Gold is no longer just a hedge, it is becoming a fear asset

Gold prices are holding near record territory as markets increasingly treat the metal not only as a macro hedge but as protection against systemic instability. What began as a strategic allocation linked to policy risk and fiscal uncertainty is now evolving into something more emotional and more structural.

Gold is shifting from a macro hedge into a fear driven asset.

This transition matters because markets behave differently when buying is motivated by protection rather than by tactical positioning. Price action becomes less sensitive to short-term data and more anchored in long-term capital preservation. That shift is now visible across both macro narratives and technical structure.

From macro hedge to fear allocation

Earlier phases of the Gold rally were largely explained by macro logic. Rising debt burdens, persistent geopolitical tensions and questions around policy credibility encouraged investors to add Gold as a hedge against longer-term systemic risk. In that regime, flows were strategic but still responsive to yields, currencies and economic data.

The current environment looks different.

Instead of reacting sharply to fluctuations in the US Dollar or rate expectations, Gold is consolidating near highs even when traditional headwinds appear. This suggests that buyers are no longer driven solely by macro optimization. They are increasingly motivated by the need for financial insurance against outcomes that are difficult to model and impossible to hedge with conventional assets.

This is how a macro hedge evolves into a fear asset. The motivation shifts from portfolio efficiency to capital protection.

Short-term volatility reflects positioning stress, not a structural break

Gold did experience a sharp intraday selloff over the past sessions, with prices falling rapidly from record levels in a short span of time. The move was significant and reflected a combination of profit-taking after a powerful rally, a firmer US Dollar and renewed speculation around the future path of Federal Reserve policy.

However, the speed of the decline does not necessarily signal a change in the broader regime. In markets where positioning has become crowded and defensive allocations have increased, liquidity can thin out quickly. That environment makes price action more vulnerable to sudden adjustments as leveraged positions are forced to rebalance.

The key point is that Gold was able to stabilize and remain near historically elevated levels after the drop. This suggests that underlying structural demand has not disappeared. Instead, the episode highlights how a fear driven asset can experience sharper short-term swings even while its longer term role in portfolios remains intact.

Why fear driven demand changes price behavior

When Gold is accumulated as a fear allocation, market mechanics change.

First, pullbacks tend to become shallower over time. Investors buying for protection are less concerned with perfect entry levels and more focused on securing exposure. That reduces the intensity and duration of corrective phases.

Second, selling pressure becomes more tactical than structural. Profit taking may occur, but there is less conviction behind aggressive short positioning because the broader macro backdrop still favors holding defensive assets.

Third, sensitivity to short-term macro data declines. Inflation prints, employment numbers and central bank communication still matter, but they are no longer the sole drivers. The dominant force becomes the perception of systemic macro uncertainty and the need for capital preservation.

This shift can keep Gold elevated even in environments that would previously have triggered deeper corrections.

Cross market signals point to rising defensive flows

Gold’s resilience is not happening in isolation. Broader market behavior suggests a subtle rotation in risk perception.

Parts of the equity market that had been supported by strong growth narratives are showing signs of fatigue and higher volatility. Sensitivity to earnings expectations and capital spending themes is reminding investors that forward projections can change quickly in uncertain environments.

At the same time, geopolitical tensions and trade frictions continue to influence capital flows and global supply chains. Fiscal trajectories in several major economies remain stretched, reinforcing questions about long-term policy credibility and monetary stability.

These cross market signals create a backdrop where defensive allocation regains importance. Gold benefits not because one specific data point changes, but because the overall level of systemic macro uncertainty remains elevated.

