Gold Price Forecast: Back to its comfort zone ahead of 1,800

XAU/USD Current price: $1,792.93

- US and UK policymakers cool down inflation-related concerns, yields retreated.

- Wall Street dipped after a strong opening, now struggles to stay afloat.

- XAU/USD is technically neutral, bulls need to break through 1,813.80.

Gold prices soared to fresh weekly highs, with spot hitting an intraday high of $1,798.90 a troy ounce. The bright metal jumped following the Bank of England monetary policy announcement, as the UK central bank decided to keep rates and the APP unchanged. Market players were hoping policymakers will hike rates, amid previous hints from Governor Andrew Bailey.

The BOE’s announcement came after the US Federal Reserve announced it would start trimming QE by $15 billion per month, also a widely anticipated movement. In both cases, policymakers tried to down talk price pressures and referred to temporal issues being behind rising inflation.

The bright metal also benefited from the poor tone of Wall Street, as US indexes dipped right after the opening, currently trading with a mixed tone. The week will end with another bang, as the US will publish the November Nonfarm Payrolls report. The country is expected to have added 425K new jobs in October, after two months of poor figures.

Gold price short-term technical outlook

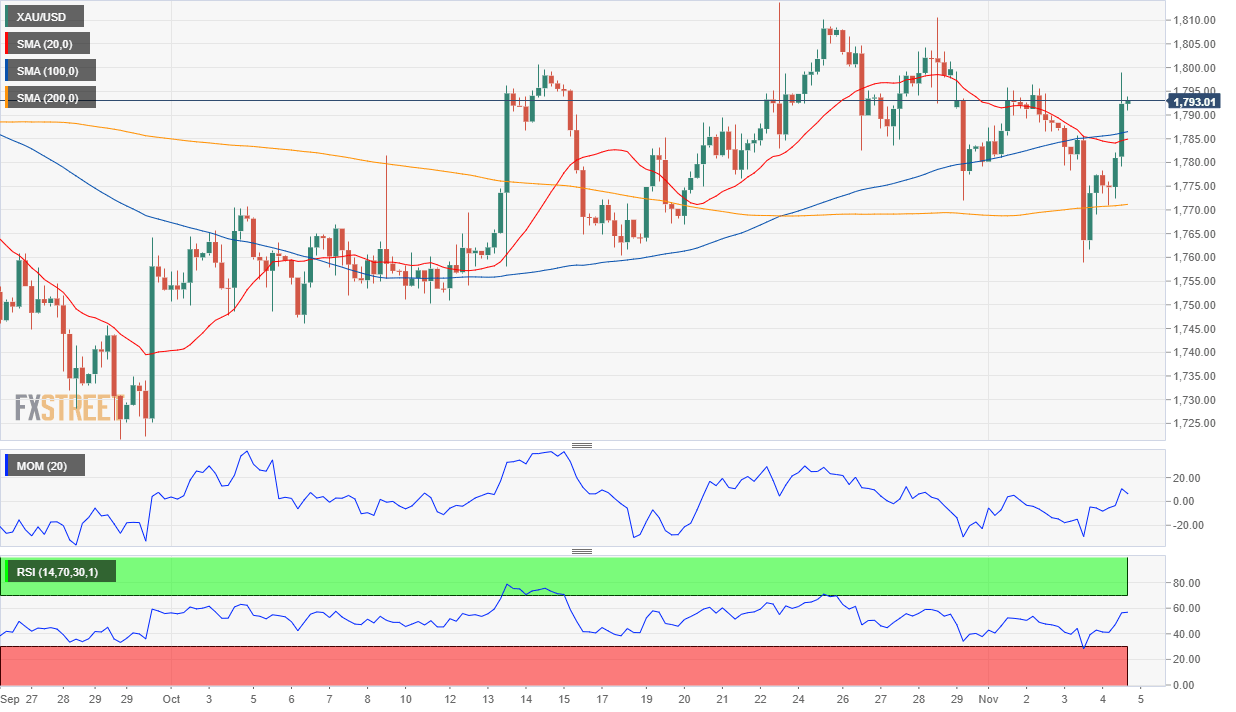

XAU/USD is back to its comfort zone in the $1,790 region, trading around the 23.6% retracement of its September/October rally. It bottomed on Wednesday near the 61.8% retracement, which somehow opens the door for a test of the October high at 1,813.80

The daily chart shows that moving averages remain directionless and in a limited range, with the price currently struggling to overcome the top of such a range. Technical indicators changed course and reentered positive territory, although holding within familiar levels.

According to the 4-hour chart, the bright metal is neutral-to-bullish, as it recovered back above al of its moving averages, which anyway lack directional strength. Technical indicators have lost their bullish strength, the Momentum around its 100 level and the RSI above its midline.

Support levels: 1,785.60 1,778.50 1,767.60

Resistance levels: 1,800.60 1,813.80 1,822.40

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.