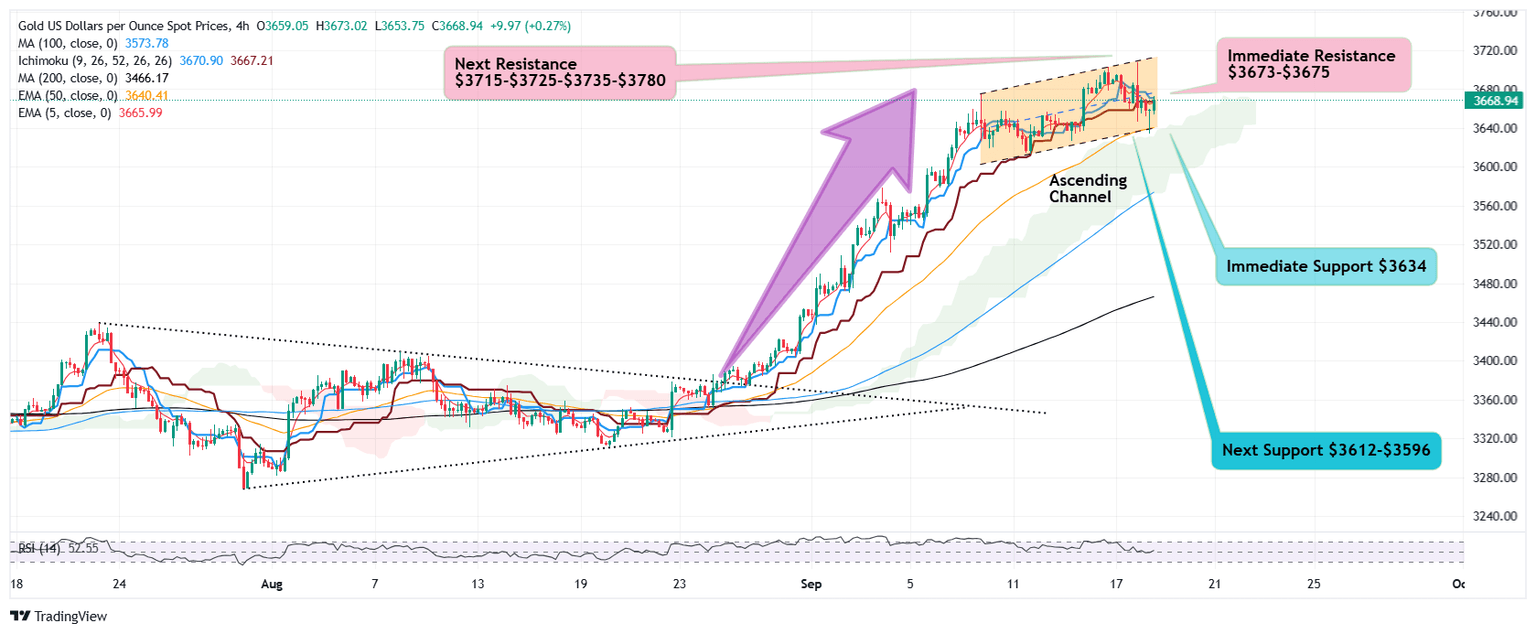

Gold drops to $3,634 on cautious Fed's commentary, rebounds to $3,673

As widely expected Federal Reserve announced a 25 BPS rate cut which was already priced in and markets gave a knee jerk reaction with a small bullish extension for new record high at $3707

However, the follow up Fed commentary sounded less dovish and some signs of hawkish tone dampened Gold bullish momentum triggering a sharp fall pushing prices to $3634 during London opening session.

Why Gold dropped to and bounced from $3.634?

Fed's commentary sounded somewhat hawkish with statements of further cuts being subject to economic data assessment over next meetings.

This sent the Dollar Index soaring from 96.20 lows to 97.30 high and triggering sharp drop in Gold prices as rising dollar increases holding cost of Gold which is a non yielding asset as compared to Bonds.

Moreover, retail profit booking is a usual occurrence on new record highs, more so during high impact economic events like interest rate decision and a follow up commentary with forward guidance.

The drop was quickly absorbed by buyers resurfacing with recovery rally reaching $3673 as this zone is a crucial support area which aligns with 4 Hourly 50 EMA and ascending channel support trendline as well as 78.6% Fibonacci retracement of $3613 low to $3707 high, turning $3634 into discounted zone that is attractive for value buying.

What's next from here?

Recovery rally has reached immediate hurdle $3673 which makes reaction to this level interesting such that a decisive break above this level opens the way to extension towards next resistance $3690-$3695 above which the rebound is likely to challenge yesterday's high of $3707

If Gold finds bullish intervention above $3707, next upside targets may reach $3715 followed by $3725-$3735

Failure to make a decisive break above $3673 will resume selling pressure and may retest $3634 below which correctional wave may retest $3615-$3613 where the selling momentum may further extend $3596-$3590 followed by 4 hourly 100 SMA $3575

Overall outlook

Though macro factors support bullish momentum and long term trend is extremely bullish with potential upside targets for $3880-$4000, a short term correction remains a strong possibility considering the straight rise as seen on Daily time frame as well as overbought RSI reading of 88 on Monthly time frame.

Author

Sunil Kumar Dixit

SK Charting

Sunil Kumar Dixit is Chief Technical Strategist and founder of SK Charting, a research firm based in India. He tracks Precious Metals, Energy, Indices and Currency Pairs. He also participates as an expert panellist on Channel Television, Nigeria.