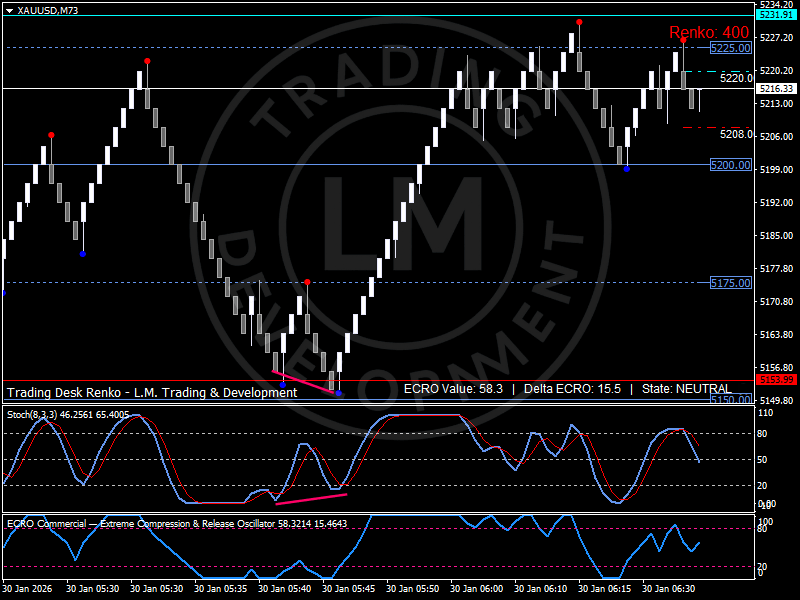

Renko structure confirms consolidation under accumulation

The Renko chart structure supports the idea of accumulation rather than exhaustion.

After a strong directional advance, price has moved into a lateral consolidation phase just below recent highs. Instead of a sharp reversal, the market is compressing within a relatively tight range. This kind of behavior typically reflects repositioning at higher levels rather than distribution ahead of a deeper decline.

The Renko method filters out time and focuses purely on price structure. In this case, it highlights that sellers have not been able to force a sustained downside sequence. Each pullback has remained contained relative to the prior advance, and the broader structure still leans toward stability near elevated levels.

This is consistent with a market where defensive demand remains active even after episodes of heightened volatility.

Momentum is neutral, not bearish

Momentum indicators reinforce the idea of balance rather than breakdown.

The Stochastic oscillator has cooled from overbought territory, indicating that the prior impulsive phase has paused. However, it is not signaling deep oversold conditions or aggressive downside momentum. This suggests normalization rather than the start of a sustained bearish move.

The ECRO reading near mid range levels shows compression rather than expansion. The market is no longer in a strong release phase, but it is also not in directional exhaustion. Instead, price action reflects temporary equilibrium between buyers and sellers after an extended move higher.

The positive Delta ECRO reading indicates that underlying expansion pressure has not vanished. Momentum has slowed, but the structure does not yet support a transition into sustained bearish territory.

Gold’s role in portfolios is evolving

Gold is behaving less like a tactical macro trade and more like a strategic fear allocation. That evolution reflects deeper changes in how investors assess risk.

When concerns center on policy credibility, fiscal sustainability and geopolitical fragmentation, traditional diversification tools can feel less reliable. In that context, Gold becomes attractive not for its yield or growth potential, but for its historical role as a store of value outside the financial system.

This perception can anchor demand even when short-term macro conditions appear less supportive. The result is a market that stays firm under conditions that would previously have triggered larger drawdowns.

Outlook

Gold’s rally is no longer driven solely by macro hedging logic. It is increasingly supported by fear-driven allocation linked to persistent systemic macro uncertainty.

As long as these underlying concerns remain in place, Gold may continue to attract capital flows focused on preservation rather than performance. In this regime, price behavior is likely to remain less sensitive to short-term fluctuations in the Dollar or economic data and more aligned with the broader need for financial insurance in an unpredictable global landscape.

Author

Luca Mattei

LM Trading & Development

Luca Mattei is a market analyst focusing on FX, metals, and macroeconomic trends. He develops trading tools for retail and professional traders, coding indicators and EAs for MT4/MT5 and strategies in Pine Script for TradingView.