Gold, Chart of the Week: Bears eye a break of critical $1,875

- Gold bears could be encouraged at this juncture following a weekly bearish close.

- The last defence is located in a 4-hour structure, $1,875.

Gold has been unable to recover from the exodus that started ahead of the Federal Open Market Committee meeting and ended the week on the backfoot.

''With the Fed telegraphing its every move, positioning analytics will be key for price action,'' analysts at TD Securities said. ''We still see a significant amount of complacent length remaining in gold, while the breadth of traders short has just started to rise from near-record lows. The bar is now razor-thin for CTAs to join into the liquidation vacuum, with ETF outflows and Shanghai trader liquidations already weighing on the yellow metal.''

Translated to the spot market, the technical outlook is aligned to the bearish outlook from a positioning perspective, The following illustrates the bias from a weekly, daily and four-hour time of reference.

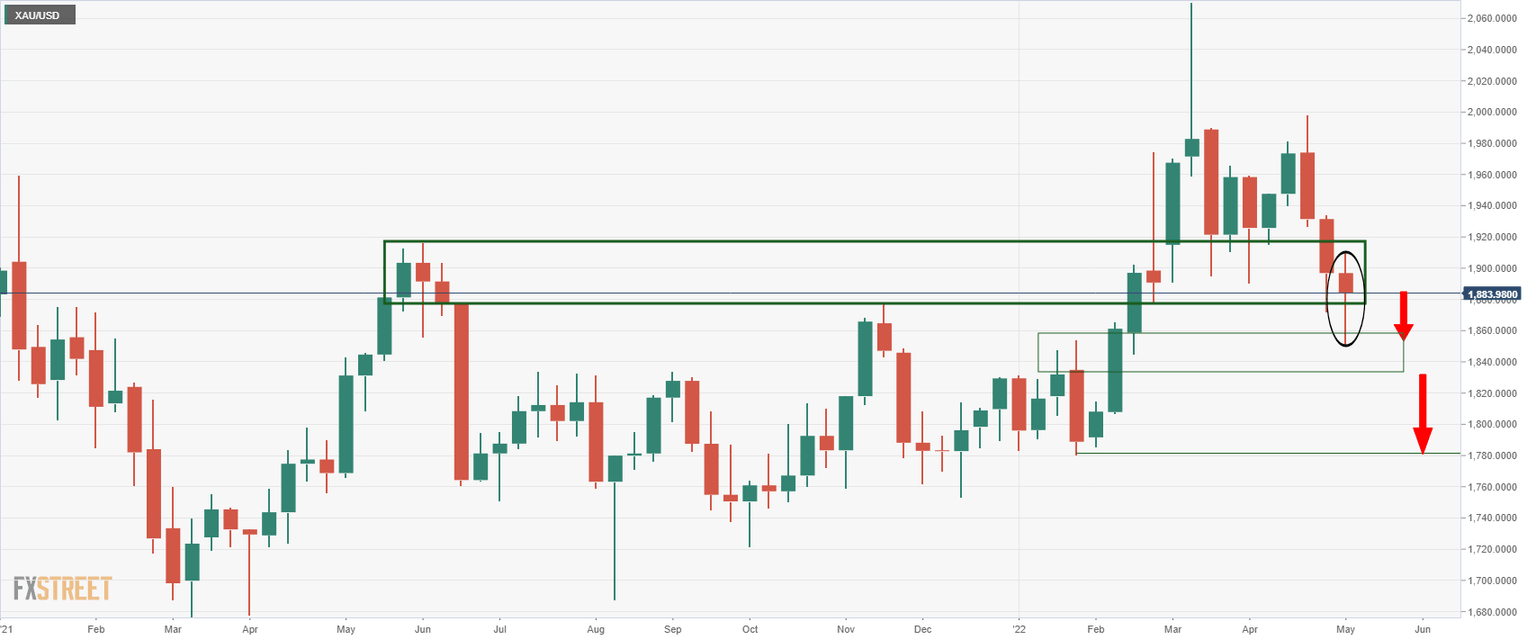

Gold weekly chart

The bearish close and wick likely will lead to a move lower in the following time frames:

