GBP/JPY stays in bear mode after slump [Video]

-

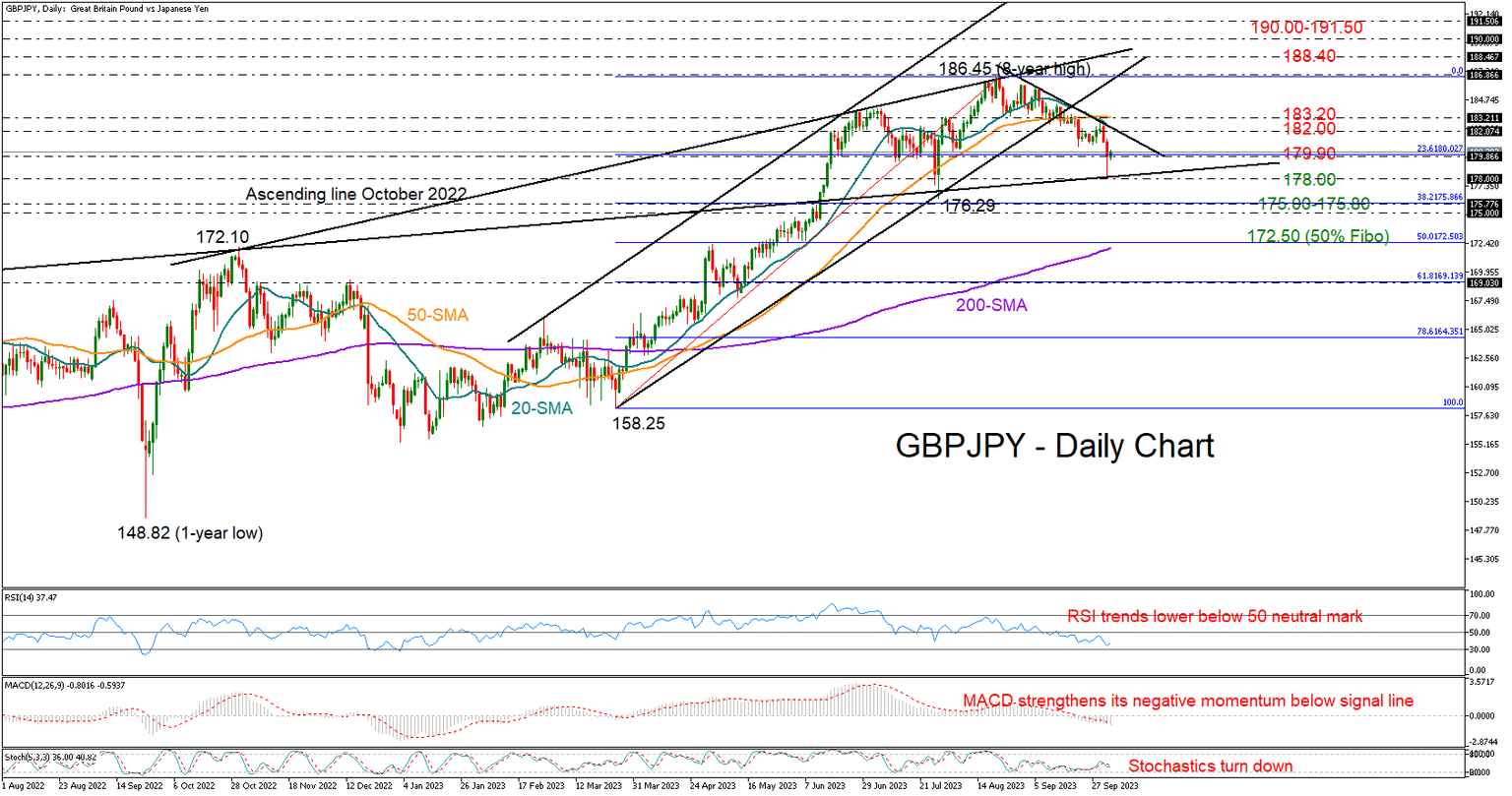

GBPJPY finds support after sudden fall, but risks remain.

-

Bearish wave could gain new legs below 178.00.

![GBP/JPY stays in bear mode after slump [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Crosses/GBPJPY/iStock-688526532_XtraLarge.jpg)

GBPJPY slumped suddenly to 10-week low of 178.00 on Tuesday in what looked to be a currency intervention from the Bank of Japan.

The resistance-turned-support trendline from April 2022 halted the bearish action and lifted the price back to the 179.90 constraining area, but downside risks have not evaporated yet.

The RSI remains negatively charged comfortably below its 50 neutral mark, while the stochastic oscillator has resumed its negative momentum. Meanwhile, the decline in the MACD has picked up pace below the red signal line, suggesting downside pressures may dominate in the short-term.

Should sellers drive below 178.00, the pair might seek shelter within the 175.00-175.80 area, where the 38.2% Fibonacci retracement level of the 158.25-186.45 uptrend is found. A step lower could stretch towards the 50% Fibonacci of 172.50 and the 200-day simple moving average (SMA). If buyers don’t show up there, the bearish wave could strengthen towards the 61.8% Fibonacci of 169.00.

On the upside, the 20-day SMA and the short-term resistance trendline drawn from recent highs could cancel any progress around 182.00. The 50-day SMA could cement that ceiling, preventing a quick rally towards the eight-year high of 186.45. Slightly higher, the bulls could face a noisy trading around the resistance line coming from October 2022 at 188.45. If this proves easy to overcome, the door will open for the 190.00 psychological mark and the 191.50 barrier from 2015.

In summary, GBPJPY bears might have some extra fuel in the tank, with traders expected to engage in new selling tendencies below 178.00.

Author

Christina joined the XM investment research department in May 2017. She holds a master degree in Economics and Business from the Erasmus University Rotterdam with a specialization in International economics.