Gold price analysis: Gold is sideways waiting for Nonfarm Payrolls

This week, FED - the US Federal Reserve notified that the QE (quantitative easing) will be reduced slowly from November till June 2022. The chairman of FED, Jerome Powell also declared that 15 billion dollars will be withdrawn every month. Importantly, Bitcoin is rising as a new king of the safe-heaven in the new decade, which pushes gold to the second choice for saving assets.

Going against gold, the DXY - US Dollar Index climbs up significantly these days because of the new positive policy of the FED.

Today, the US Bureau of Labor Statistics will release Non-farm Payrolls which will have an important effect on the USD, especially gold.

Moving average analysis

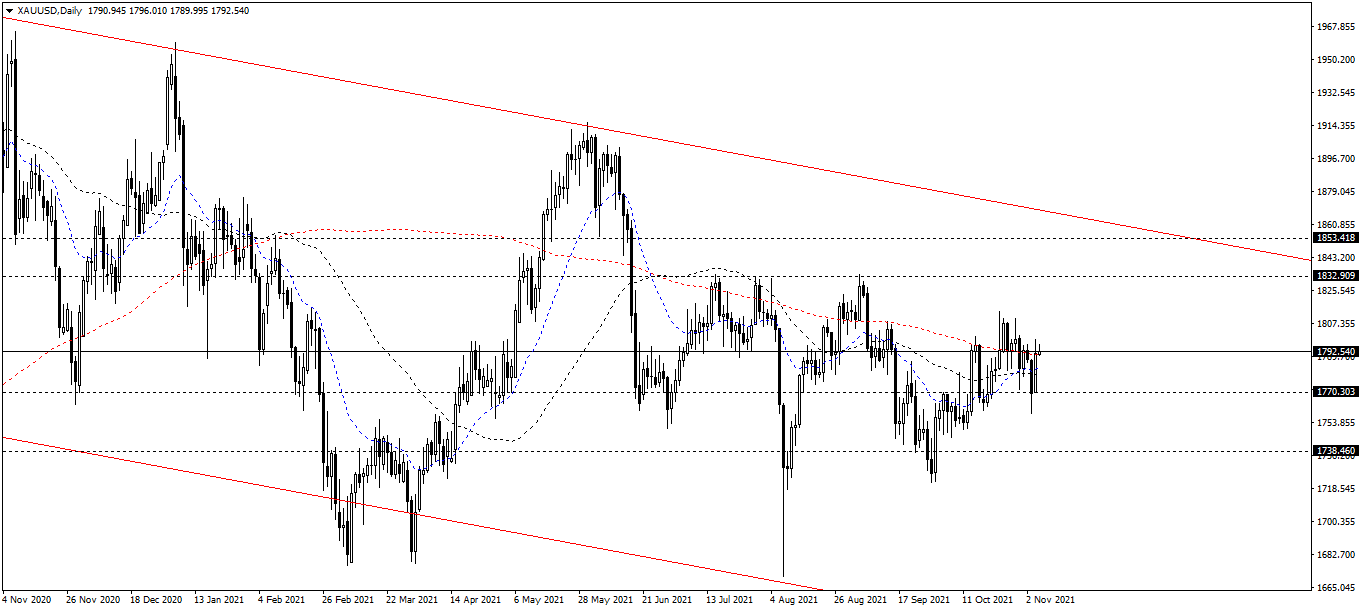

On the daily chart, the MA20/MA50 have reverse signals, however, it is not enough for the bulls to hold the game. The MA20/MA50 are still above the MA200. Eventually, the bears is coming back.

On the 4-hour chart, both the two MA20/MA50 climbed up, making a significant uptrend. The MA20 is below the MA50 showing that there may be a chance gold will fall down at the weekend.

On the 1-hour chart, the MA200 crossed over the MA20/MA50 and made a significant diversification over the MA50. But, be careful about the climbing of the MA20 which reaches the peak of MA200 right now.

In conclusion, in the long-term, gold might fall down. In the mid-term and the short-term, the bulls is dominating.

Fibonacci analysis

The Fibonacci indicator is measured on the daily chart at 2 levels:

The $1920/oz: This is a double top pattern, which is made in the last 6 months.

The $1680/oz: The strongest support in the past 2 years.

Gold is accumulating at the zone between $1770/oz and $1830/oz, considered as the Fibonacci 61.8 and 78.6. Keep an eye on the Fibonacci 78.6, this is the short-term goal for the bears this week if they want to make a significant impact.

Support/resistance analysis

The resistances are $1800/oz and $1830/oz.

The supports are $1760/oz and $1740/oz.

Author

Thang Le

Independent Analyst

Thang Le is founder and owner of PSK - a financial community in Vietnam which at: Advising on strategic investment for individuals; Supporting the development of the investment community. He is Financial Analyst at Lion Group Hol