Global stocks rally as Fed commits to easy money policies

Global stocks were in the green today after the Federal Reserve signals a willingness to leave interest rates lower for longer. Futures tied to the Dow Jones rose to $33,445 while those linked to the S&P 500 rose to $4,080. In Europe, the DAX and FTSE 100 indices rose by more than 0.15%. In the minutes published yesterday, the Federal Reserve said that it would maintain the current easy money policies in a bid to stimulate the economy. They also downplayed the risks of leaving rates low for long, maintaining that the recent performance of the bond market is a signal of stronger growth prospects. Jerome Powell will deliver a speech later today.

The euro was little changed today after the mixed economic numbers from Europe. In a report, Eurostat said that the producer price index (PPI) rose by 0.5% in February after rising by 1.7% in the previous month. This increase led to an annualised gain of 1.5%, higher than the previous 0.4%. Meanwhile, in Germany, factory orders rose by 1.2% in February, helped by the automobile industry. In France, exports and imports declined in February, widening the trade deficit. The bloc is expected to have a slower recovery because of the slow rollout of the vaccine.

The price of crude oil declined as the market reacted to the rising number of coronavirus cases in key countries. In the past few days, the number of cases in places like Brazil and India has surged, leading many to worry about demand. This happened even as the International Monetary Fund boosted the economic forecast, which is a bullish thing for oil prices. Similarly, the American Petroleum Institute (API) and the Energy Information Administration (EIA) published relatively bullish inventories report.

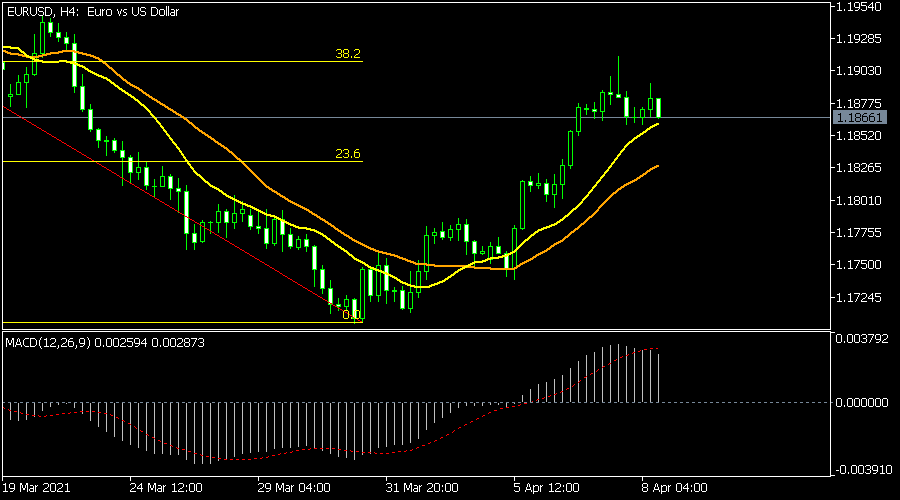

EUR/USD

The EUR/USD price has struggled in the past few sessions after it rose to a two-week high. It is trading at 1.1866, which is slightly below this week’s high of 1.1915, which was slightly above the 38.2% Fibonacci retracement level. The signal and histogram of the MACD are above the neutral line while the price is slightly above the 25-day and 15-day exponential moving averages. It has also formed an inverted hammer candlestick pattern, which is a sign that the bearish trend may continue for a while.

GBP/USD

The GBP/USD price is under pressure as worries of the vaccine passports issue remain. It is trading at 1.3738, which is below this week’s high of 1.3920. On the four-hour chart, the pair has moved below the moving average while the MACD has moved below the neutral level. The Relative Strength Index (RSI) is slightly above the oversold level. Therefore, the pair may keep falling with the next target being the March 25 low of 1.3660.

USD/JPY

The USD/JPY price declined to an intraday low of 109.45. On the four-hour chart, it has moved below the ascending trendline shown in yellow. It has also declined below the year-to-date high of 110.95. Like the GBP/USD, the MACD has moved below the neutral level while the Stochastic oscillator has also fallen. The pair seems to be starting a new bearish momentum that could see it moving below 109.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.