Gold: Bullish outlook significantly compromised [Video]

![Gold: Bullish outlook significantly compromised [Video]](https://editorial.fxstreet.com/images/Markets/Commodities/Metals/Gold/aurum-37842316_XtraLarge.jpg)

Gold

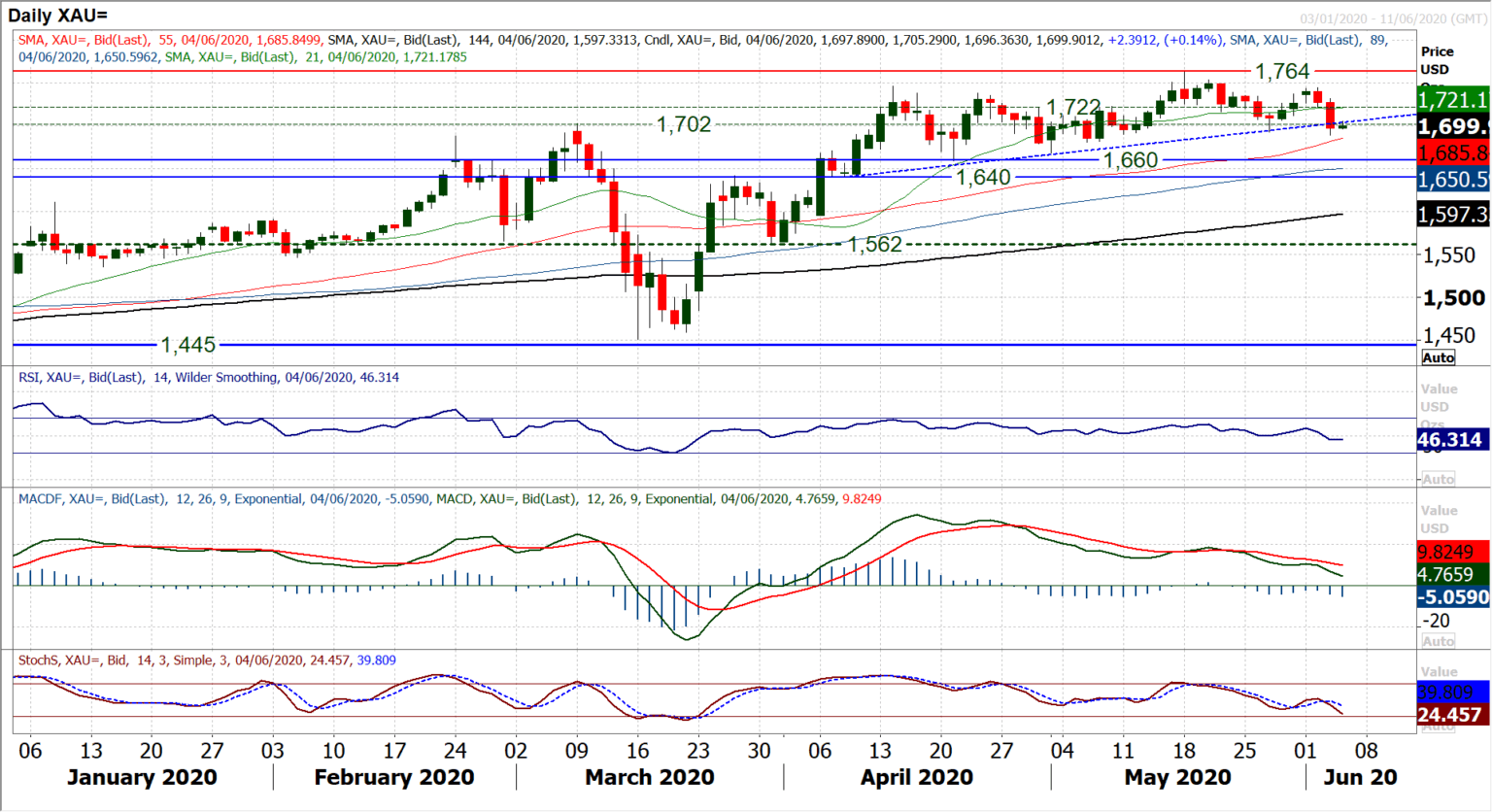

The immediate bullish outlook for gold has been significantly compromised by price declines of the past two sessions. We have recently been discussing how difficult the upside moves are becoming for gold. Two decisive negative candles of the past couple of sessions reflects this. Since the March low, the market has been trying to pull higher, but is consistently being impacted by near term corrective moves. These moves have been breaking ever shallower uptrends. The latest breach of a very shallow 8 week uptrend shows that near to medium term moves on gold are increasingly choppy. All the while, momentum indicators have been sliding lower over a medium term basis. The lower highs on RSI are now added to by a move below 50. MACD lines are sliding ever back towards neutral. Stochastics are turning lower under neutral. This makes for a difficult market to make much on the long side on a near to medium term basis. Breaking the support of the low at $1693 now means that $1744 is a key lower high under $1764. Whilst the medium to longer term fundamentals on gold remain strong, it is increasingly clear that the near term trading moves are difficult to navigate. The market has stabilised to an extent this morning (and it is interesting that this comes with a slight corrective move on risk appetite). Where previously the lows where coming between the 21 day moving average (today at $1721 and interestingly around the old $1722 pivot) and the former 8 week uptrend (around $1704 today), if this now turns into a basis of resistance for another lower high, we may need to start factoring in a deeper corrective move towards $1660/$1668. In the meantime, there is a choppy sideways range to trade.

Author

Richard Perry

Independent Analyst