Gold faces cloudy outlook near key support area

-

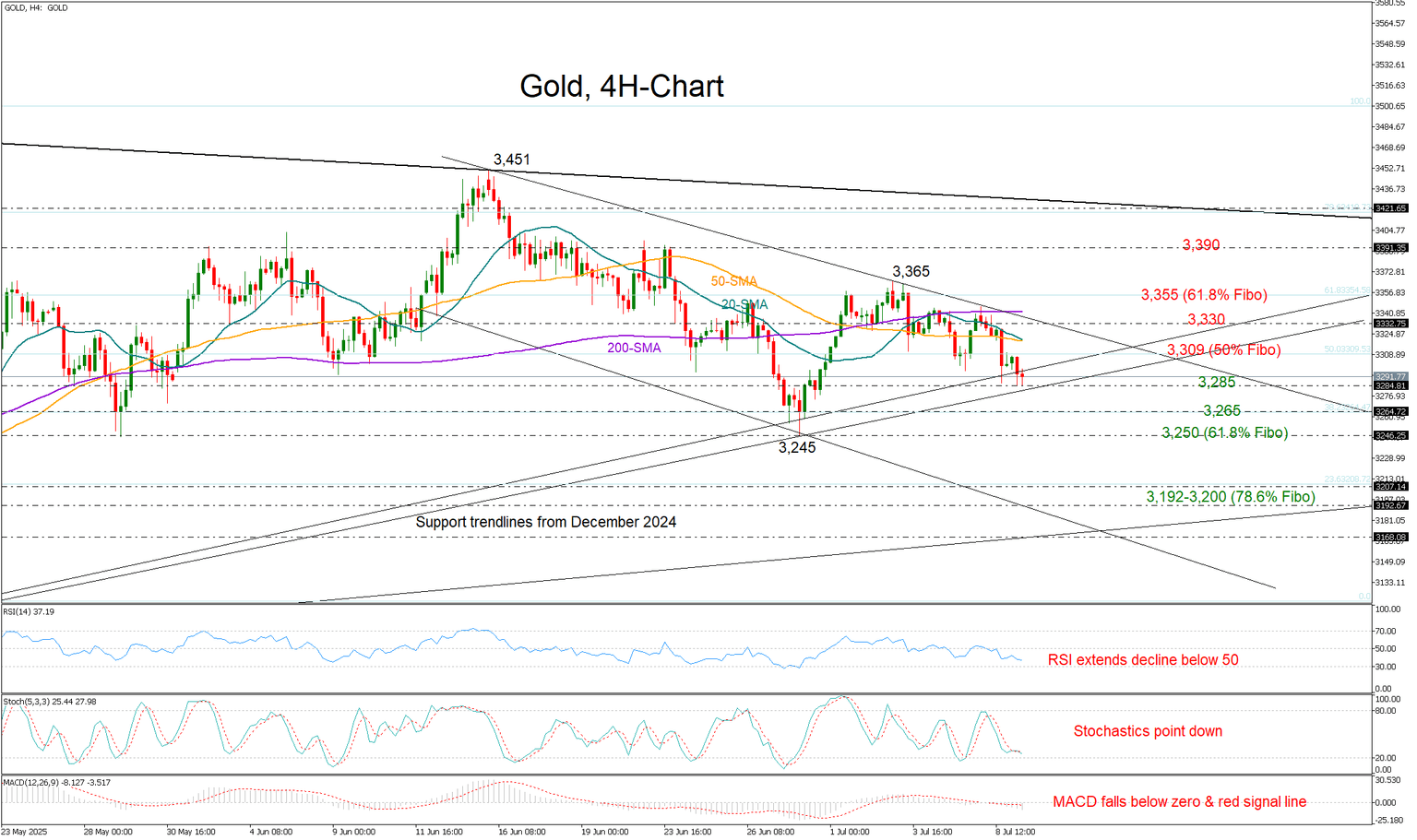

Gold tests key support trendline as sellers retain control.

-

Bearish bias needs confirmation below 3,285.

Gold has been on the backfoot so far this month, as diminished rate cut expectations and a risk-off mood have dominated market sentiment.

From a technical perspective, the decline appears to have further room to run. The RSI and MACD keep decelerating in the bearish territory, and with the RSI still above its 30 oversold level, a rebound may not be imminent in the coming sessions. Yet, optimism has not entirely faded, as the price is currently testing the support trendline drawn from late 2024.

If the floor at 3,285 gives way, the next potential pause could occur within the critical 3,250–3,265 area. A drop below that zone is expected to trigger a stronger bearish wave toward the 3,192–3,200 range.

In the event that upside pressures re-emerge, the bulls will aim for a close above the resistance trendline at 3,330. If they succeed, the price could quickly rebound to 3,355 and potentially gain momentum toward 3,390. Still, only a sustained move above 3,420 would significantly improve the outlook.

In summary, July’s pullback in the gold market may deepen in the short term, with confirmation likely to come below the 3,285 level.

Author

Christina joined the XM investment research department in May 2017. She holds a master degree in Economics and Business from the Erasmus University Rotterdam with a specialization in International economics.