Gold awaits CPI data while holding below record highs

Gold (XAUUSD) holds near peak levels amid rising political instability and global tensions. Uncertainty surrounding the Federal Reserve, rising conflict risks in the Middle East, and fragile market sentiment have strengthened demand for safe-haven assets. At the same time, markets await key U.S. inflation data that could influence rate expectations and dollar direction. This mix of macro drivers and technical strength keeps gold firmly supported with the potential for further upside.

Gold benefits from political instability and geopolitical risk

Gold is holding just below record highs and remains positioned for further gains as global risks continue to build. A criminal investigation involving Fed Chair Jerome Powell has raised concerns about the independence of the central bank. Powell’s public response, pointing to political retaliation from former President Trump, has intensified doubts over the Fed’s autonomy. This uncertainty is driving demand for defensive assets, with gold benefiting from its safe-haven role.

Rising geopolitical tensions have added another layer of uncertainty to the global environment, further supporting gold’s defensive appeal. Former President Trump has warned of possible military action in response to Iran’s crackdown on protesters, further escalating geopolitical concerns. He also announced a 25% tariff on countries continuing trade with Iran, amplifying fears of renewed trade disruptions. These developments have emerged at a time when global risk appetite is already fragile. As a result, gold has attracted renewed safe-haven demand, with market participants seeking protection against rising geopolitical instability.

Meanwhile, the latest U.S. jobs report revealed signs of labor market weakness but fell short of justifying immediate rate cuts. Still, markets continue to anticipate two reductions later this year. Attention now turns to the upcoming CPI data, which could reshape expectations. A weaker inflation reading may strengthen the case for a rate cut at the January 28 meeting. In contrast, a stronger print could reduce easing expectations, lifting the dollar and weighing on gold in the short term.

Gold builds strength within broadening wedge after triangle breakout

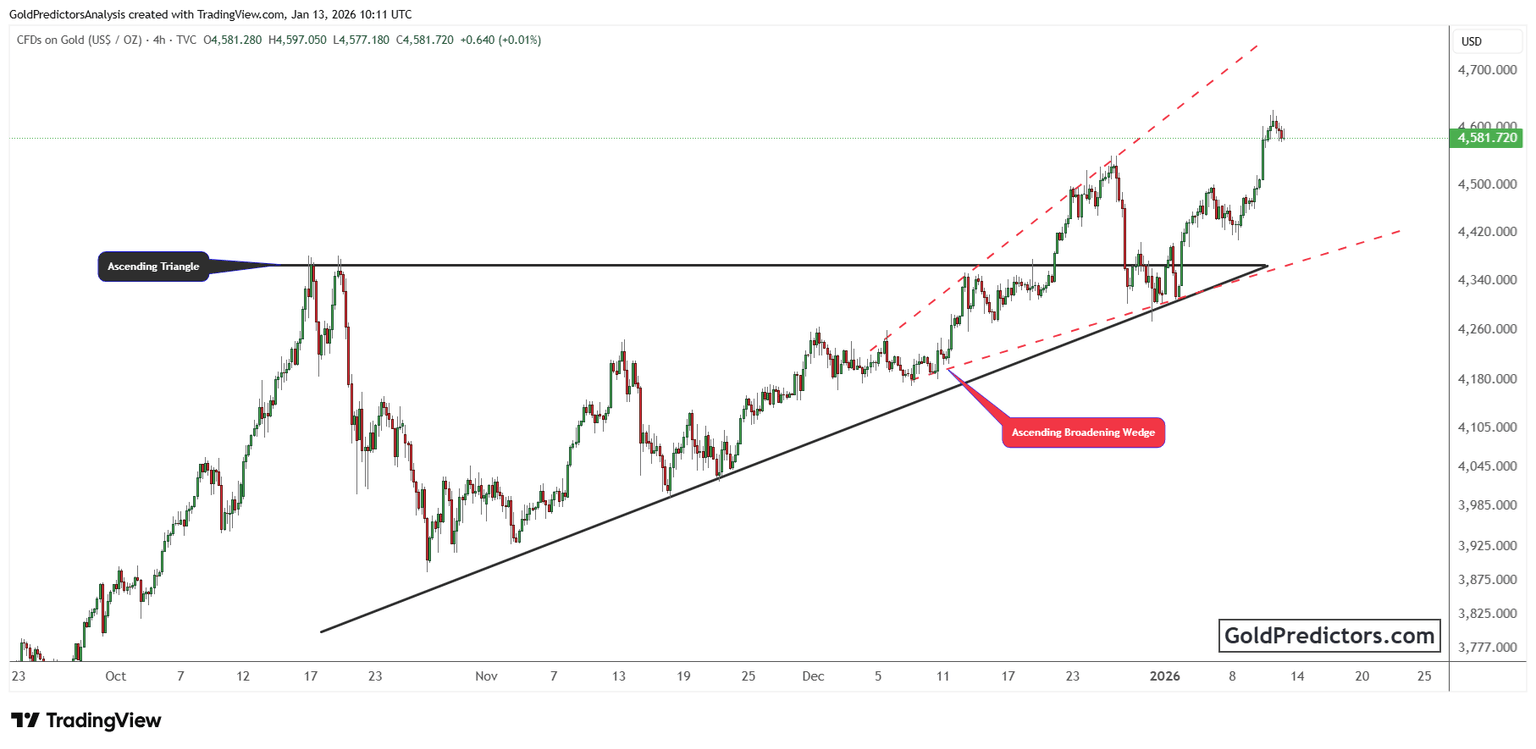

The gold chart below shows a strong technical foundation, with an initial ascending triangle pattern leading into an ascending broadening wedge. The first breakout occurred within the triangle, where price steadily built pressure between rising support and horizontal resistance. Once gold closed above the upper boundary, it signaled a shift from consolidation to upward acceleration.

After the triangle breakout, gold entered an ascending broadening wedge, defined by diverging trendlines. This structure reflects increasing volatility and upward bias. Price respected the lower boundary on multiple occasions, signaling strong dip-buying interest. As long as price continues to hold above this rising support, the broader technical outlook remains constructive and favors further upside.

Currently, gold is consolidating near the midpoint of the ascending broadening wedge, holding recent gains while preserving its bullish structure. This may signal a temporary pause in momentum, but the broader technical outlook remains positive. The ongoing pattern of higher highs and higher lows suggests that any pullbacks could be limited in scope.

Gold outlook: Political instability and bullish structure support higher prices

Gold remains in a strong position, supported by a bullish technical setup and a surge in safe-haven demand. Geopolitical tensions, political instability, and uncertainty around Fed policy continue to drive interest in the metal. With price action holding firm within a broadening wedge, the overall outlook points higher. The upcoming CPI data may trigger short-term volatility, but the broader trend still favors further gains.

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Author

Muhammad Umair, PhD

Gold Predictors

Muhammad Umair is a financial markets analyst and investor who focuses on the forex and precious metals markets.