Gold Price Forecast: Bears aiming to retest the year low

XAU/USD Current price: $1,736.45

- Supply change issues are taking their toll on global economic growth.

- US Federal Reserve chief Powell noted inflation is more concerning than earlier this year.

- XAU/USD has fallen to a fresh one-month low and has room to extend its slump.

Gold plunged to $1,728.08 a troy ounce a fresh seven-week low, as market participants rushed into the greenback in a risk-averse scenario. Global shortages and bottlenecks have been in the eye of the storm, as the world resumed post-pandemic lockdowns economic activity. Problems in the supply-end have pushed prices higher, and result in mounting inflationary pressures, a double edge sword spurring risk aversion.

There were two main factors pushing market participants into the greenback. Energy blackouts in China, and fears of gasoline shortages in the UK. Power cuts in China have been blamed on rising coal prices leading to short supply, and have affected factories, triggering speculation of slowing economic progress. In the UK, a tanker drivers’ shortage last week has spurred fears of gas shortage, with panic buying actually triggering gas scarcity in stations. The government has put the army to deliver gasoline in an attempt to cool down panic buying.

During US trading hours, Federal Reserve Chair Jerome Powell testified before a Congress special commission, noting that 'it's fair to say' inflation is more concerning than earlier this year, citing supply chain issues.

Gold price short-term technical outlook

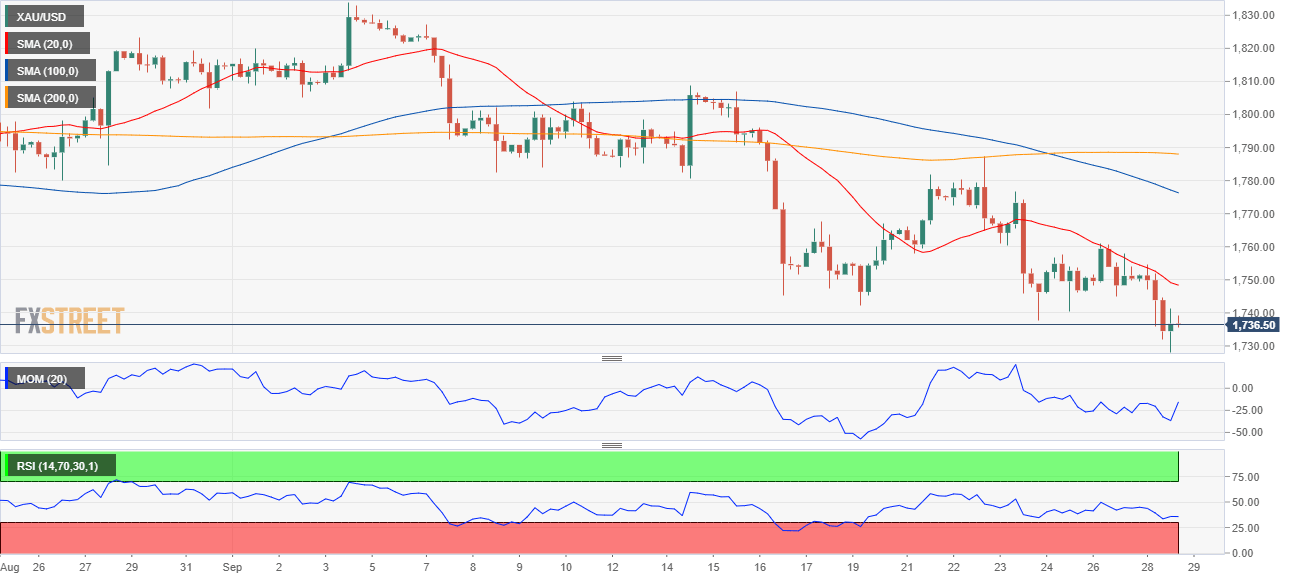

XAU/USD has bounced modestly and currently trades around $1,738 a troy ounce, firmly bearish according to the daily chart. The bright metal has fallen further below all of its moving averages, with the 20 SMA accelerating its slump below the longer ones. At the same time, technical indicators have resumed their declines within negative levels, with the RSI currently at fresh lows around 25.

In the near term and according to the 4-hour chart, gold seems to have set an intraday bottom. The following advance has been shy, which means that another leg lower is not out of the table. Technical readings maintain the risk skewed to the downside, as the metal is developing below a firmly bearish 20 SMA while the 100 SMA has extended its slide below the 200 SMA. Finally, technical indicators have stabilized near oversold readings, bouncing just modestly, although falling short from suggesting a steady advance in the near term.

Support levels: 1,728.10 1,717.60 1,708.40

Resistance levels: 1,751.60 1.760.85 1,769.10

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.