Gold, Chart of the Week: XAU/USD bears eye a typical corrective opportunity below critical resistance

- Gold bulls are meeting daily resistance that guards a break towards $1,860.

- Continued failures at $1,800 opens risk of a test of dynamic support.

Gold price ended lower on Friday but a touch away from the highs set on the day and for the week on a session that gave good two ways business on mixed sentiment following the release of US November employment data. XAU/USD closed below Thursday's bulls cycle highs and a few US dollars below $1,800oz.

Even though the Nonfarm Payrolls data showed that stronger-than-expected hiring reflected the tightness of the labour market, investors faded the US dollar as Fed officials spoke dovish on the outlook.

Analysts at TD Securities, noting that Gold prices have propelled into an upward trajectory toward $1,800/oz, they say this should see length increase again in the coming week. ''However, with inflation still a big problem, and strong wage and jobs data persisting, long position shedding may materialize again, should the Fed not be as dovish as currently expected on December 14th.''

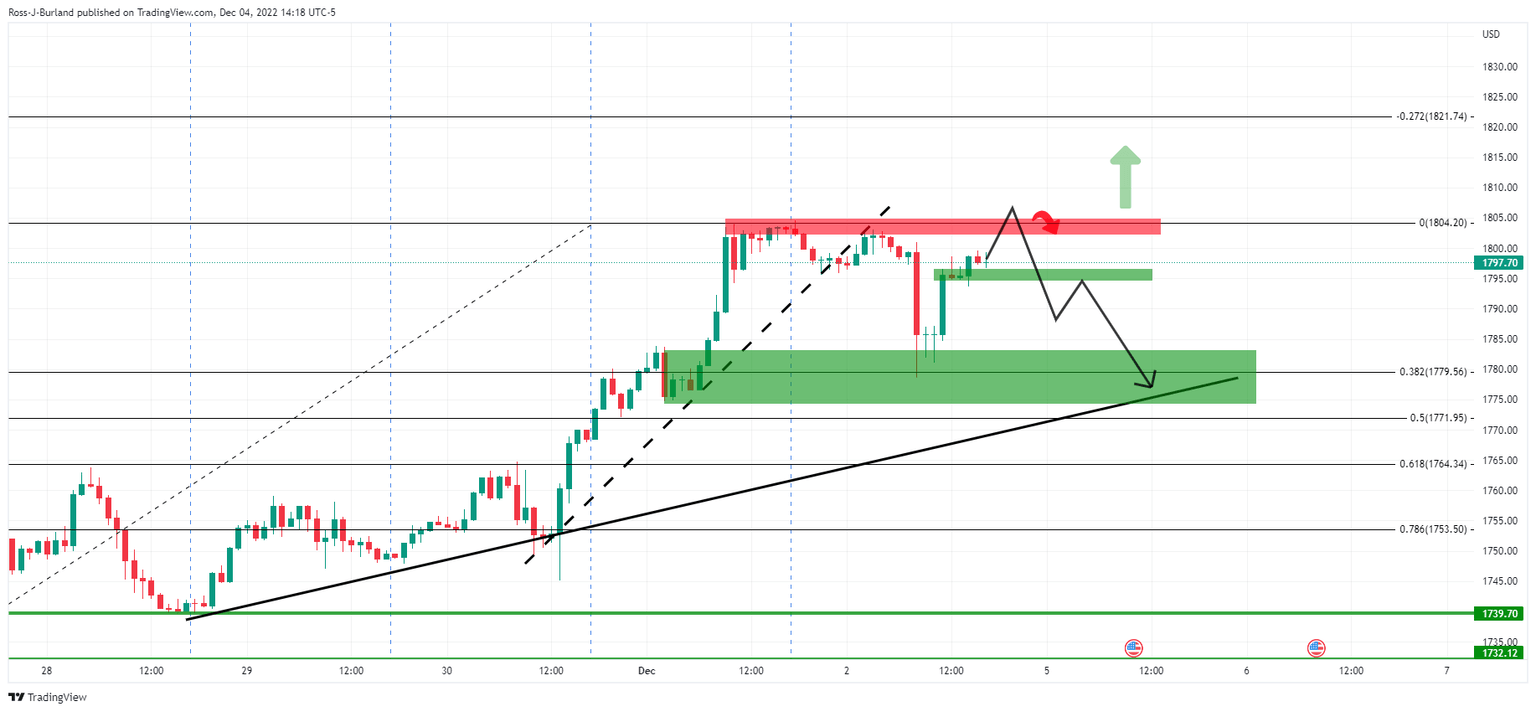

Meanwhile, moving to the technicals, the price has stalled leaving a topping M-formation on the 4-hour chart in a broader bullish scenario:

Gold H4 chart

Gold daily chart

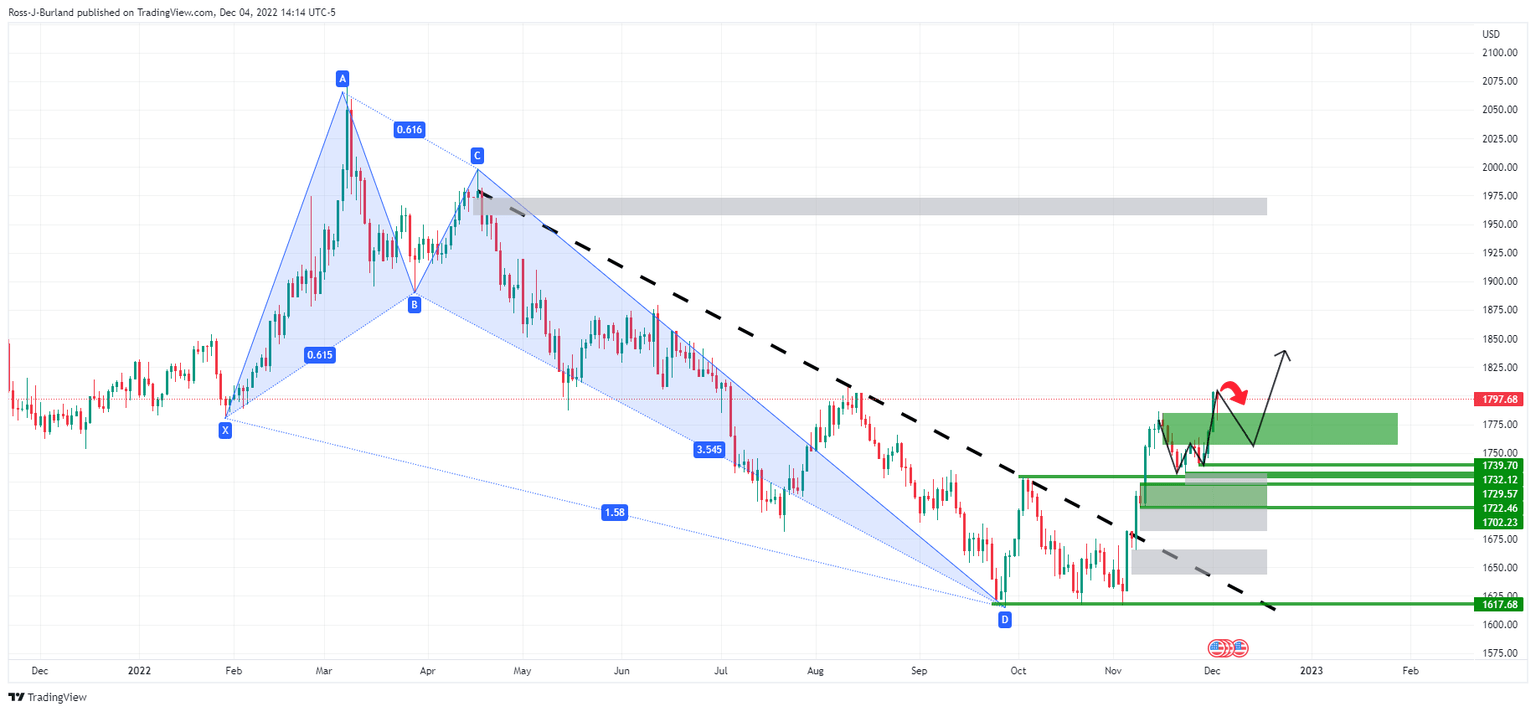

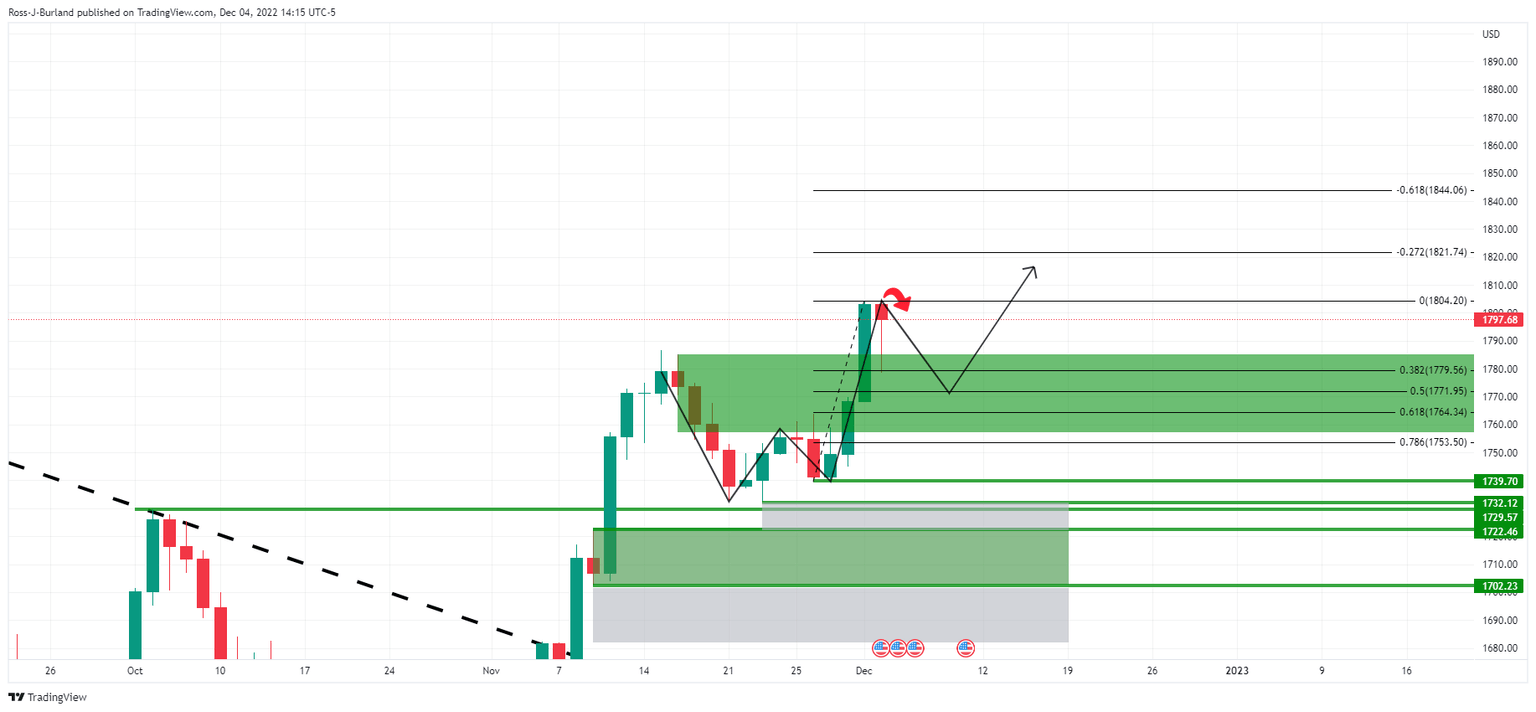

On the back side of the trend, the price is bullish as per the harmonic pattern while above the W-formation's lows near $1,730. Zooming in ...

There are prospects of a correction towards the neckline of the W-formation for the days ahead as illustrated above and below down on the hourly chart:

With the price potentially basing, for the meantime, in the $1,790s, a move into test into the $1,800s could draw in the sellers again for the opening sessions with move into the dynamic support that meets the daily 38.2% Fibonacci and a 50% mean reversion below that.

If the bulls were to commit, however, a break towards $1,860 will be on the cards as per the daily chart:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.