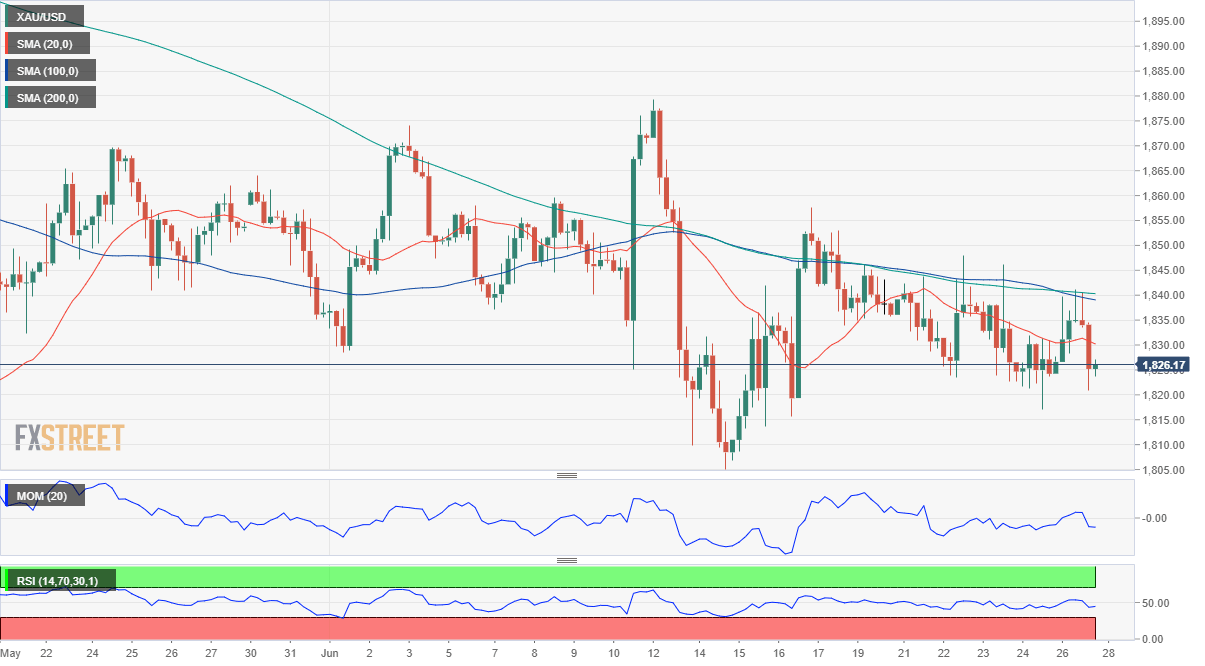

The daily chart for XAUUSD shows that the risk remains skewed to the downside while selling interest remains aligned around a flat 200 SMA. At the same time, the 20 SMA is slowly gaining bearish traction below the longer ones, further reinforcing the idea of another leg south in the near future. Also, technical indicators hold within negative levels, with moderated bearish strength, not enough to confirm an imminent slide.

Technical readings in the 4-hour chart also favor a downward continuation. The 100 and 200 SMAs converge around the daily high of $1,841.01, while the 20 SMA hover around $1,831.50. Technical indicators, in the meantime, head marginally lower within negative levels, also lacking strength enough to confirm a bearish breakout. Bears will have better chances if the metal breaks below $1.814.70, a strong static support level.

Support levels: 1,814.70 1,803.90 1,789.50

Resistance levels: 1,831.50 1,843.20 1,853.10

View Live Chart for the XAUUSD

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.