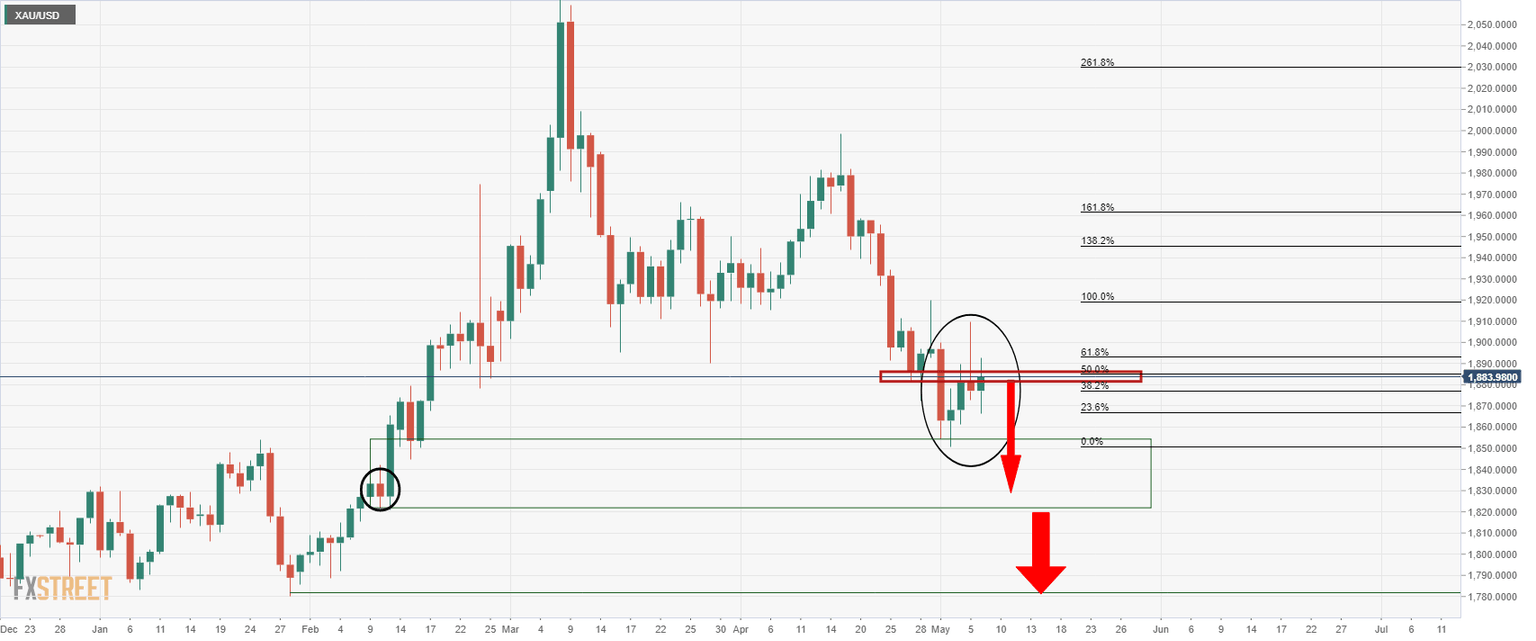

Gold daily chart

The bullish correction is struggling to maintain a commitment at the critical resistance structure on the daily chart. At a 50% mean reversion point, the bears could be encouraged to move in for the week ahead.

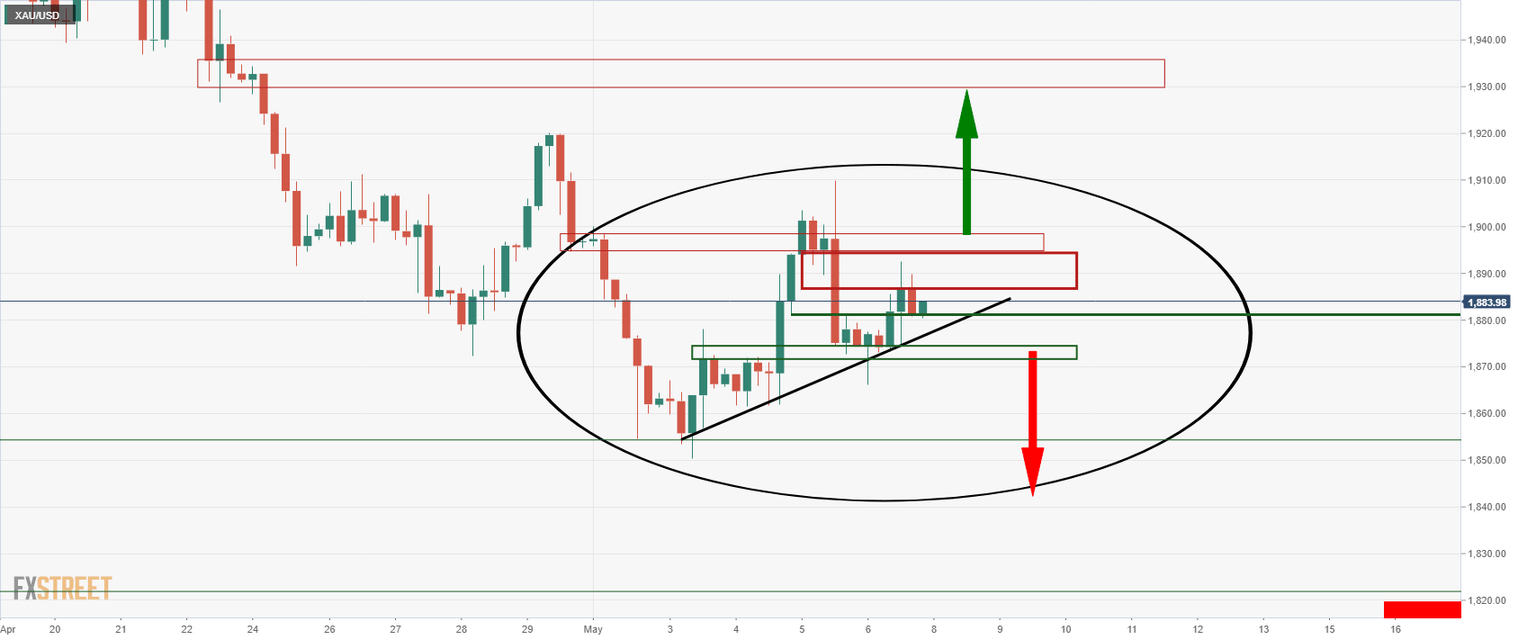

Gold H4 chart

The 4-hour structure will require a break of a series of supports of $1,880 horizontal support, the trendline and a subsequent follow through below $1,875.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.