German stocks rise even as Nord Stream crisis continues

German stocks rose even after the ongoing energy crisis continued. Gas prices jumped by more than 10% after the German foreign minister said that the Nord Stream gas pipeline cannot be permitted because it does not comply with European law. The gas pipeline is expected to double the capacity of the undersea cable from Russia to Europe. As such, the rising gas prices will likely lead to higher inflation and the cost of doing business in Germany and other European countries. The DAX index rose to 15,765 euros.

The Japanese yen was little changed after the latest Tankan sentiment data from the country. According to the Bank of Japan, the large non-manufacturers index rose from 2 in the third quarter, to 9 in Q4. The large manufacturers’ index remained unchanged at 18. While businesses are doing well, they expressed concerns about the rising cost of doing business and the ongoing supply chain disruptions. Additional data showed that Japan’s core machinery orders rose to 3.8% in October after declining by 2.4% in the previous month. Focus shifts to this week’s interest rate decision by the Bank of Japan.

The economic calendar was relatively muted today. However, investors focused on the key economic numbers and events that are scheduled for later this week. On Tuesday, the key numbers to watch will be the UK employment and the US producer price index (PPI) data. The market will also focus on interest rate decisions by the likes of the Bank of England (BOE), Federal Reserve, Swiss National Bank and the European Central Bank.

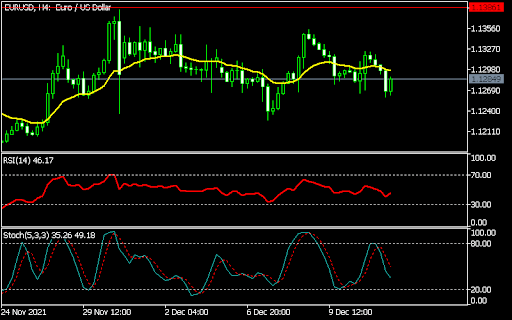

EURUSD

The EURUSD pair declined to a low of 1.1260 and then pulled back to the current 1.1286. On the four-hour chart, the pair is slightly below the 25-day moving average while the Relative Strength Index (RSI) is at the neutral level of 46. The Stochastic and MACD indicators have also tilted lower. Therefore, the pair will likely remain in this range during the American session.

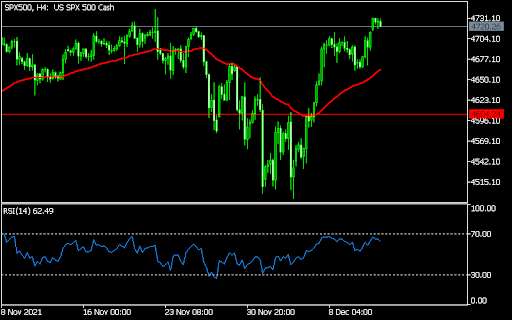

SPX500

The S&P 500 futures rose slightly as investors refocused on the upcoming Fed interest rate decision. The index is trading at $4,721, which is a few points below its all-time high. The index remains above the 25-day and 50-day moving averages while the Relative Strength Index (RSI) has been rising. Therefore, the pair could have a pullback this week as investors wait for the Fed decision.

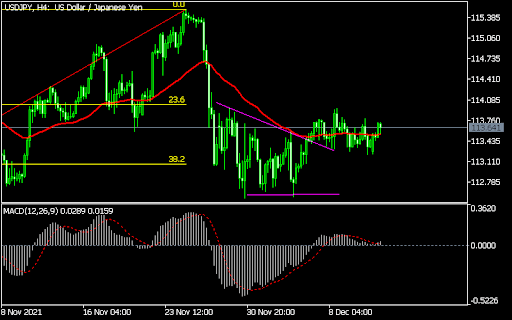

USDJPY

The USDJPY was little changed after the latest Japan sentiment data. The pair is trading at 113.62, where it has been in the past few days. The pair is slightly below the 23.6% Fibonacci retracement level and is along the 25-day and 50-day moving averages. The MACD and the Average True Range (ATR) show that it has not been volatile. The pair will likely remain in this range during the American session.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.